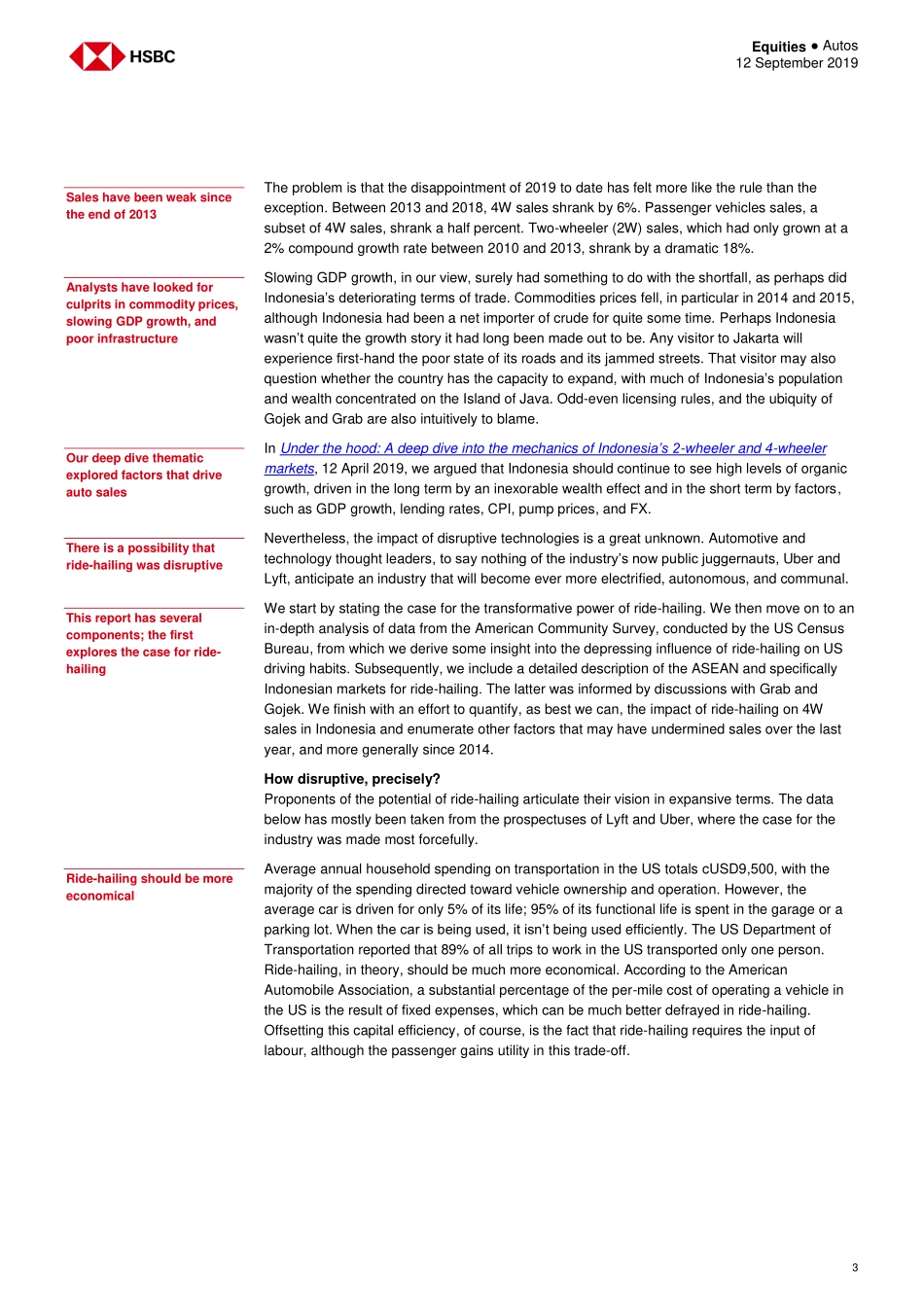

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. MCI (P) 065/01/2019 MCI (P) 008/02/2019 Issuer of report: The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch View HSBC Global Research at: https://www.research.hsbc.com Ride-hailing in Indonesia is big and disruptive, but data is scarce; this report includes a plethora of information, as well as takeaways from discussions with Grab and Gojek We think the impact of ride-hailing on 4W sales so far has been limited; cyclical factors are likely to have outweighed it We maintain Buy on Astra International and Astra Otoparts Has ride-hailing undermined 4W sales? Indonesia’s 4W sales year-to-date in 2019 are down c14% y-o-y. This has disappointed not only us (+3.7%) but also IHS (+5%), Fitch (+6%), and the Association of Indonesian Automotive Industries (-4.3%). Elections are an oft cited culprit of the slowdown, but the weakness has persisted long after their conclusion in April. The open question is how much of today’s weakness is structural and how much is cyclical, a question brought into focus by 4W sales having peaked in 2013. Ride-hailing is one potential structural headwind. In their prospectus, both Uber (UBER US, USD31.86, Hold) and Lyft (LYFT US, USD44.50, Hold) make expansive cases for the disruptive potential of ride-hailing. For example, almost half of Lyft’s riders reported that they use their cars less because of Lyft, with 22% saying that a car had become less important. Indonesia, in some ways, seems to be an even more extreme example. Visitors to Jakarta marvel at the ubiquity of 2Ws in service to Grab and Gojek. We think the impact has been limited: This report contains an extensive description of the ride-hailing markets in ASEAN and specifically Indonesia. The latter was informed by discussions we had with both Gojek and Grab. We use this as the basis for the discussion of the potential impact of ride-hailing on 4W sales. We conclude that even optimistic estimates of the number of forgone consumers due to ride-hailing represent a fraction of the market for automobile sales. More realistic assumptions suggest a low single-digit impact in any given year. The American Community Survey also suggests a limited impact: There are many differences between the US and Indonesian auto markets, but common to both is the significant growth of ride-hailing. If ride-hailing is corrosive to automobile sales, we would expect to see the impact in both markets. Unlike Indonesia, the US has extensive household-level survey data, which paints a detailed picture of changing preferences for vehicle ownership. Counterintuitively, between 2012 and 2017, cities that likely experienced the highest incursion of ride-hailing had hi...