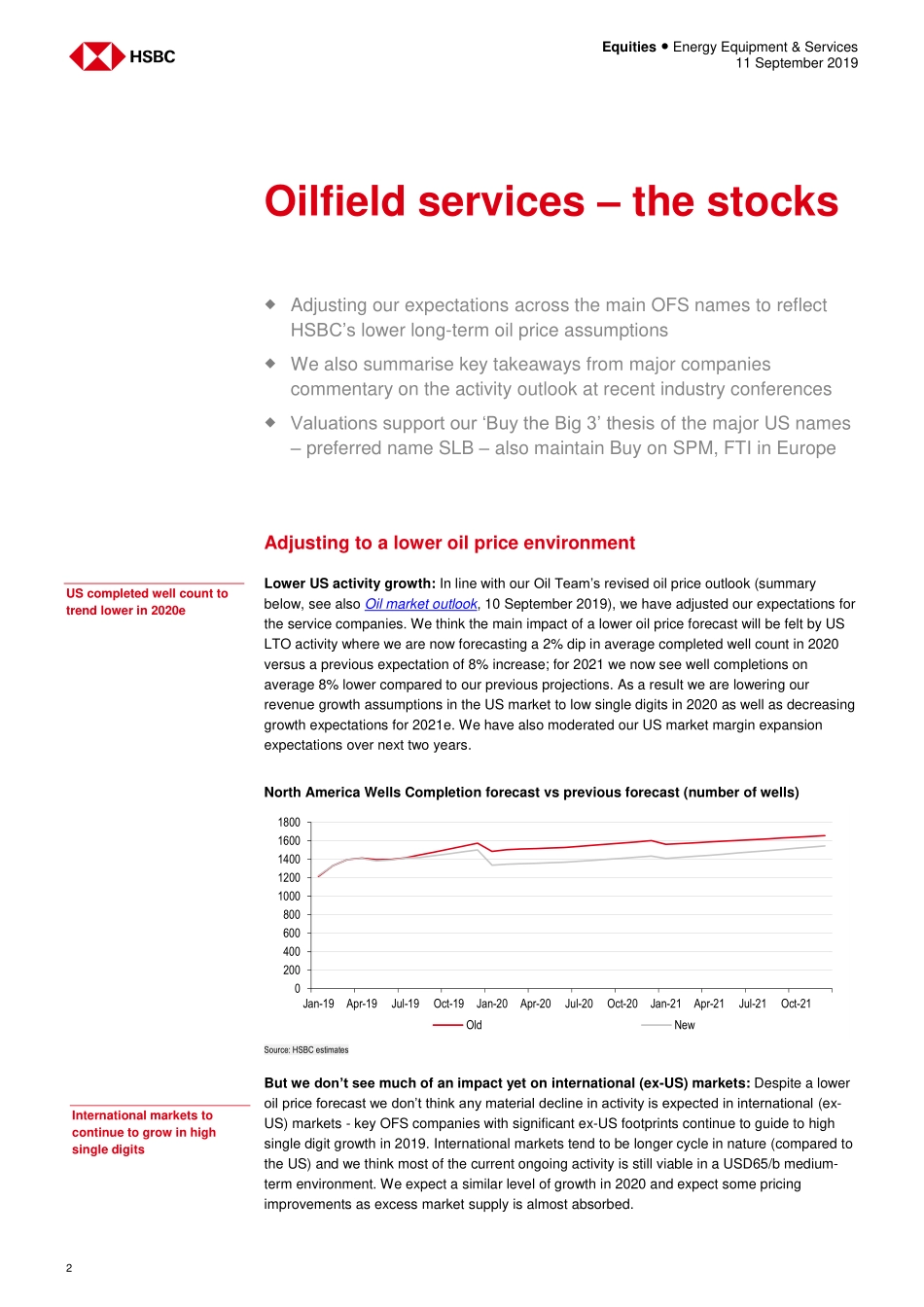

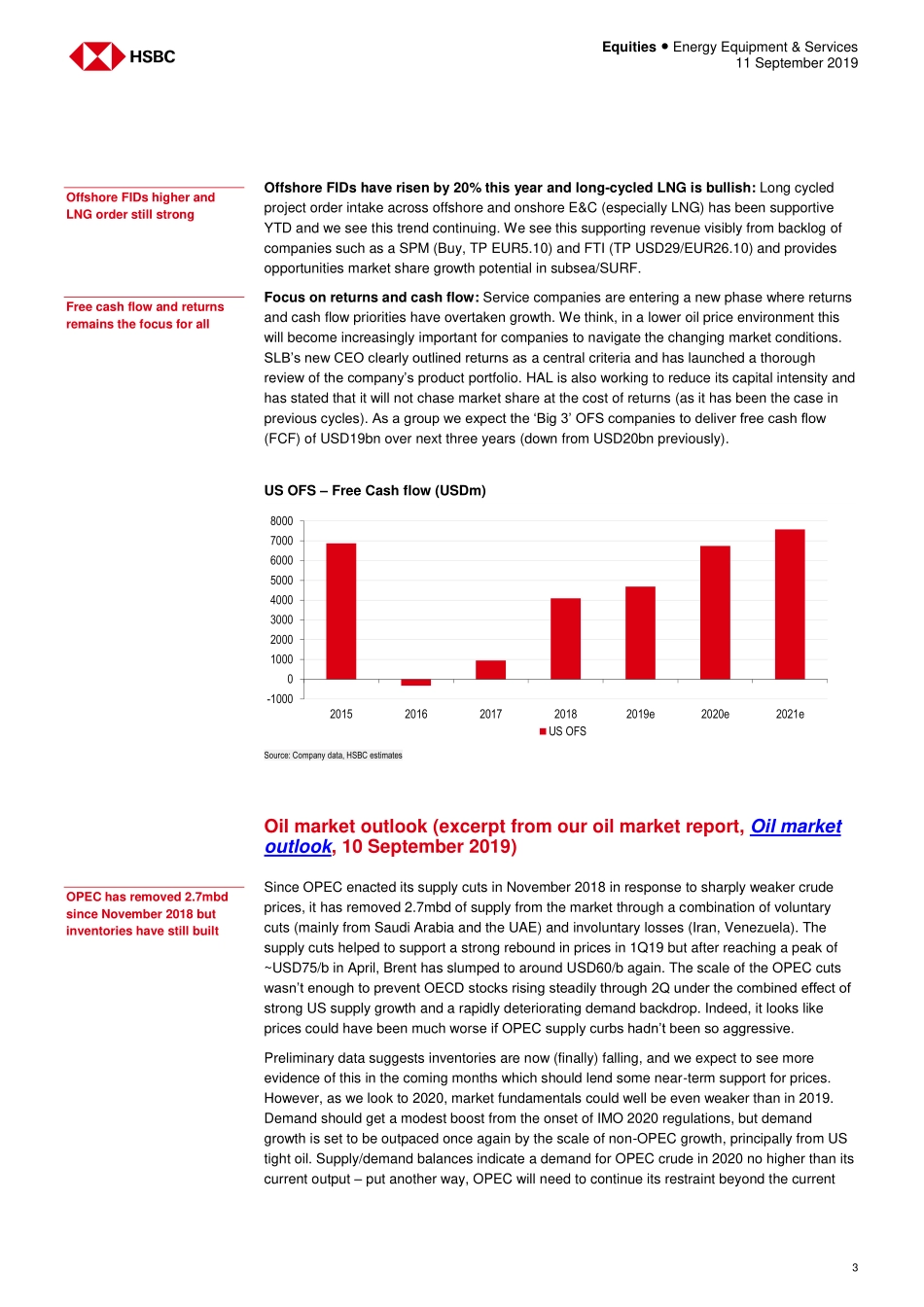

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: HSBC Securities and Capital Markets (India) Private Limited View HSBC Global Research at: https://www.research.hsbc.com We align our short cycle OFS expectations with our revised framework for oil – USD60/b for 2020e, USD65/b longer term North American growth affected, but see limited impact on recovery in international and offshore markets We lower forecasts and TPs for the ‘Big 3’ and WEIR; prefer SLB’s ex-US exposure and offshore/gas-driven SPM, FTI What’s changed: To reflect our revised oil price framework, we lower our EPS estimates for the ‘Big 3’ by on average 3% for 2019e, 5% for 2020e and 10% for 2021e (most for HAL, least for BHGE/SLB). We also cut our oil and gas estimates for WEIR, but see minor company-level impact due to the large Mineral business. These changes reflect lower growth and weaker margin incrementals from North American LTO (light tight oil) markets. We now see the completed well count down 2% in 2020e (versus up 8% before) and up 7% in 2021e (versus up 4% before); overall we see 26% growth from start-2019 to end-2021 (versus 36% before). On average across the ‘Big 3’, we cut TPs by 3%, but we see 50% upside and forecast USD19bn of free cash generation over 2019-2021e (down slightly from USD20bn before). What’s