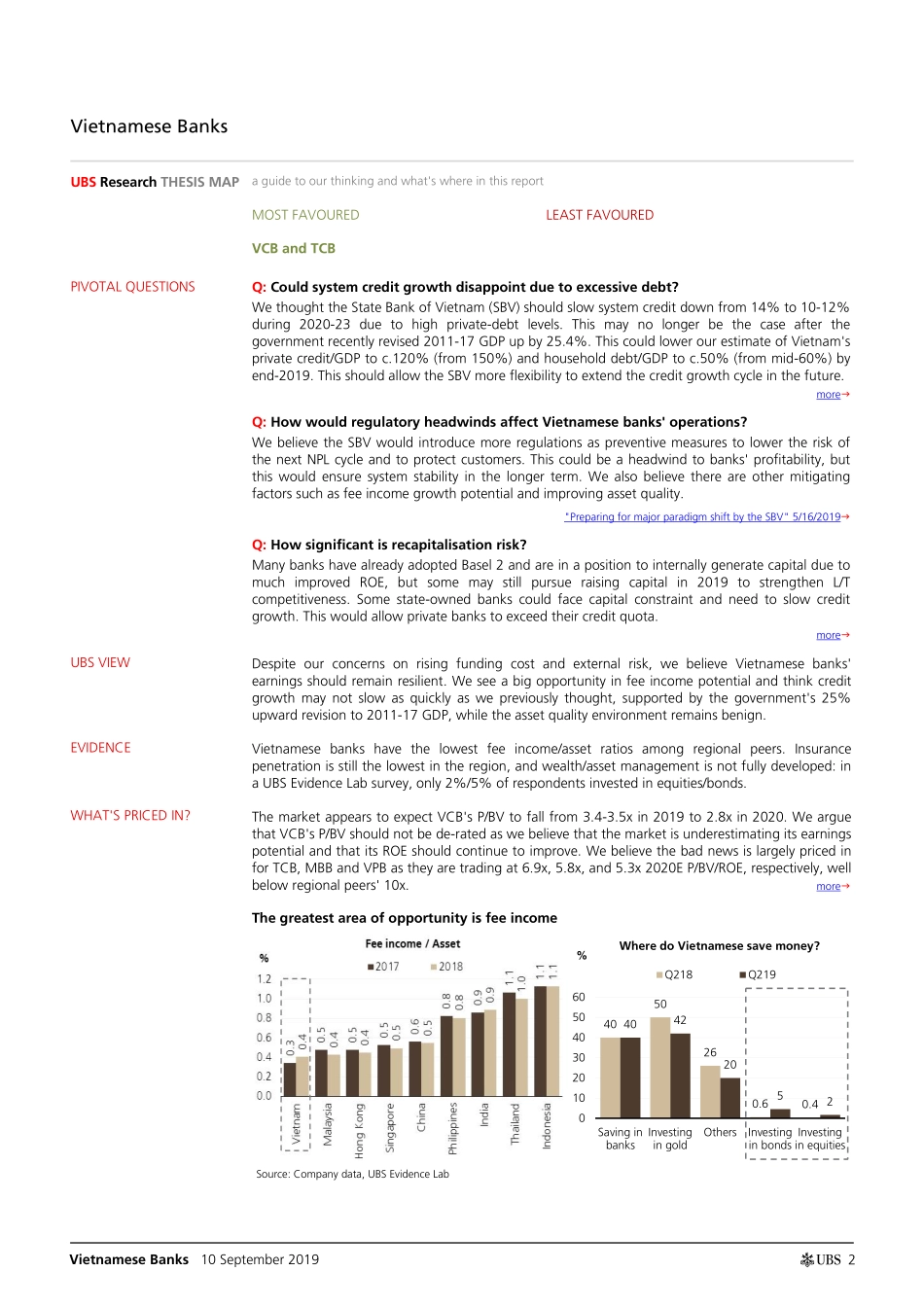

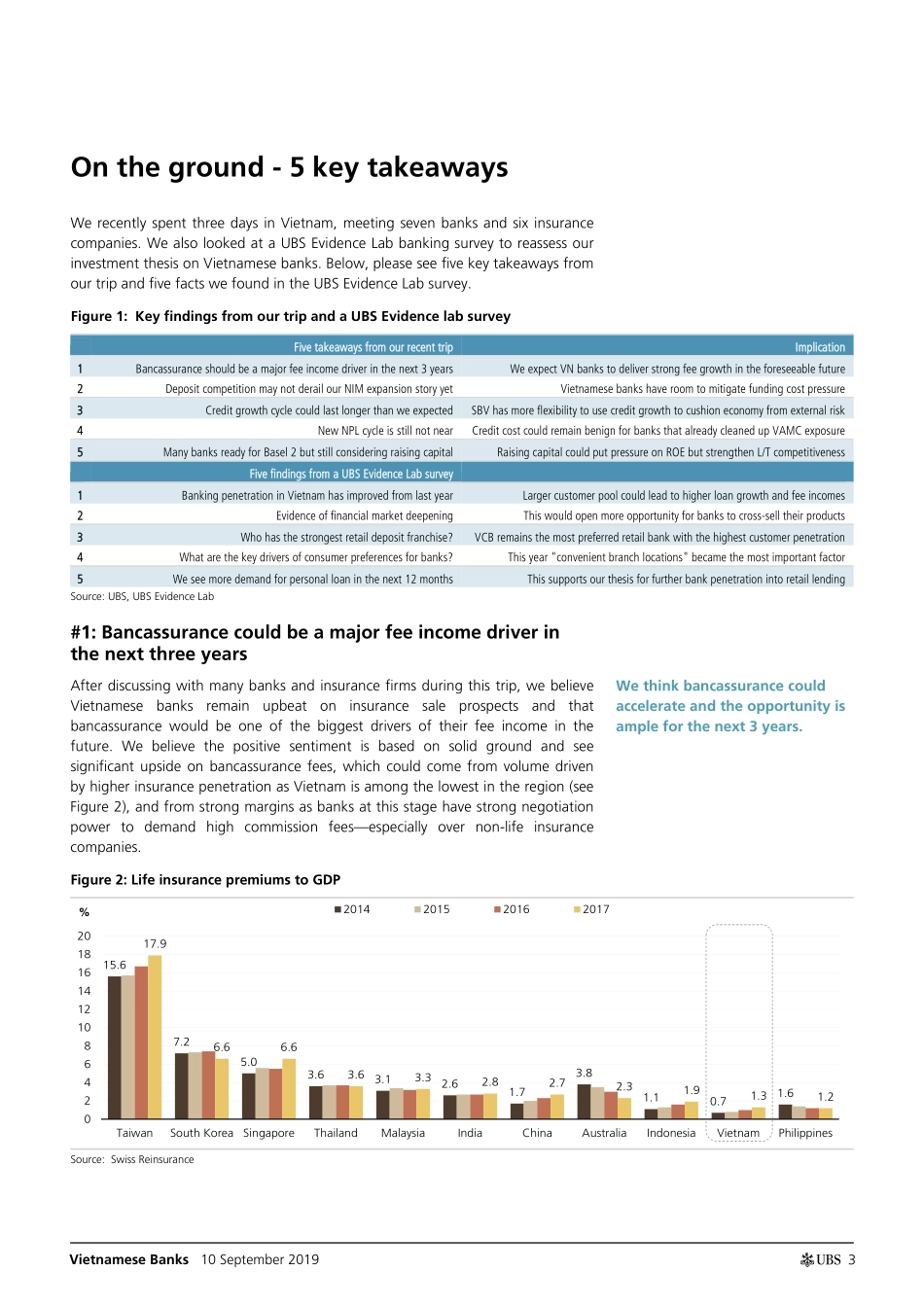

www.ubs.com/investmentresearch This report has been prepared by UBS Securities (Thailand) Ltd. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 36. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 10 September 2019 Vietnamese Banks UBS Evidence Lab: Why should investors buy Vietnamese banks now? New evidence supports positive view; upgrade VCB to Buy (top picks: VCB/TCB) We visited Vietnam and used the results of an on-the-ground survey that UBS Evidence Lab conducted with over 1,000 local respondents to reassess the investment thesis we put forth when we initiated coverage of the sector in 2018, UBS Evidence Lab: Can the music keep playing? Overall, despite our concern on rising funding costs, high private-debt levels and external risks, we still believe this is a good time to invest in Vietnamese banks. We expect the economy to remain strong with GDP of 6.5-6.6% during 2019-20E. We see a big opportunity in fee income potential. Moreover, we believe system credit growth may not slow as quickly as we previously thought and that a new NPL cycle is not near. Five key takeaways from our recent trip in Hanoi and HCMC 1) Bancassurance could be a major driver of fee income as our analysis indicates life insurance premiums could triple in the next three years. 2) Deposit competition may not yet derail our NIM expansion story. We were relieved when the SBV recently warned banks to stop irrational competition and we believe banks could pass rising funding costs on to customers and have room to improve loan mix. 3) Credit growth cycle could last longer than we previously expected, supported by the government's recent 25% upward revision to 2011-2017 GDP. 4) We think the new NPL cycle is not near and credit cost should remain benign—especially for banks that have already cleaned up their VAMC exposure. 5) Many Vietnamese banks are ready for Basel 2 next year but some may consider raising capital to strengthen their L/T competitiveness. Five key findings from a UBS Evidence Lab survey Referring to a recent UBS Evidence Lab survey, we found that: 1) banking penetration has improved; 2) financial markets are deepening, which reaffirms our belief in banks' ample fee income potential; 3) regarding strength of retail deposit franchise, VCB remains the most preferred retail bank and has the highest customer penetration in the survey. MBB and VPB continue to rank poorly on customer preference and account penetration. TCB appeared to lose ground in customer preference rankings but this does not necessarily mean its retail deposit franchise...