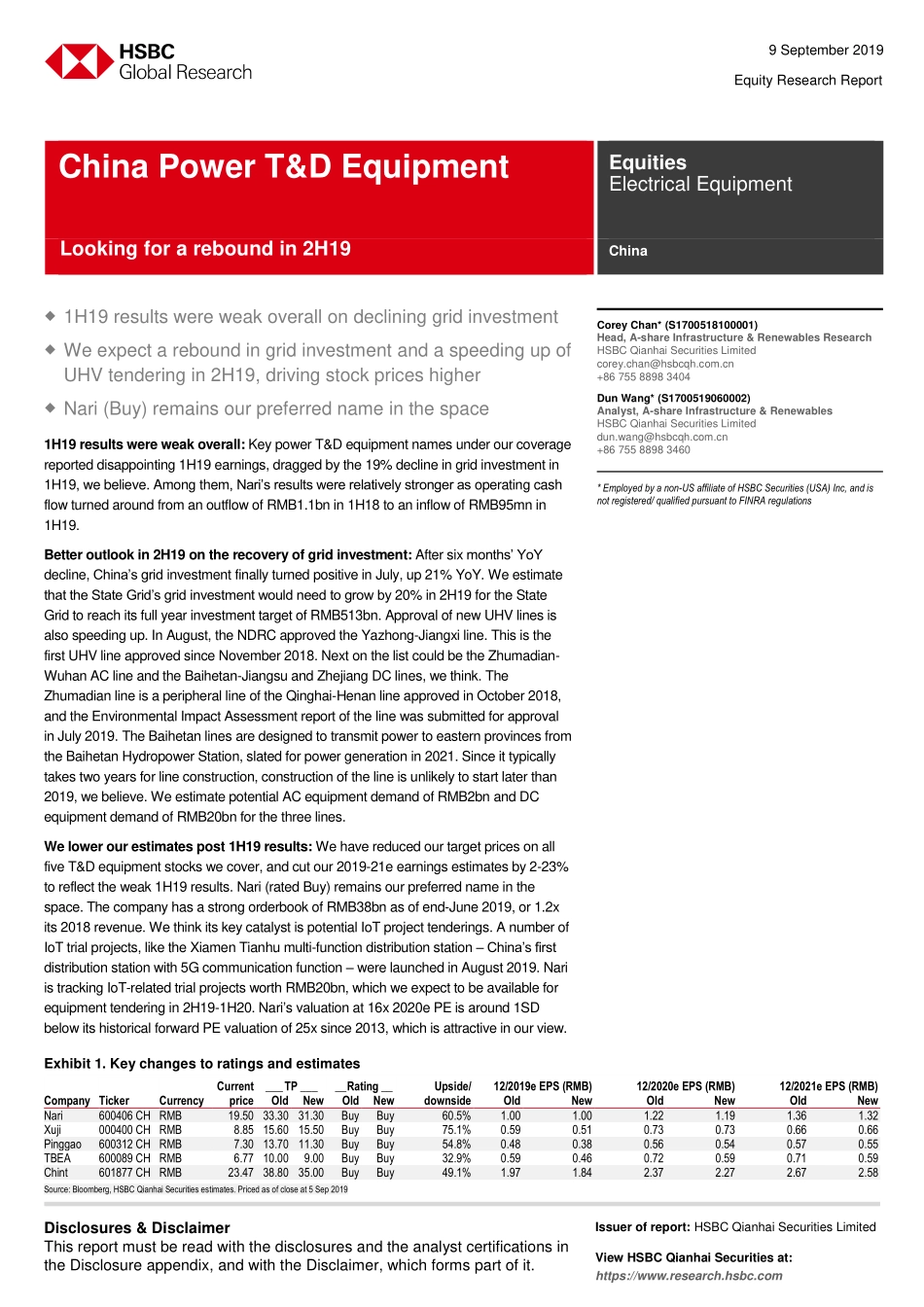

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: HSBC Qianhai Securities Limited View HSBC Qianhai Securities at: https://www.research.hsbc.com Equity Research Report 1H19 results were weak overall on declining grid investment We expect a rebound in grid investment and a speeding up of UHV tendering in 2H19, driving stock prices higher Nari (Buy) remains our preferred name in the space 1H19 results were weak overall: Key power T&D equipment names under our coverage reported disappointing 1H19 earnings, dragged by the 19% decline in grid investment in 1H19, we believe. Among them, Nari’s results were relatively stronger as operating cash flow turned around from an outflow of RMB1.1bn in 1H18 to an inflow of RMB95mn in 1H19. Better outlook in 2H19 on the recovery of grid investment: After six months’ YoY decline, China’s grid investment finally turned positive in July, up 21% YoY. We estimate that the State Grid’s grid investment would need to grow by 20% in 2H19 for the State Grid to reach its full year investment target of RMB513bn. Approval of new UHV lines is also speeding up. In August, the NDRC approved the Yazhong-Jiangxi line. This is the first UHV line approved since November 2018. Next on the list could be the Zhumadian-Wuhan AC line and the Baihetan-Jiangsu and Zhejiang DC lines, we think. The Zhumadian line is a peripheral line of the Qinghai-Henan line approved in October 2018, and the Environmental Impact Assessment report of the line was submitted for approval in July 2019. The Baihetan lines are designed to transmit power to eastern provinces from the Baihetan Hydropower Station, slated for power generation in 2021. Since it typically takes two years for line construction, construction of the line is unlikely to start later than 2019, we believe. We estimate potential AC equipment demand of RMB2bn and DC equipment demand of RMB20bn for the three lines. We lower our estimates post 1H19 results: We have reduced our target prices on all five T&D equipment stocks we cover, and cut our 2019-21e earnings estimates by 2-23% to reflect the weak 1H19 results. Nari (rated Buy) remains our preferred name in the space. The company has a strong orderbook of RMB38bn as of end-June 2019, or 1.2x its 2018 revenue. We think its key catalyst is potential IoT project tenderings. A number of IoT trial projects, like the Xiamen Tianhu multi-function distribution station – China’s first distribution station with 5G communication function – were launched in August 2019. Nari is tracking IoT-related trial projects worth RMB20bn, which we expect to be available for equipment tendering in 2H19-1H20. Nari’s valuation at 16x 2020e PE is around 1SD below its historic...