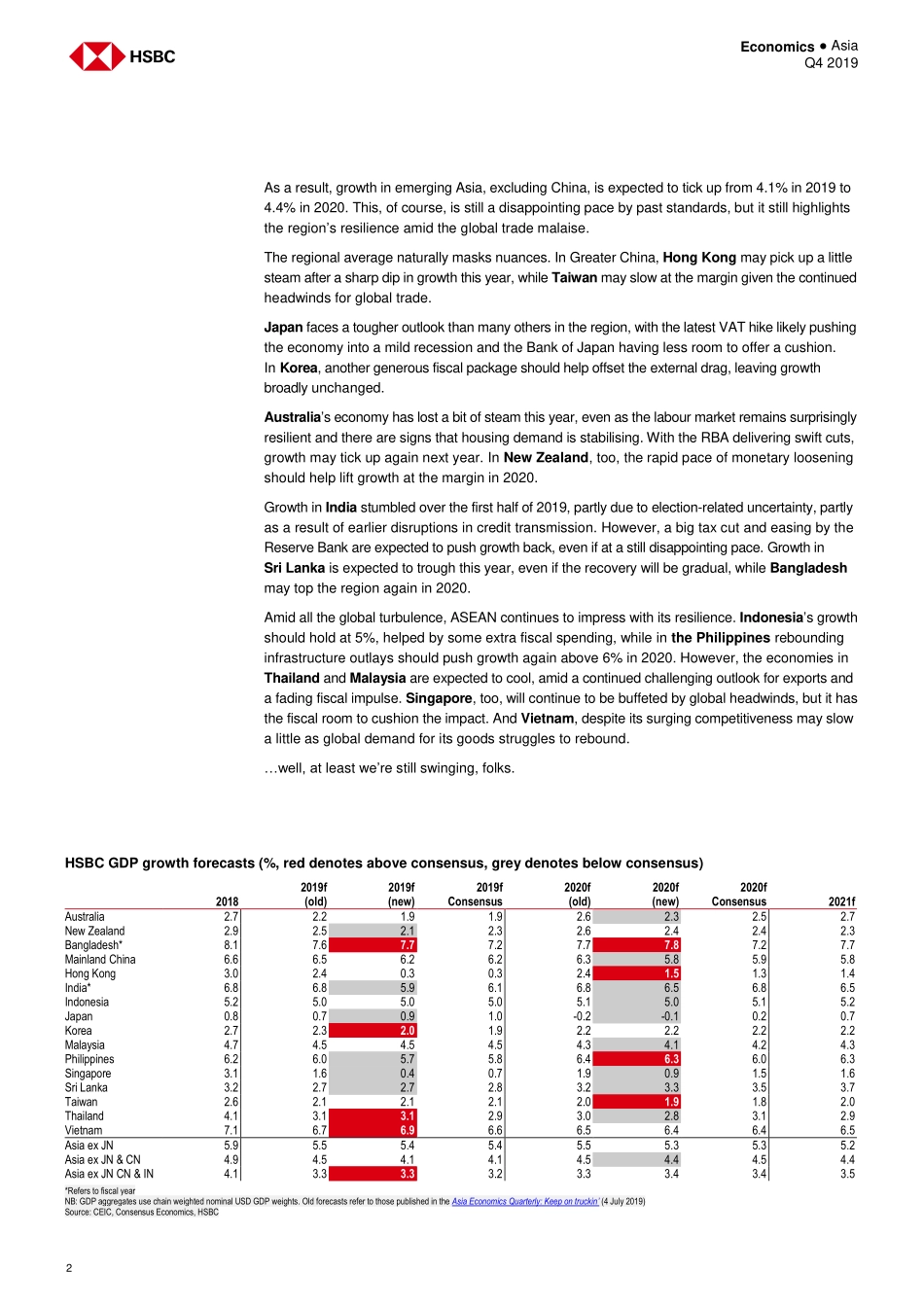

www.research.hsbc.comDisclosures & Disclaimer: This report must be read with the disclosures and the analyst certifications inthe Disclosure appendix, and with the Disclaimer, which forms part of it.EconomicsAsiaQ4 2019By: Frederic Neumann and Qu HongbinAsian EconomicsBending, not breakingTrade tensions and wobbly local demand are weighing on growth in China and elsewhere in AsiaBut further policy easing, both fiscal and monetary, will strengthen resilience across the region……even if it may take a little while longer for growth to swing back 1 Economics ● Asia Q4 2019 Things have been a little bumpier than expected across Asia, but the region is firmly holding on to growth. Exports, the main fuel of Asia’s economic engine, have dried up, with shipments falling for several months. Trade tensions between the US and China are only partly to blame: wobbly demand across developed and even many emerging markets, as well as a tired electronics cycle, have equally weighed on shipments. Hesitant easing in mainland China has further curtailed growth, not only domestically, but more broadly across the region. And yet, all considered, overall demand in Asia is ticking along at a decent enough pace. To prevent a further slowdown, however, extra easing, both monetary and fiscal, will be required. Even then, given continued global headwinds, it will take a little while longer before Asia swings back with its customary panache. Not this time Yes, things feel soggy. Look closely, however, and the region’s economies have arguably held up better than many others, notably in the West. And yet, without extra stimulus, Asia, too, is bound to slip further. Good news, then, that there is more easing in the pipeline. That said, mainland China is not about to pull out the massive reflation investors got accustomed to over previous cycles. It’s more about fine-tuning the stance, rather than pulling out all the stops: incremental monetary and fiscal easing will have to do. As a result, HSBC’s Chief China Economist, Qu Hongbin, expects growth to slow to 5.8% in 2020 from 6.2% this year. That means that downward pressures on regional, if not global, trade will persist for a while, even if trade tensions were to ease, say, because of a potential mini-deal between the US and China in the coming weeks or months. Further afield, the outlook for demand still looks shaky as well. As HSBC’s Group Chief Economist Janet Henry and Global Economist James Pomeroy detail in a recent report: while there are lots of attempts to ‘pump the air’ back into the global economy, growth in developed markets looks set to slip further (see Global Economics Quarterly: putting the air back in, 26 September, 2019). Which brings us back to the need for more stimulus. Almost all economies across Asia are expected to ease monetary policy again in the coming months....