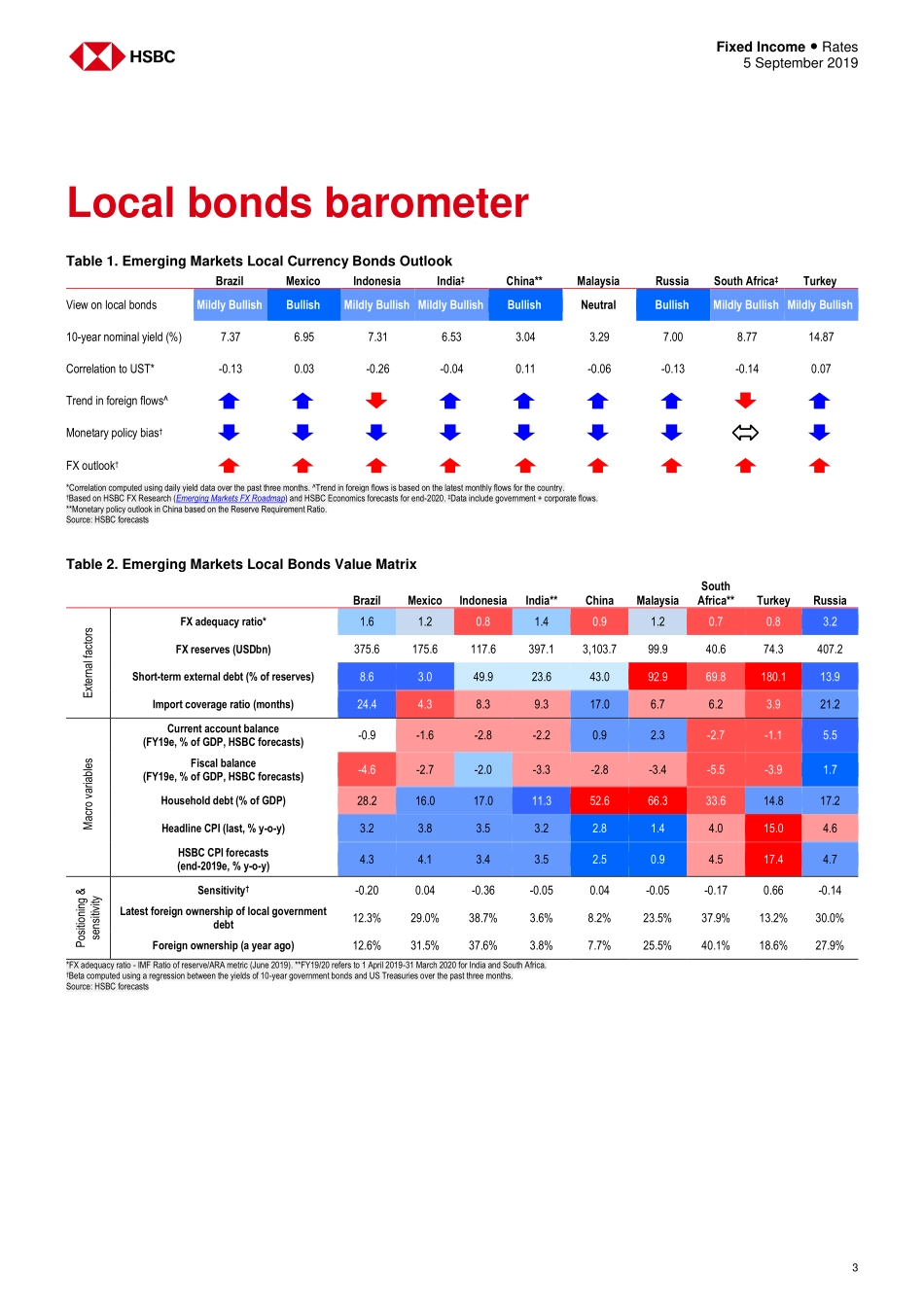

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: The Hongkong and Shanghai Banking Corporation Limited View HSBC Global Research at: https://www.research.hsbc.com THIS CONTENT MAY NOT BE DISTRIBUTED TO THE PEOPLE'S REPUBLIC OF CHINA (THE "PRC") (EXCLUDING SPECIAL ADMINISTRATIVE REGIONS OF HONG KONG AND MACAO) Volatility is back but we stick to our bullish views on EM local rates given the global easing cycle and relatively high yields Our model reveals that the recent decline in EM local bond yields is not excessive Our preferred bond exposures include 15yr South Africa, 10yr for Indonesia, Mexico, Brazil, India, 30yr China, and 5yr Russia The return of vol: While volatility has undoubtedly returned to global markets we maintain our bullish duration stance on EM local rates. This is due to the global easing cycle, widening yield differentials with G3 bonds, and limited impact from falling EM FX. We see that volatility in EM rates is still low on a relative basis but to reduce exposure to any potential pick-up we recommend adding convexity to portfolios in some liquid low-yielding markets, and in particular, Thailand. A modelled approach to EM yields: To better understand the impact of EM FX, EM FX volatility, and US Treasury yields on EM local bond yields we introduce a valuation model that uses neural networks, a type of machine learning which can identify relationship and spot patterns from large volumes of data. We find this model correctly predicts the direction of average EM bond yields most of the time. This reveals that the downtrend in local bond yields, despite weaker EM FX and higher implied volatility, is not an anomaly but largely a function of lower US Treasury yields. EM debt flows: While capital inflows into EM local debt markets moderated in July and August, some indications show offshore demand for Asian high yielders is returning. In fact, the latest jump in EM FX vol has not yet dented the offshore appetite for EM local bonds. However, with EM FX vol still fairly modest we believe it is crucial to monitor several risk events that could be a key source of volatility in EM FX and subsequent outflows from EM local debt. This not only includes the volatility in the yuan on the back of US-China trade tensions but also uncertainty surrounding Brexit and intensifying risks in Argentina. Our preferred markets: Our long duration stance remains intact in most EM high yielders including South Africa (buy 15yr SAGBs), Indonesia (buy 10yr IndoGBs), Mexico (buy 10yr Mbonos), Brazil (buy 10yr BNTNF), and India (buy 10yr Gsecs). We also retain our preference for local bonds in Russia (buy 5yr OFZs) and China (buy 30yr CGBs). We have cut our mildly...