not changed: Versus our previous long-term assumption of USD70/b Brent, we do not think USD65/b will imply a material change to the gradual international and offshore upstream recovery seen so far this year. We see IOC capex at USD134bn by 2021/22e, up 28% versus the trough in 2017. We also see a robust cycle for natural gas-related investment activity, especially LNG. This supports little change to our assumptions for non-North American oilfield activity, including offshore. Our investment views: The ‘international’ (ex-US) market recovery supports our preference for SLB (Buy, TP USD51), but with the ‘Big 3’ trading at 20-40% discounts to historical valuations, we also see attractive upside with BHGE (Buy, TP USD30) and HAL (Buy, TP USD33). We continue to prefer SPM (Buy, TP EUR5.1) and FTI (Buy, TP USD29.0/EUR26.1) in Europe, supported by exposure to natural gas/LNG-driven backlog growth and gradual offshore investment recovery. We are buyers of WEIR despite the weaker outlook for its oil & gas business due to positive order newsflow from its larger Minerals business ‒ new TP of 1,870p (from 1,895p). 11 September 2019 Abhishek Kumar* Analyst HSBC Securities and Capital Markets (India) Private Limited abhishek.kumar@hsbc.co.in +91 80 4555 2753 Tarek Soliman*, CFA Analyst HSBC Bank plc tarek.soliman@hsbc.com +44 20 3268 5528 David Phillips* Head of Equity Research, Deve...