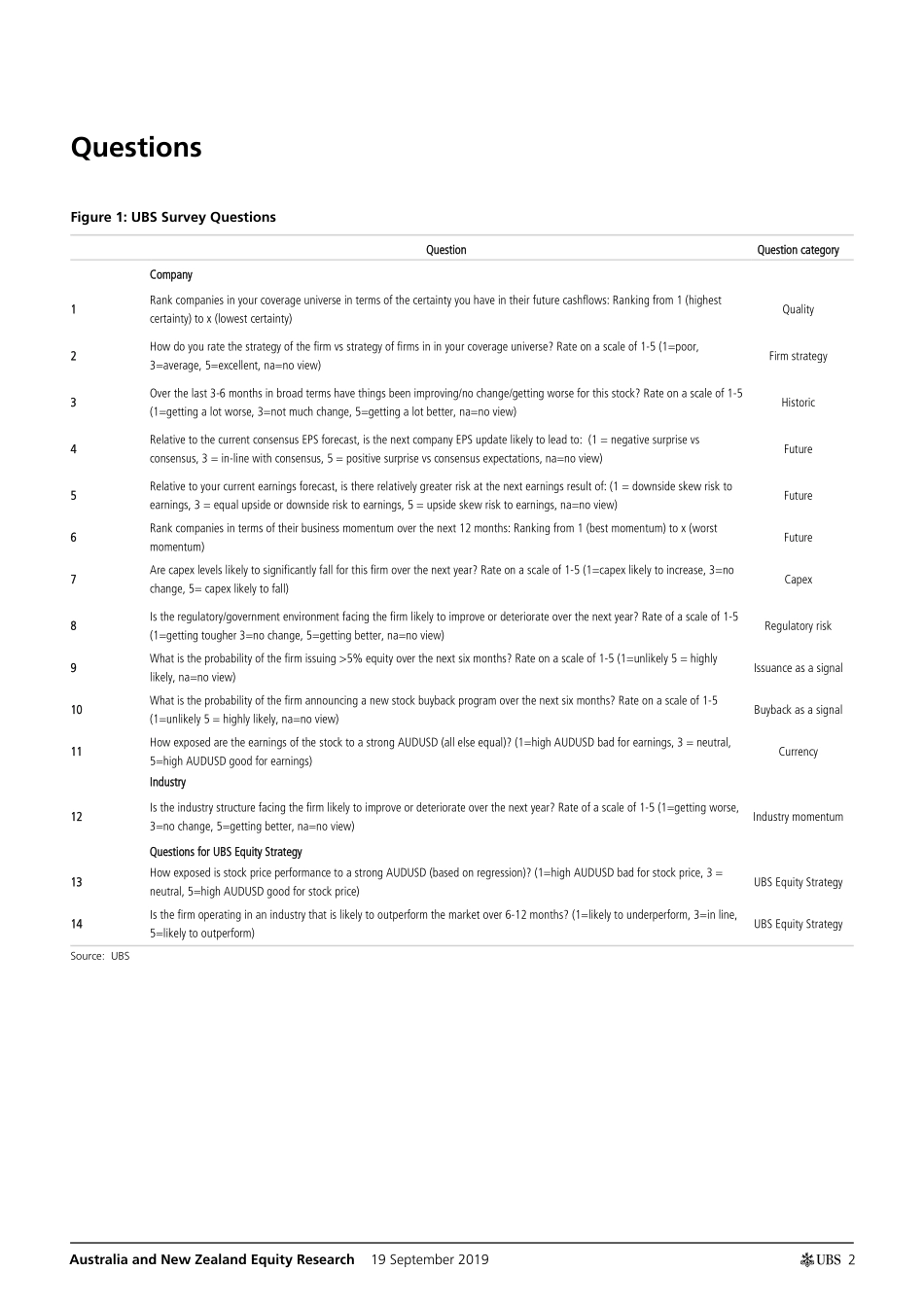

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Australia Ltd. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 76. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 19 September 2019 Australia and New Zealand Equity Research Survey Responses UBS Survey Responses This report shows monthly survey responses from UBS analysts for companies covered in Australia and New Zealand. The results of this monthly survey are based on the published views of UBS analysts. Question categories There are 12 questions answered by UBS stock analysts and two questions answered by UBS strategists. Questions relate to business quality, firm strategy, business conditions and the company's industry. Forward looking data Survey responses provide an alternative way to quantify the views of research analysts. Most of the questions are forward looking. Forward looking data can be used to augment the historic financial performance of companies. Equities Australasia Quantitative Paul Winter Analyst paul-j.winter@ubs.com +61-2-9324 2080 Pieter Stoltz, CFA Analyst pieter.stoltz@ubs.com +61-2-9324 3779 James Cameron Analyst james-a.cameron@ubs.com +61-2-9324 2074 Oliver Antrobus, CFA Analyst oliver.antrobus@ubs.com +61-3-9242 6467 Luke Brown, CFA Analyst luke.brown@ubs.com +61-2-9324 3621 Nathan Luk Associate Analyst nathan.luk@ubs.com +61-2-9324 3496 Australia and New Zealand Equity Research 19 September 2019 2 Questions Figure 1: UBS Survey Questions Question Question category Company 1 Rank companies in your coverage universe in terms of the certainty you have in their future cashflows: Ranking from 1 (highest certainty) to x (lowest certainty) Quality 2 How do you rate the strategy of the firm vs strategy of firms in in your coverage universe? Rate on a scale of 1-5 (1=poor, 3=average, 5=excellent, na=no view) Firm strategy 3 Over the last 3-6 months in broad terms have things been improving/no change/getting worse for this stock? Rate on a scale of 1-5 (1=getting a lot worse, 3=not much change, 5=getting a lot better, na=no view) Historic 4 Relative to the current consensus EPS forecast, is the next company EPS update likely to lead to: (1 = negative surprise vs consensus, 3 = in-line with consensus, 5 = positive surprise vs consensus expectations, na=no view) Future 5 Relative to your current earnings forecast, is there relatively greater risk at the next earnings result of: (1 = downside skew risk to earnings, 3 = equal upside or downside risk to earnings, 5 = upside skew risk to earnings, na=no view) Future 6 Rank companies in terms of...