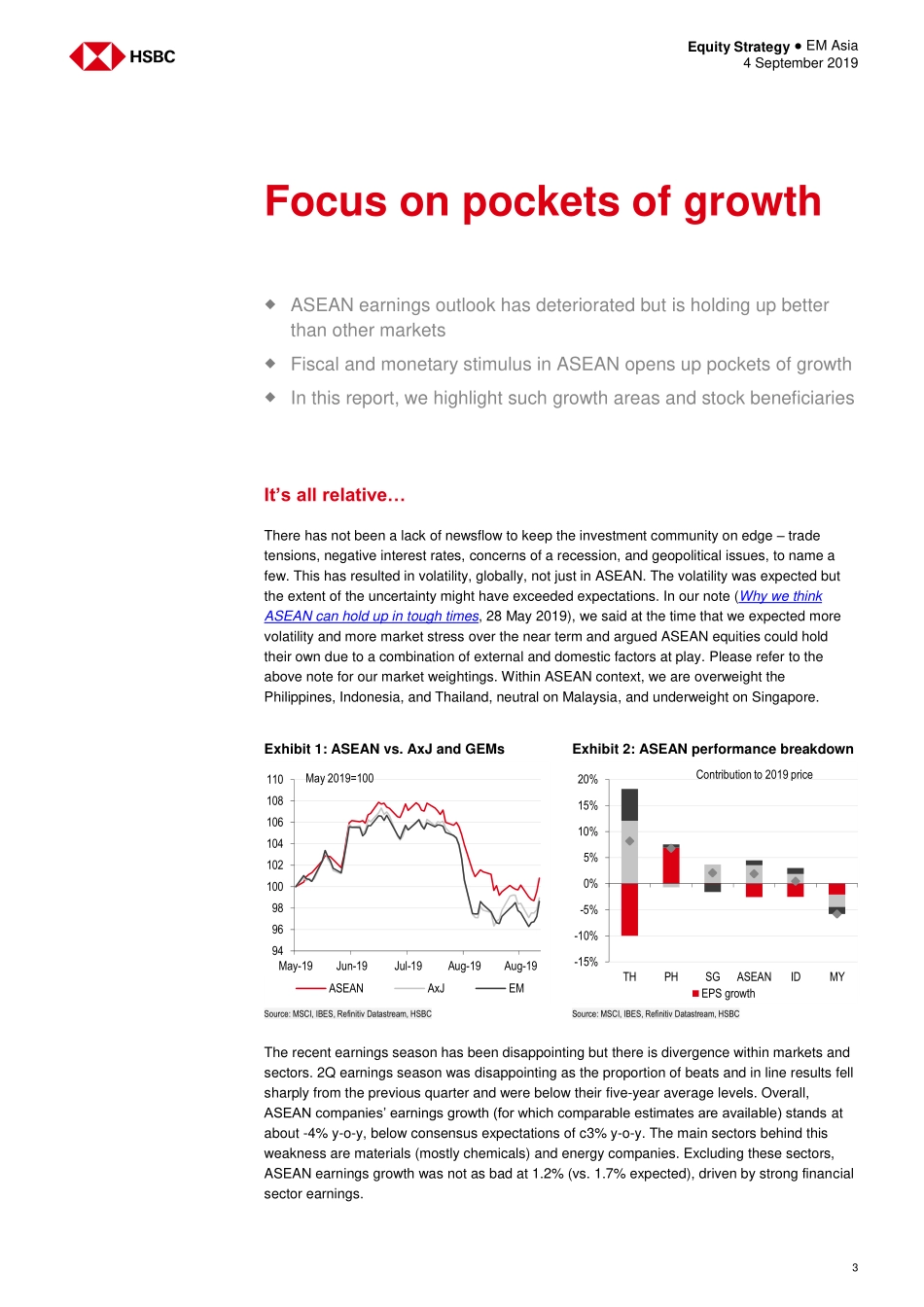

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: The Hongkong and Shanghai Banking Corporation Limited View HSBC Global Research at: https://www.research.hsbc.com ASEAN earnings season disappointed; but headline numbers masked divergence within markets and sectors We look below the headline numbers and identify pockets of growth; domestic demand led by fiscal and monetary stimulus are the key drivers We present our “strategy list” which highlights names that could benefit from “pockets of growth” in ASEAN ASEAN earnings forecasts have been revised lower but they are still holding up better than Asia ex Japan and GEMs. Consensus had pegged ASEAN 2019 earnings growth at 7.6% y-o-y at the start of the year, this is now down to 3.5% y-o-y. However, several sectors like real estate, industrials, healthcare, and communication services are seeing an improving earnings outlook. For 2Q19, ASEAN companies’ earnings growth (for which comparable estimates are available) stands at about -4% y-o-y, below consensus expectations of c3% y-o-y. The main sectors behind this weakness are materials (mostly chemicals) and energy companies. Excluding these sectors, ASEAN earnings growth was not as bad at 1.2% (vs. 1.7% expected), driven by strong financial sector earnings. Domestic demand matters for ASEAN earnings. While several countries in the region have high levels of exports, listed ASEAN companies are largely domestic, with almost 80% of sales taking place in their home market. Therefore, key to ASEAN earnings is domestic demand...supported by monetary and fiscal stimulus. Lower rates globally have provided breathing space for emerging markets such as ASEAN to loosen monetary policy. In addition, this has also opened up fiscal space for these economies to pursue investment and government spending. This is positive for domestic oriented sectors such as consumer, real estate, telcos, and select industrials. Looking for brighter spots. Historically, the actual EPSg always comes in below the forecasts in middle of the year. But this time, fiscal stimulus and infrastructure spending in some markets could support earnings, so too should lower rates. Apart from earnings, we also argue that valuations in ASEAN are supportive, trading at one SD below its five-year average history and also relative to Asia ex Japan. Fund positioning is light and high dividend yield is an added attraction in a low rate environment. We like the Philippines, Thailand, and Indonesia markets. Among sectors we like consumer, real estate, telcos, and select industrials. Our ASEAN strategy list on the next page highlights the relevant stocks.4 September 2019 Devendra Joshi* Equity Strategist, ASEAN and Frontier Markets The Hongko...