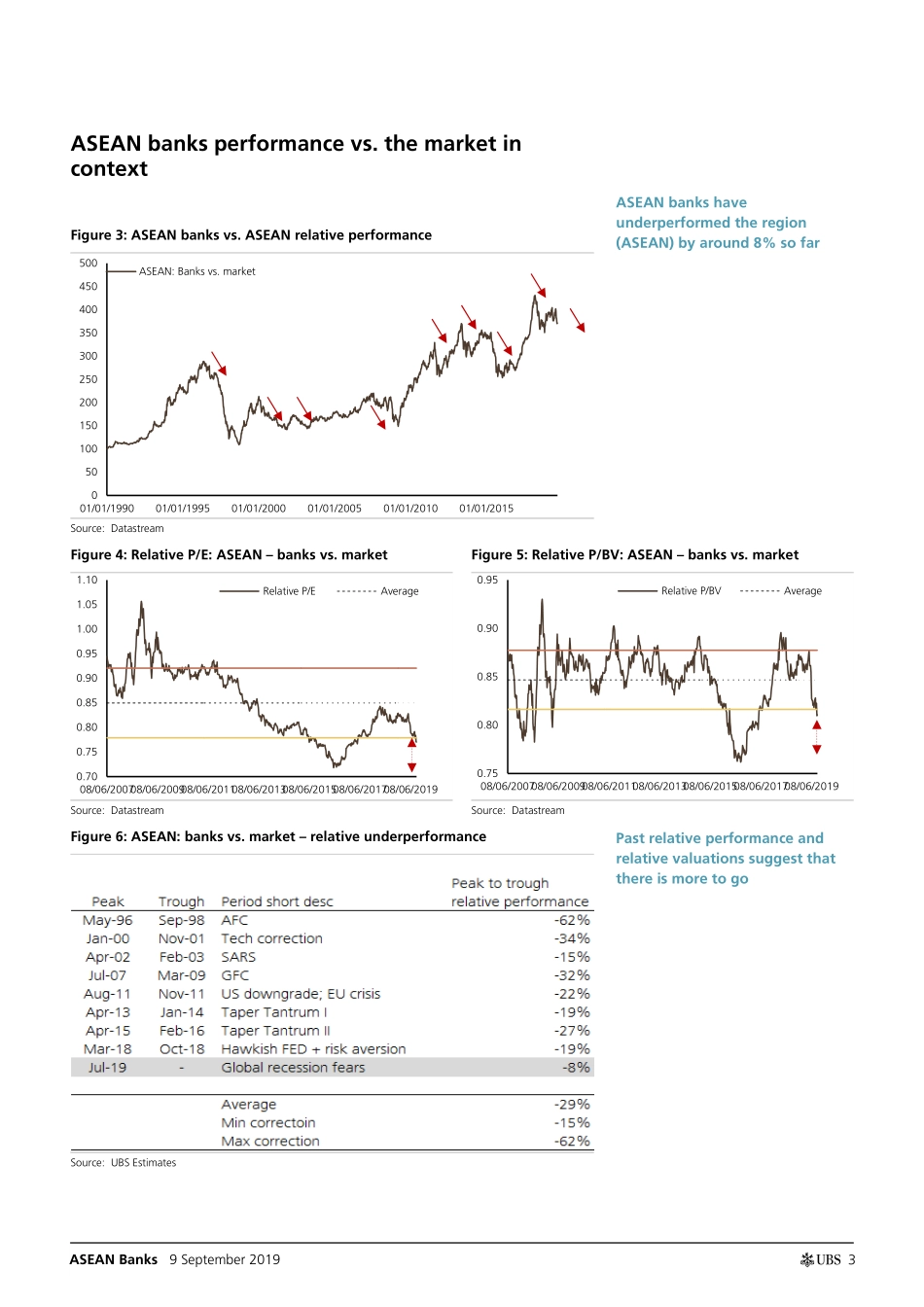

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Pte. Ltd. (Reg. No. 198500648C). ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 65. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 9 September 2019 ASEAN Banks Philippines a bright spot; Singapore downgrade to underweight ASEAN banks underperformed by (only) 7-8% so far… In ASEAN, banks have underperformed by 7-8% ytd and we believe this is likely to continue as global recession worries rise and central banks lower rates. Looking back at eight periods of significant u/p by ASEAN banks in the last 30y, the average was -30%. The worst was during the Asian Financial Crisis (-62%) and least during SARS (-15%). Relative valuations for ASEAN banks are surely not stretched today but there is room to compress, even relative to latest trough levels in 2015-16 (RMB devaluation). We see biggest risk of u/p for Singapore banks and downgrade the sector to underweight. Philippine banks remain a clear overweight. We also upgrade Thai & Malaysian banks to Neutral, and maintain Neutral on Indonesian banks, though reasoning is different. Philippine banks a bright spot; Singapore banks likely to underperform In Philippines, the impact of lower rates on loan growth and asset quality will be a net positive for earnings. While lower rates are clearly negative for the NIM, RRR cuts help offset this almost completely. Moreover valuations both relative to ASEAN banks and the local market look attractive. In Singapore, on the other hand, not only the GDP is most sensitive to external demand shift, we also expect the flow through of US interest rates to SG to rise in future. This will put more pressure on NIM than seen so far. A sustained growth slowdown is also likely to make investors worry about asset quality. In particular, as post IFRS9 adoption, credit costs have declined c50% and sector NPL coverage has fallen below 100%. Dividend yield (c5%) provides valuation support for now but we suspect investors will start questioning its sustainability. Valuation vs. ASEAN also suggests there could be more downside. MY/TH banks: limited downside but missing a catalyst; Indo. banks: too pricey. Earnings catalysts seem missing for both Thai and Malaysian banks at this point but relative valuations suggest little room for further underperformance. On the other hand, for Indonesian banks, earnings momentum for 2020 looks the strongest in ASEAN but valuations look stretched and suggest little room for any disappointment, possibly on margins, loans and/or credit costs. Most prefer...