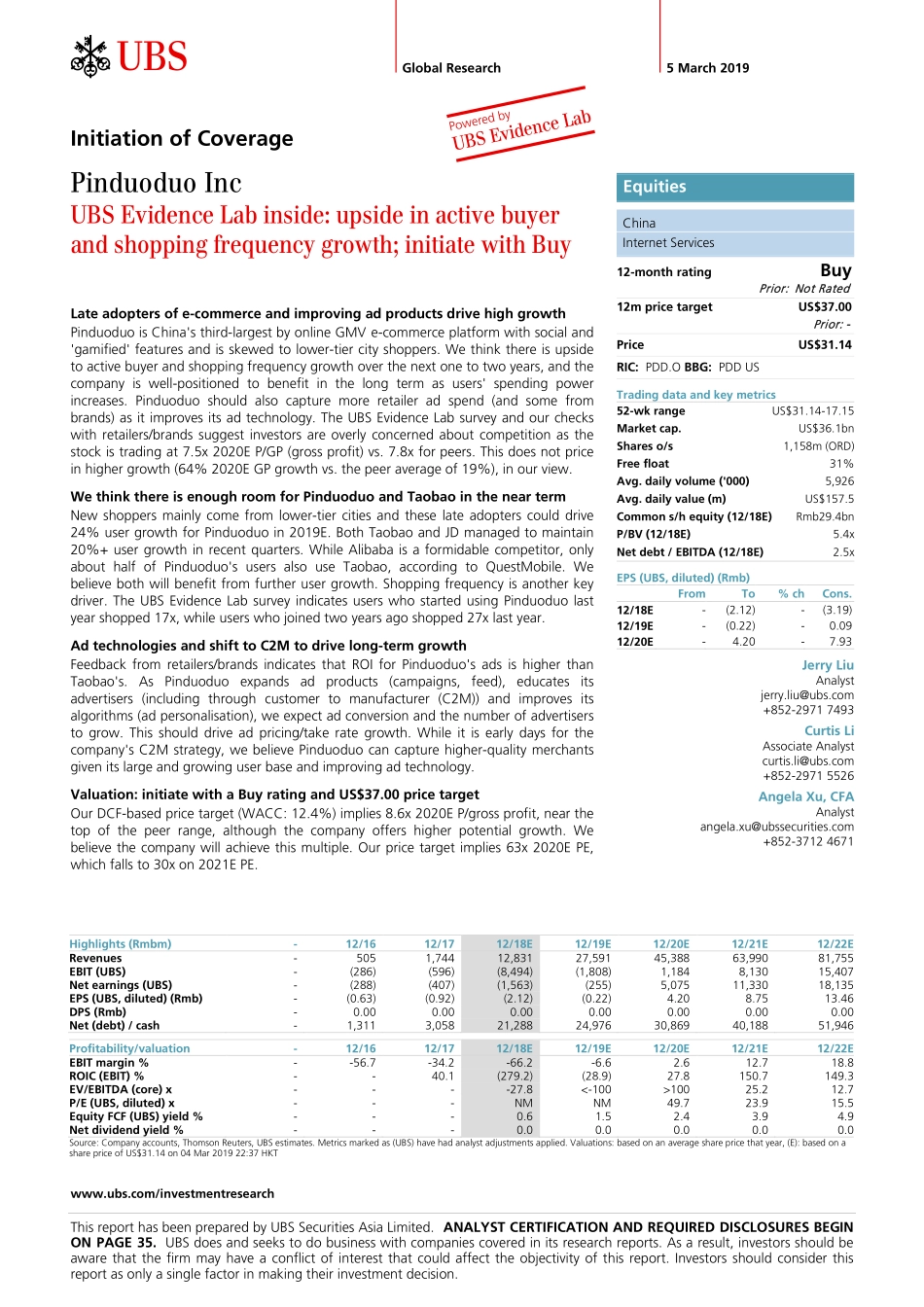

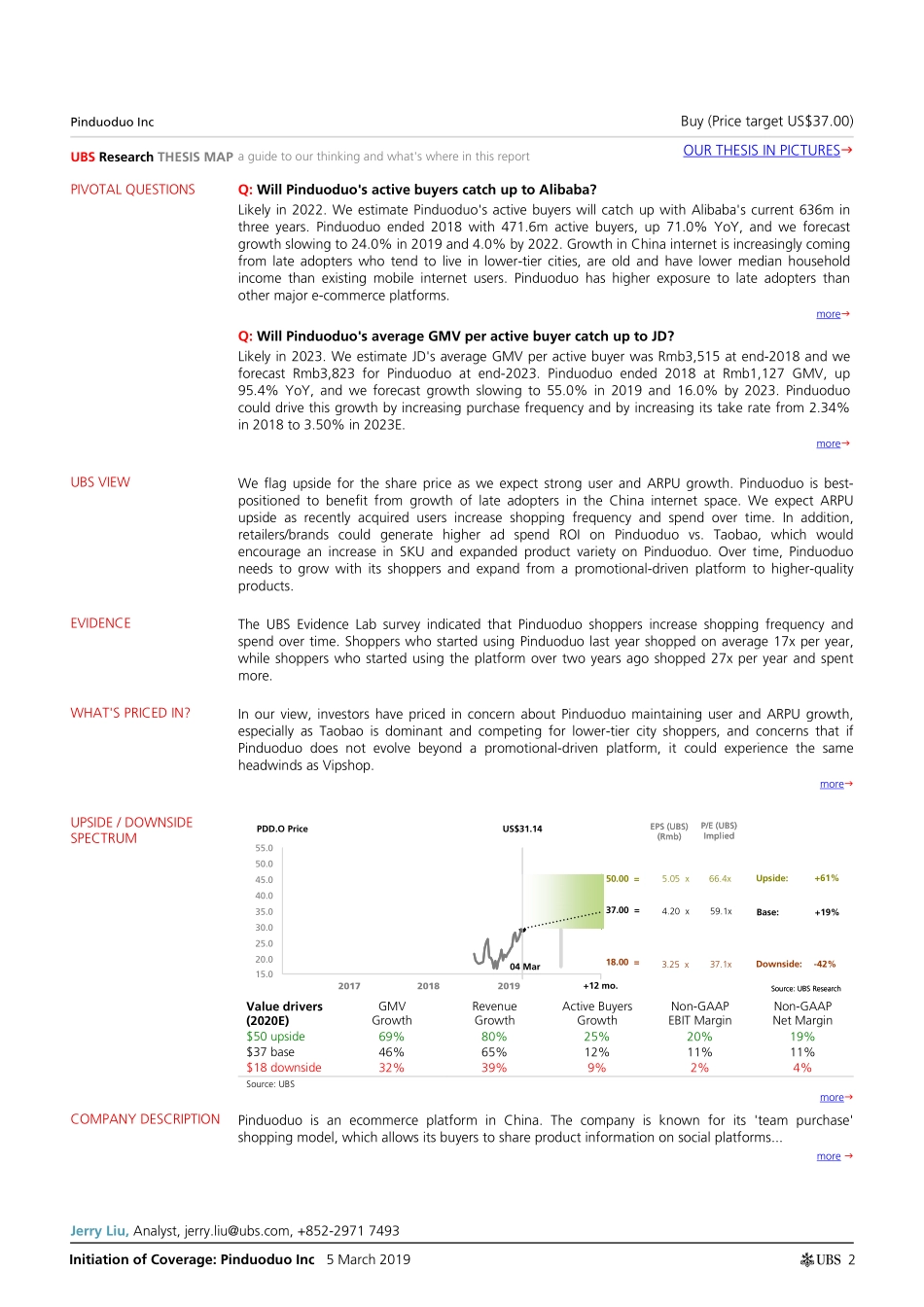

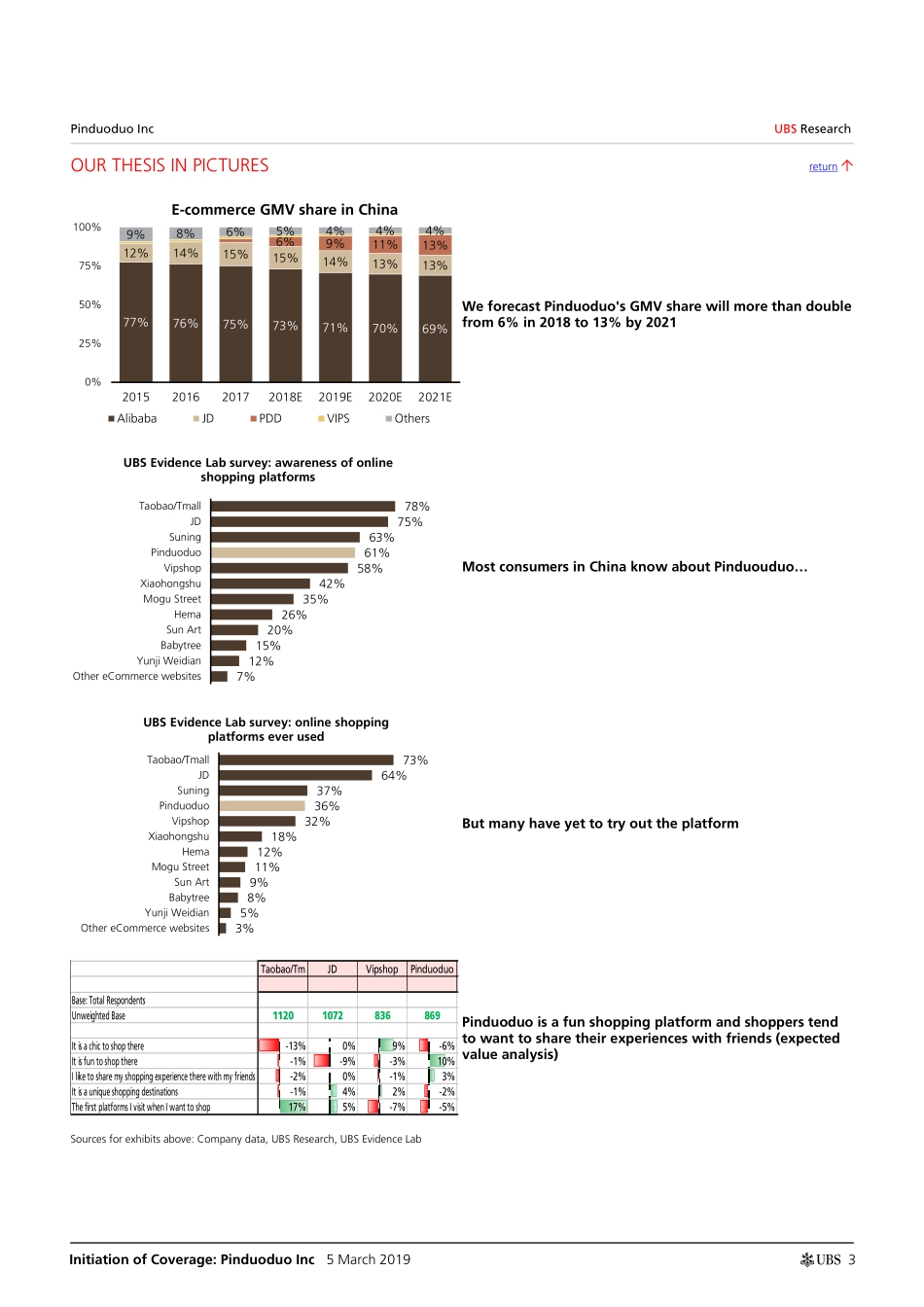

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Asia Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 35. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 5 March 2019 Initiation of Coverage Pinduoduo Inc UBS Evidence Lab inside: upside in active buyer and shopping frequency growth; initiate with Buy Late adopters of e-commerce and improving ad products drive high growth Pinduoduo is China's third-largest by online GMV e-commerce platform with social and 'gamified' features and is skewed to lower-tier city shoppers. We think there is upside to active buyer and shopping frequency growth over the next one to two years, and the company is well-positioned to benefit in the long term as users' spending power increases. Pinduoduo should also capture