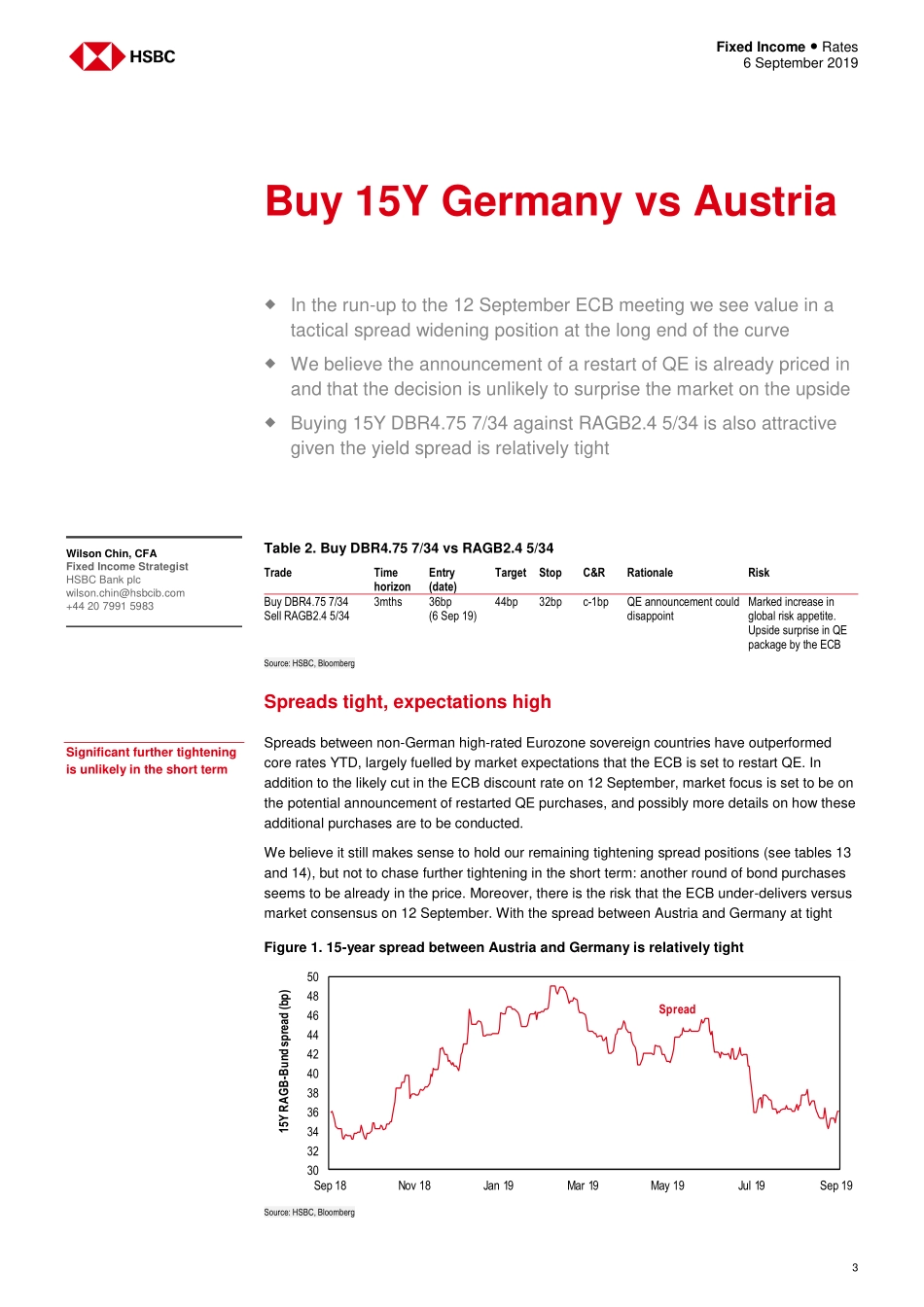

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: HSBC Bank plc View HSBC Global Research at: https://www.research.hsbc.com With the ECB meeting looming, we focus on hedges in core and non-core EGBs to protect from potential disappointments This could also cause the front end of EURUSD xccy swaps to steepen, aided by increased SSA issuance We look for the Euro inflation curve to flatten as the relative weakness of the front end appears excessive Buy 15Y Germany versus Austria Page 3 Spreads in the Eurozone core are tight, and vulnerable to widening if the size of QE disappoints. Given high expectations, the risk/reward of this widener is attractive. Spain: sell the belly of the 5-10-30Y fly Page 5 History suggests the Spanish curve could bow out at the 10-year point if the ECB disappoints on QE, but tends to bull flatten on a positive surprise. EURUSD xccy steepener Page 7 Seasonality and potential Fed balance sheet changes make the front end of the xccy curve vulnerable to a fall, but cross-country SSA issuance could impact the belly. Euro inflation swap curve flattener Page 9 The front-end is already cheap enough, and we favour positioning for under-performance at the long-end due to subdued demand and persistently low inflation. US Treasuries: tactically sell 2-3Y segment versus 1Y and 4Y Page 11 Total return analysis suggests the 2-3Y segment has tended to under-perform, rolling up the curve to a greater extent than the wings. 6 September 2019 Chris Attfield Strategist HSBC Bank plc christopher.attfield@hsbcib.com +44 20 7991 2133 Wilson Chin, CFA Fixed Income Strategist HSBC Bank plc wilson.chin@hsbcib.com +44 20 7991 5983 Subhrajit Banerjee, CFA Fixed Income Strategist HSBC Bank plc subhrajit.banerjee@hsbcib.com +44 20 7991 6851 Daniela Russell Head of UK Rates Strategy HSBC Bank plc daniela.russell@hsbcib.com +44 20 7991 1352 Lawrence Dyer Head of US Rates Strategy HSBC Securities (USA) Inc. lawrence.j.dyer@us.hsbc.com +1 212 525 0924 Shrey Singhal, CFA Fixed Income Strategist HSBC Securities (USA) Inc. shrey.singhal@us.hsbc.com +1 212 525 5126 Steven Major, CFA Global Head of Fixed Income Research HSBC Bank plc steven.j.major@hsbcib.com +44 20 7991 5980 DM Rates Ideas Fixed Income Rates Global Table 1. Summary of views Country Duration 10-30Y curve Break-even New trade ideas (this week) US Neutral Neutral Bullish Sell 2-3Y UST vs 1,4Y Euro core Mildly bullish Flatter Mildly bearish Buy 15Y Bund vs RAGB; EURUSD xccy steepener; EUR inflation swap flattener Euro non-core Neutral Flatter Mildly bearish Sell belly of 5-10-30Y Bonos UK Neutral Neutral Neutral Japan Mildly bullish Flatter Neutral Canada Neutral Flatter Mildly bullish Australia Neutral Flatter Mildly bullish...