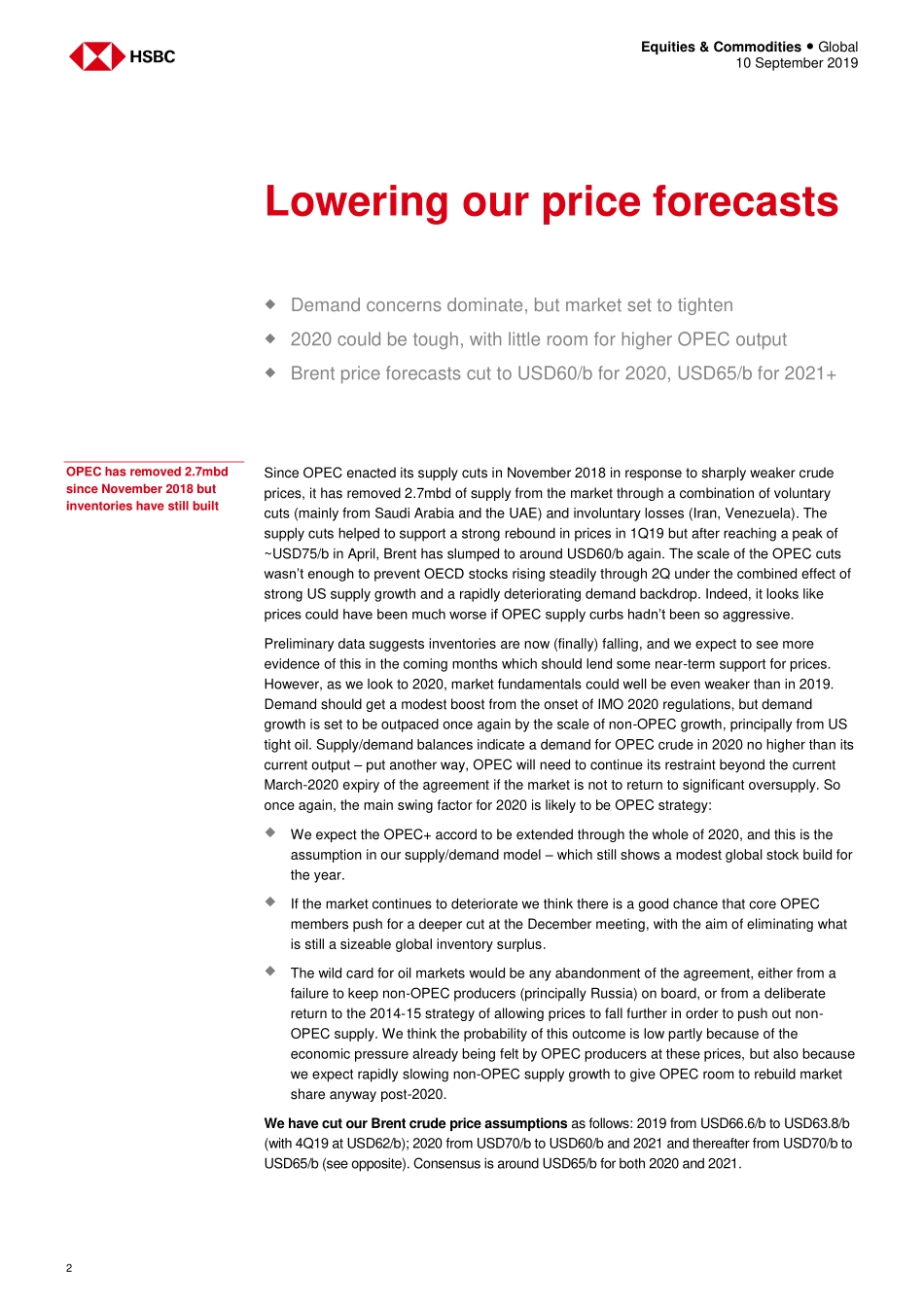

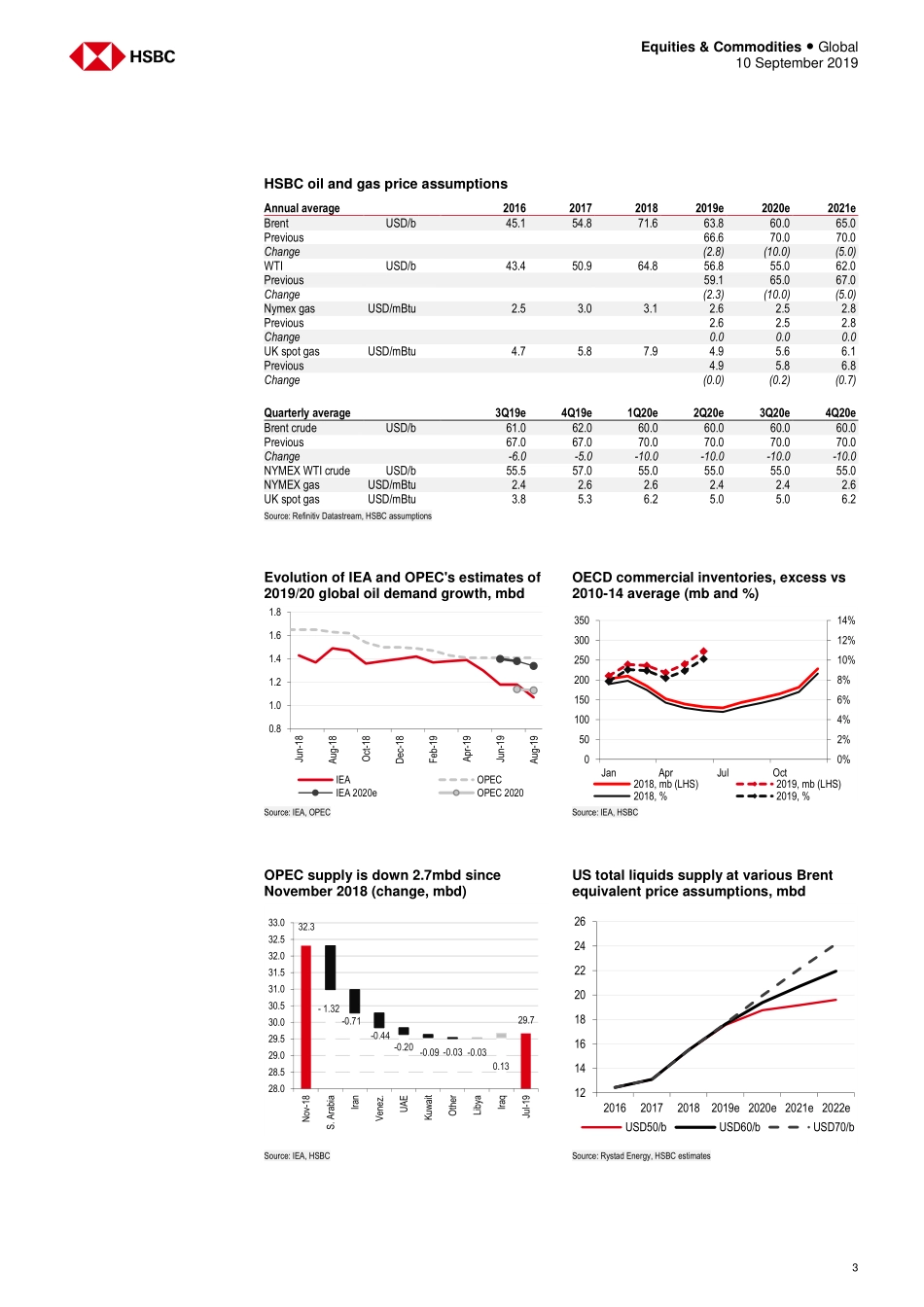

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: HSBC Bank plc View HSBC Global Research at: https://www.research.hsbc.com Demand concerns dominate at present, although the market should tighten in the next few months 2020 could be tough, with little room for higher OPEC output 2020 Brent price forecast cut by USD10/b to USD60/b; longer term forecasts cut by USD5/b to USD65/b Prices languish despite harsh OPEC cuts: OPEC supply has fallen by 2.7mbd since November as a result of aggressive production cuts (more than 1.4mbd from Saudi Arabia alone) and involuntary losses from Iran and Venezuela. Despite this, prices have remained under pressure from a combination of strong US supply growth (+2mbd y/y), rising OECD inventories and sentiment dominated by demand risks. Near-term price support? We have moved into the period where seasonal demand strength should allow significant stock draws in the coming months. This should lend some near-term support to prices, provided it shows up in OECD stocks and the macro environment doesn’t deteriorate further. Not much relief in 2020: it is hard to see the market tightening in 2020. Once again we expect non-OPEC supply growth (+2.0mbd) to outstrip demand growth (+1.1mbd), leaving virtually no room for OPEC to increase supply from current levels, and