more retailer ad spend (and some from brands) as it improves its ad technology. The UBS Evidence Lab survey and our checks with retailers/brands suggest investors are overly concerned about competition as the stock is trading at 7.5x 2020E P/GP (gross profit) vs. 7.8x for peers. This does not price in higher growth (64% 2020E GP growth vs. the peer average of 19%), in our view. We think there is enough room for Pinduoduo and Taobao in the near term New shoppers mainly come from lower-tier cities and these late adopters could drive 24% user growth for Pinduoduo in 2019E. Both Taobao and JD managed to maintain 20%+ user growth in recent quarters. While Alibaba is a formidable competitor, only about half of Pinduoduo's users also use Taobao, according to QuestMobile. We believe both will benefit from further user growth. Shopping frequency is another key driver. The UBS Evidence Lab survey indicates users who started using Pinduoduo last year shopped 17x, while users who joined two years ago shopped 27x last year. Ad technologies and shift to C2M to drive long-term growth Feedback from retailers/brands indicates that ROI for Pinduoduo's ads is higher than Taobao's. As Pinduoduo expands ad products (campaigns, feed), educates its advertisers (including through customer to manufacturer (C2M)) and improves its algorithms (ad personalisation), we expect ad conversion and the number of advertisers to grow. This should drive ad pricing/take rate growth. While it is early days for the company's C2M strategy, we believe Pinduoduo can capture higher-quality merchants given its large and growing user base and improving ad technology. Valuation: initiate with a Buy rating and US$37.00 price target Our DCF-based price target (WACC: 12.4%) implies 8.6x 2020E P/gross pr...