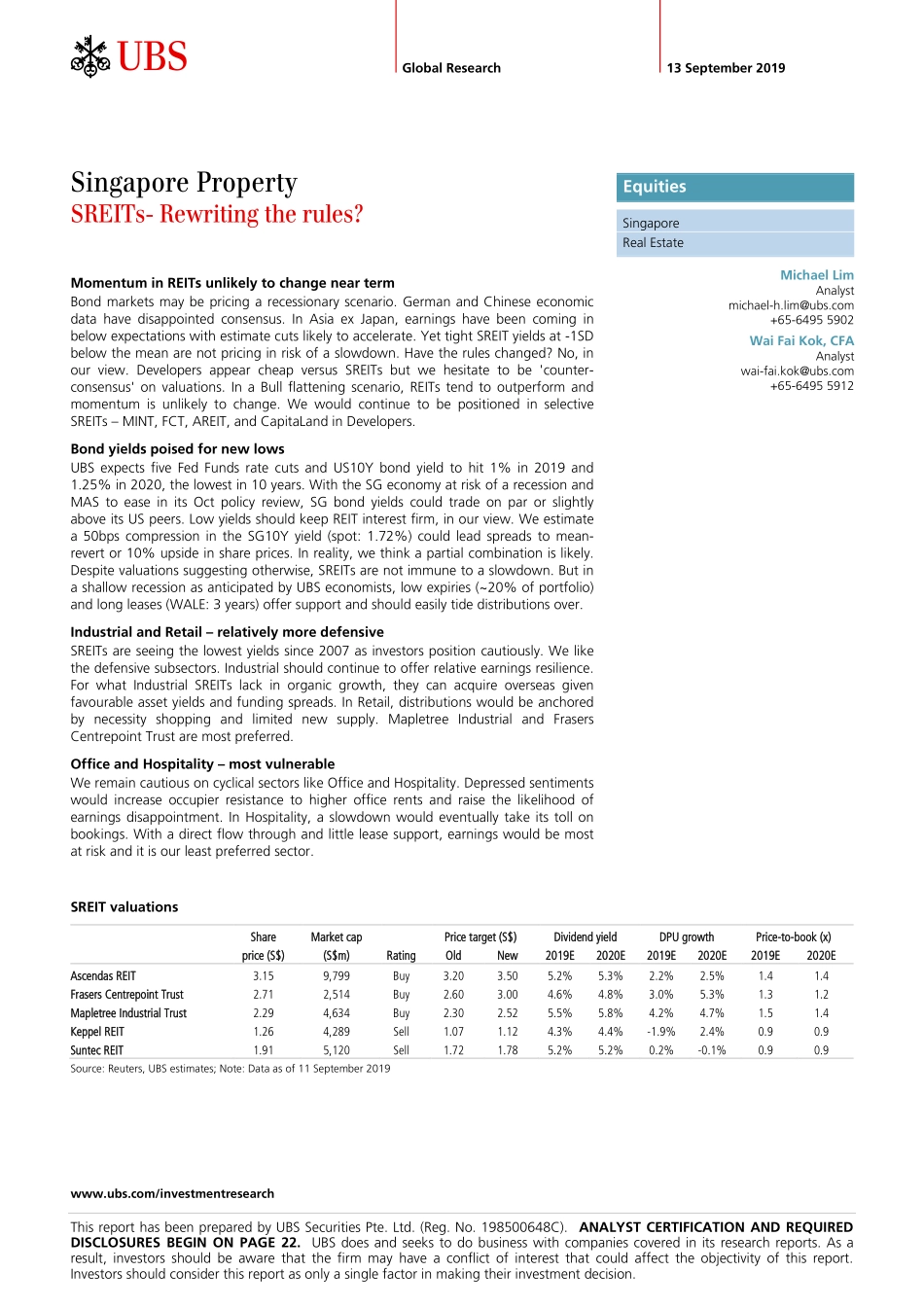

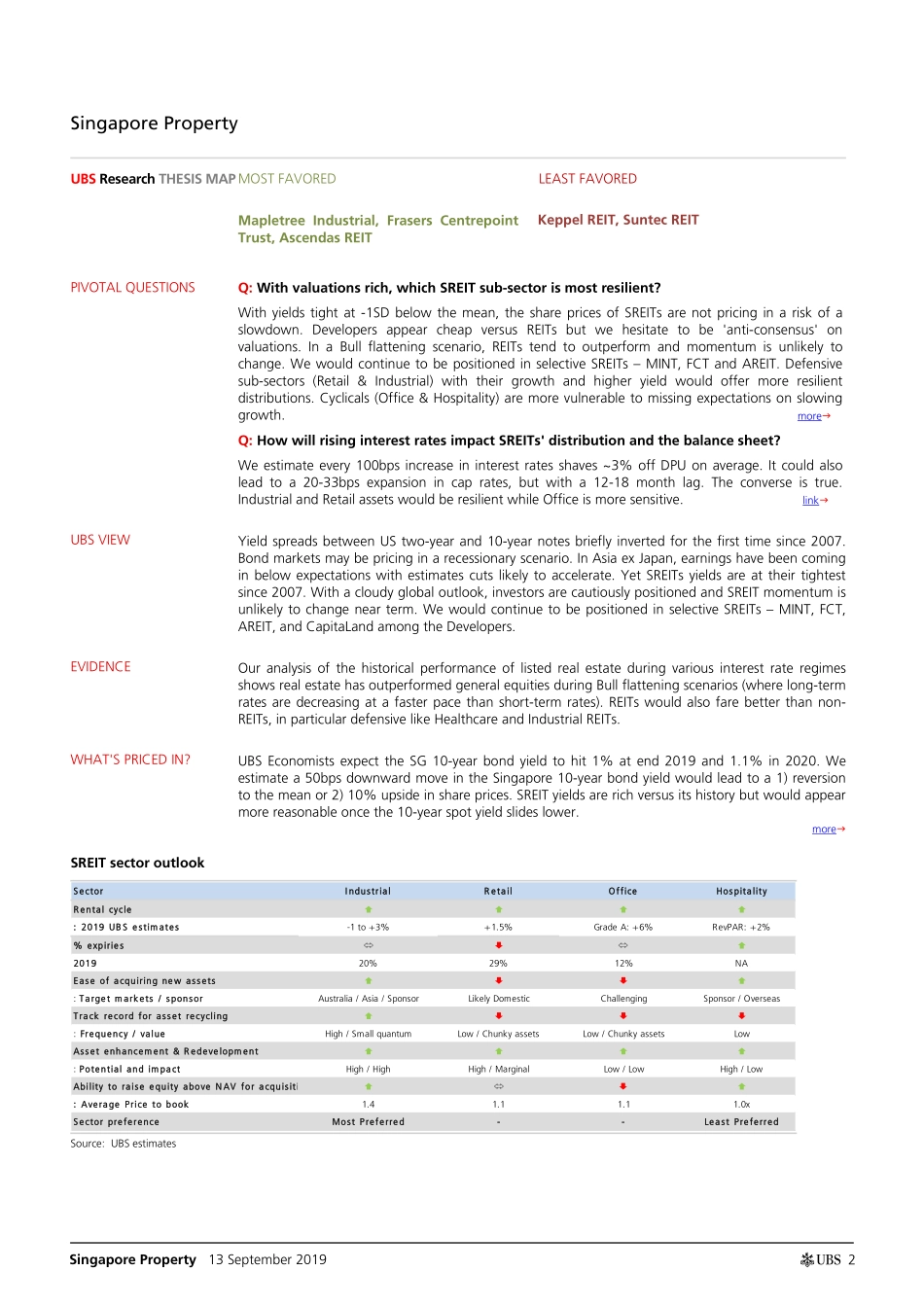

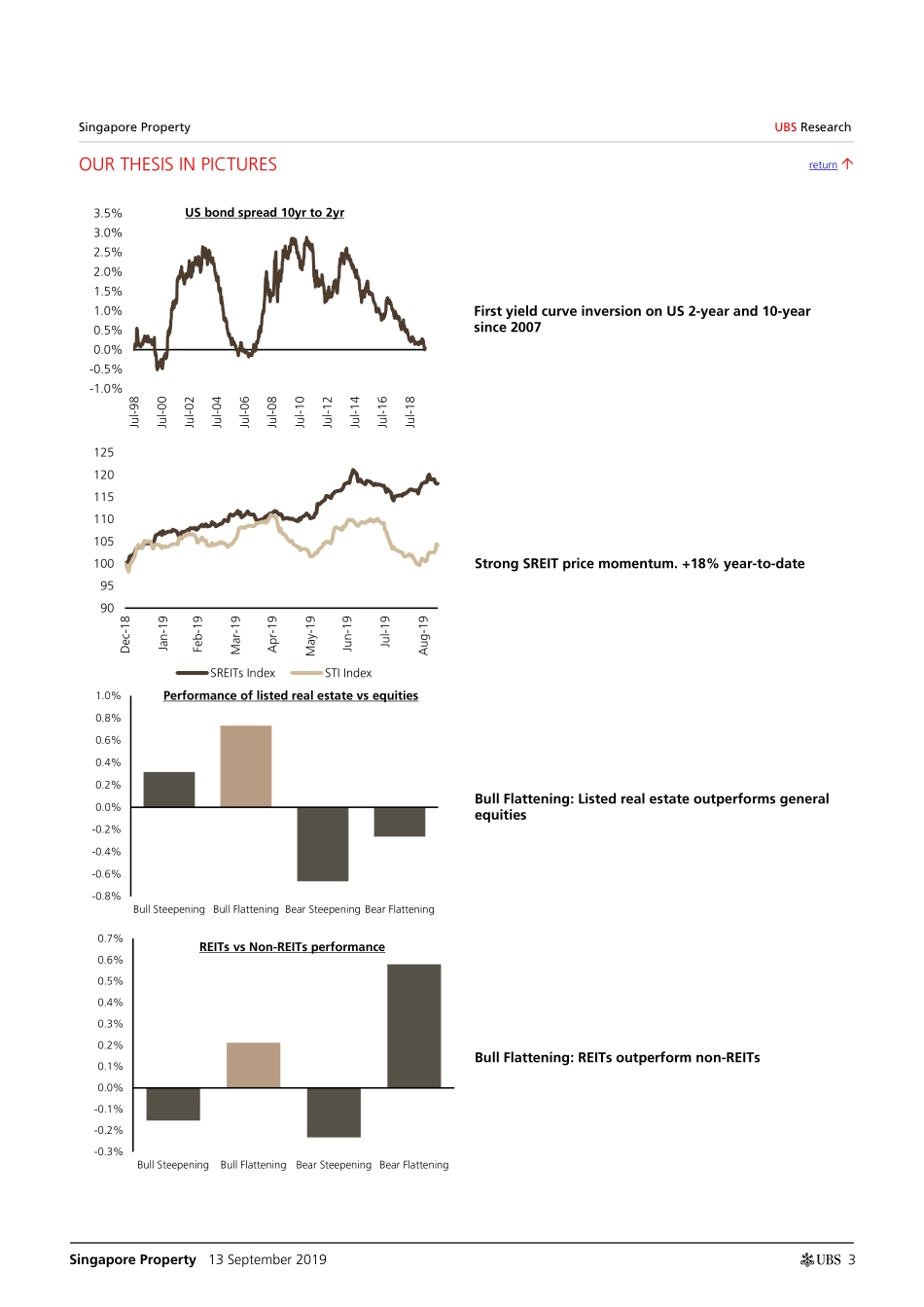

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Pte. Ltd. (Reg. No. 198500648C). ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 22. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 13 September 2019 Singapore Property SREITs- Rewriting the rules? Momentum in REITs unlikely to change near term Bond markets may be pricing a recessionary scenario. German and Chinese economic data have disappointed consensus. In Asia ex Japan, earnings have been coming in below expectations with estimate cuts likely to accelerate. Yet tight SREIT yields at -1SD below the mean are not pricing in risk of a slowdown. Have the rules changed? No, in our view. Developers appear cheap versus SREITs but we hesitate to be 'counter-consensus' on valuations. In a Bull flattening