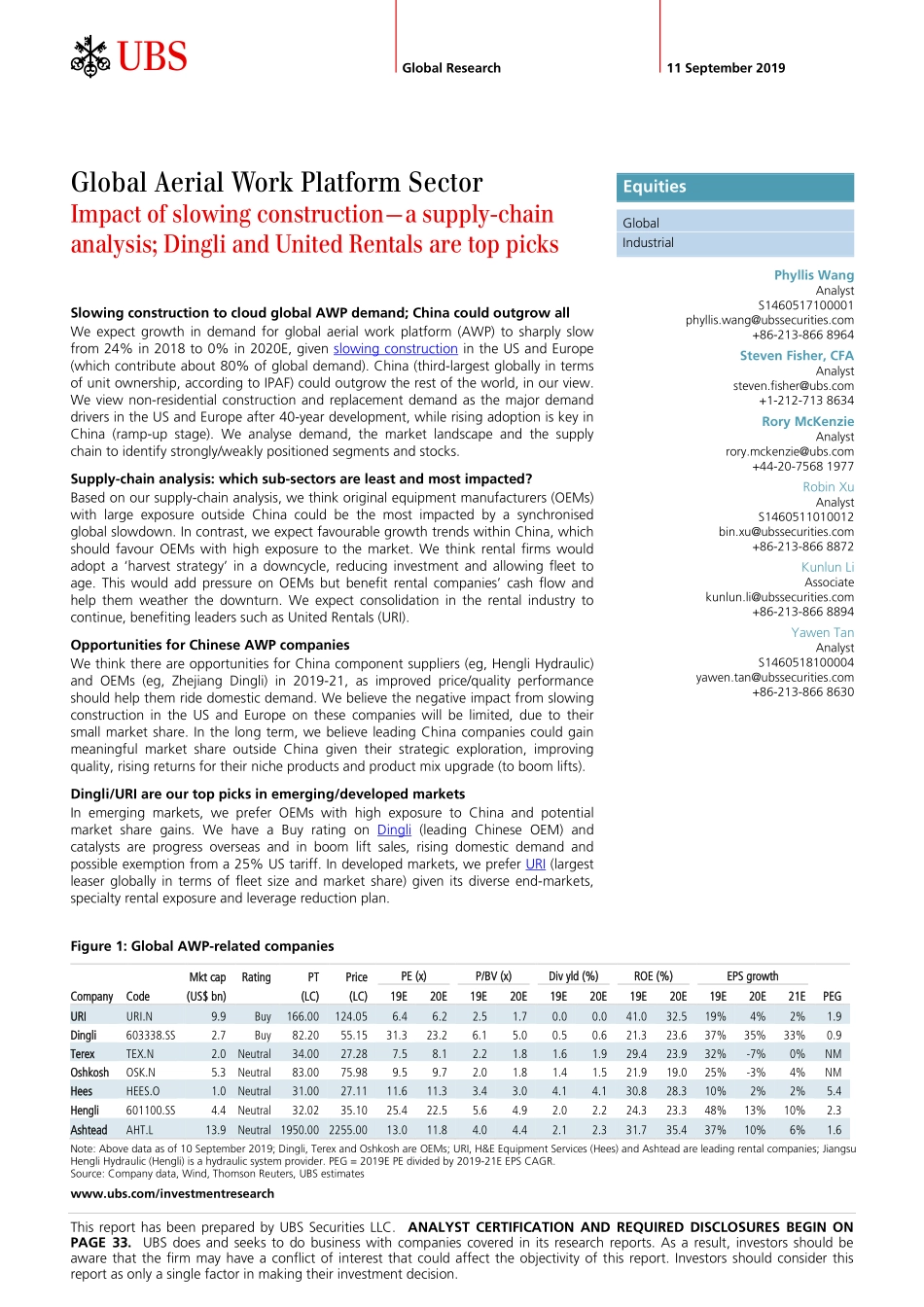

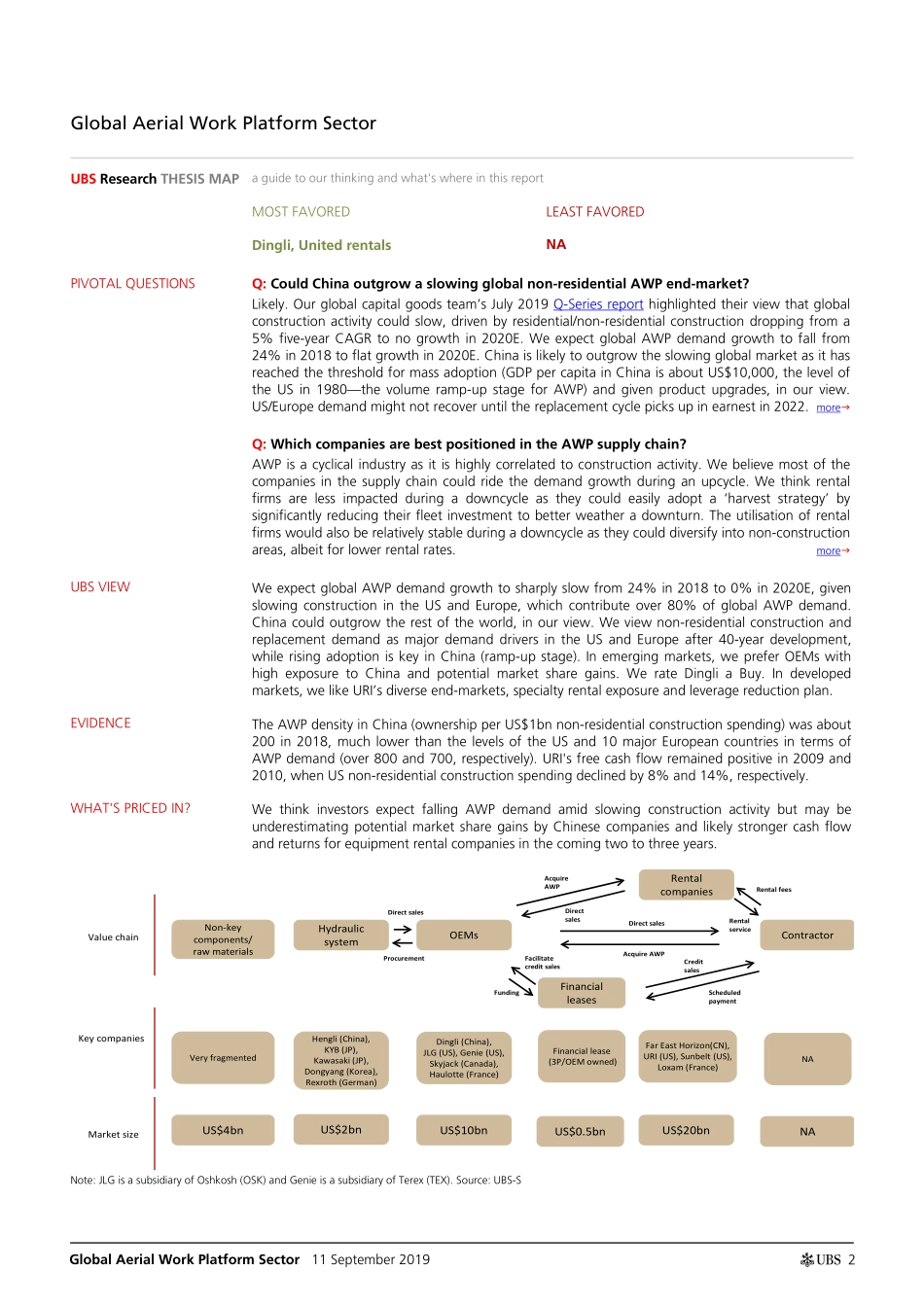

www.ubs.com/investmentresearch This report has been prepared by UBS Securities LLC. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 33. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 11 September 2019 Global Aerial Work Platform Sector Impact of slowing construction—a supply-chain analysis; Dingli and United Rentals are top picks Slowing construction to cloud global AWP demand; China could outgrow all We expect growth in demand for global aerial work platform (AWP) to sharply slow from 24% in 2018 to 0% in 2020E, given slowing construction in the US and Europe (which contribute about 80% of global demand). China (third-largest globally in terms of unit ownership, according to IPAF) could outgrow the rest of the world, in our view. We view non-residential construction and replacement demand as the major demand drivers in the US and Europe after 40-year development, while rising adoption is key in China (ramp-up stage). We analyse demand, the market landscape and the supply chain to identify strongly/weakly positioned segments and stocks. Supply-chain analysis: which sub-sectors are least and most impacted? Based on our supply-chain analysis, we think original equipment manufacturers (OEMs) with large exposure outside China could be the most impacted by a synchronised global slowdown. In contrast, we expect favourable growth trends within China, which should favour OEMs with high exposure to the market. We think rental firms would adopt a ‘harvest strategy’ in a downcycle, reducing investment and allowing fleet to age. This would add pressure on OEMs but benefit rental companies’ cash flow and help them weather the downturn. We expect consolidation in the rental industry to continue, benefiting leaders such as United Rentals (URI). Opportunities for Chinese AWP companies We think there are opportunities for China component suppliers (eg, Hengli Hydraulic) and OEMs (eg, Zhejiang Dingli) in 2019-21, as improved price/quality performance should help them ride domestic demand. We believe the negative impact from slowing construction in the US and Europe on these companies will be limited, due to their small market share. In the long term, we believe leading China companies could gain meaningful market share outside China given their strategic exploration, improving quality, rising returns for their niche products and product mix upgrade (to boom lifts). Dingli/URI are our top picks in emerging/developed markets In emerging markets, we prefer OEMs with high exposure to China and potential market share gains. We have a Buy rating on Dingli (l...