needing its supply cuts to be sustained through the year if significant oversupply and inventory builds are to be avoided. Where are the main risks? We see two main upside risks for prices: 1) a less pessimistic market view on the demand outlook, particularly if US/China trade issues are resolved, and 2) a commitment to deeper cuts from OPEC/non-OPEC, which could be possible ahead of the seasonally weak 1Q20 given the soft outlook for balances next year On the downside, a further worsening of the global economic outlook or an easing of export sanctions on Iran or Venezuela could put more pressure on prices. However, the real downside risk (though there is no sign of it at this point) would come from any change in OPEC’s strategy of supply restraint, either from a collapse of its accord with non-OPEC producers or from a deliberate return to the 2014-15 policy of allowing prices to fall to squeeze out non-OPEC supply. Lower price assumptions: We have cut our Brent crude price assumptions as follows: 2019 from USD66.6/b to USD63.8/b (with 4Q19 at USD62/b); 2020 from USD70/b to USD60/b, and 2021 and thereafter from USD70/b to USD65/b. 10 September 2019 HSBC OIL AND GAS PRICE ASSUMPTIONS Annual average 2018 2019e 2020e 2021e Brent1 71.6 63.8 60.0 65.0 Prev. 66.6 70.0 70.0 WTI1 64.8 56.1 55.0 62.0 Nymex gas2 3.07 2.60 2.50 2.75 UK spot gas2 7.87 4.88 5.60 6.10 Quarterly a...