scenario, REITs tend to outperform and momentum is unlikely to change. We would continue to be positioned in selective SREITs – MINT, FCT, AREIT, and CapitaLand in Developers. Bond yields poised for new lows UBS expects five Fed Funds rate cuts and US10Y bond yield to hit 1% in 2019 and 1.25% in 2020, the lowest in 10 years. With the SG economy at risk of a recession and MAS to ease in its Oct policy review, SG bond yields could trade on par or slightly above its US peers. Low yields should keep REIT interest firm, in our view. We estimate a 50bps compression in the SG10Y yield (spot: 1.72%) could lead spreads to mean-revert or 10% upside in share prices. In reality, we think a partial combination is likely. Despite valuations suggesting otherwise, SREITs are not immune to a slowdown. But in a shallow recession as anticipated by UBS economists, low expiries (~20% of portfolio) and long leases (WALE: 3 years) offer support and should easily tide distributions over. Industrial and Retail – relatively more defensive SREITs are seeing the lowest yields since 2007 as investors position cautiously. We like the defensive subsectors. Industrial should continue to offer relative earnings resilience. For what Industrial SREITs lack in organic growth, they can acquire overseas given favourable asset yields and funding spreads. In Retail, distributions would be anchored by necessity shopping and limited new supply. Mapletree Industrial and Frasers Centrepoint Trust are most preferred. Office and Hospitality – most vulnerable We remain cautious on cyclical sectors like Office and Hospitality. Depressed sentiments would increase occupier resistance to higher office rents and raise the likelihood of earnings disappointment. In Hospitality, a slowdown would eventually...