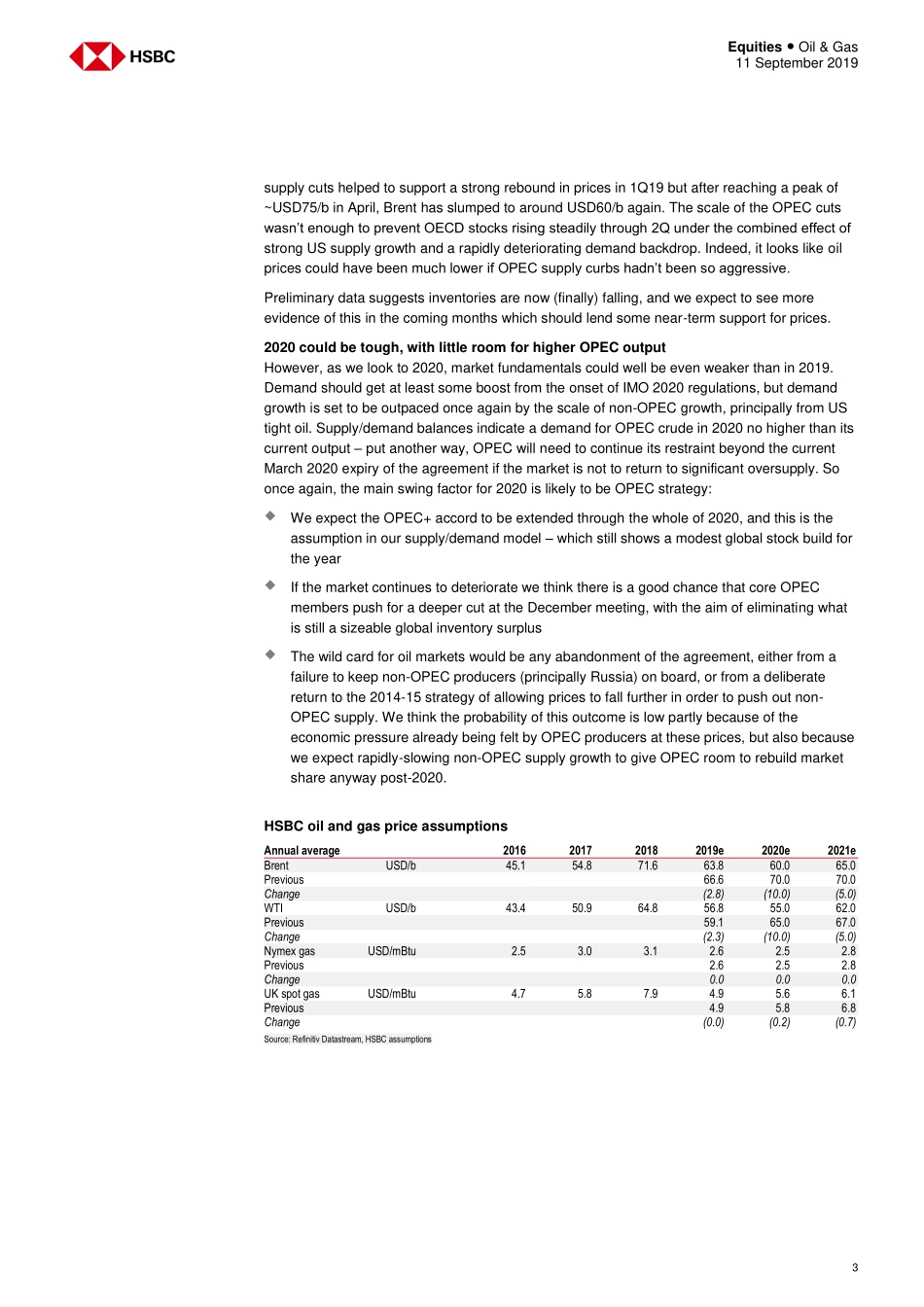

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: HSBC Bank plc View HSBC Global Research at: https://www.research.hsbc.com Cutting forecasts and target prices on lower Brent forecasts of USD60/b for 2020 and USD65/b long-term (from USD70/b) Breakevens are much more of a differentiating factor at lower prices – Equinor, BP and Total stand out as sector-leading Downgrade ENI and RDS to Hold. Reiterate Buy on BP, Equinor, Repsol, Total; most upside potential in BP, Equinor With Brent prices in the USD70/b’s, almost all the major oils were in strongly positive free cash territory and their seemed little to differentiate the stocks. This isn’t the case at lower prices, where things are more marginal. Lower free cash margins matter and stock selection becomes more important again. We lowered our Brent forecasts to USD60/b for 2020 and USD65/b for 2021 vs USD70/b in a report published yesterday (Oil market outlook: Cutting price deck – 2020 looks challenging). This has meant average cuts to our CFPS forecasts of 11% for 2020 and 6% for 2022. However, this still points to a strong outlook for the sector and we expect the stocks to re-rate over time, but given the less certain macro backdrop this re-rating could take longer than we had thought before. As a result, we have lowered our target prices by an average 9%. In this report we examine a downside case of USD55/b Brent plus gas prices, refining and chemicals margins staying weak in order to test the resilience of the companies. This is where differences in breakevens really show up, and the merits of the more defensive stocks become apparent. In particular, we think low breakevens at Equinor, BP and Total given them a critical advantage. Shell’s outlook is strong at USD65-70/b but a high free cash breakeven leaves it much less flexibility than key peer BP, which remains a top pick; we downgrade Shell from Buy to Hold and see better catalysts in BP; see our report: BP the better defensive play; RDS downgraded to Hold for more detail. ENI’s above-average breakeven is behind our downgrade to Hold. We reiterate Buy ratings on Equinor, Repsol and Total, and Hold ratings on Chevron and Exxon. The highest upside implied by our target prices is in Equinor (20%) and BP (18%). 11 September 2019 Gordon Gray* Global Head of Oil and Gas Equity Research HSBC Bank plc gordon.gray@hsbcib.com +44 20 7991 6787 Kim Fustier* Analyst, Oil & Gas HSBC Bank plc kim.fustier@hsbc.com +44 20 3359 2136 * Employed by a non-US affiliate of HSBC Securities (USA) Inc, and is not registered/ qualified pursuant to FINRA regulations Global integrated oils Equities Oil & Gas Global Integrated oils – Stock summary table Current _____...