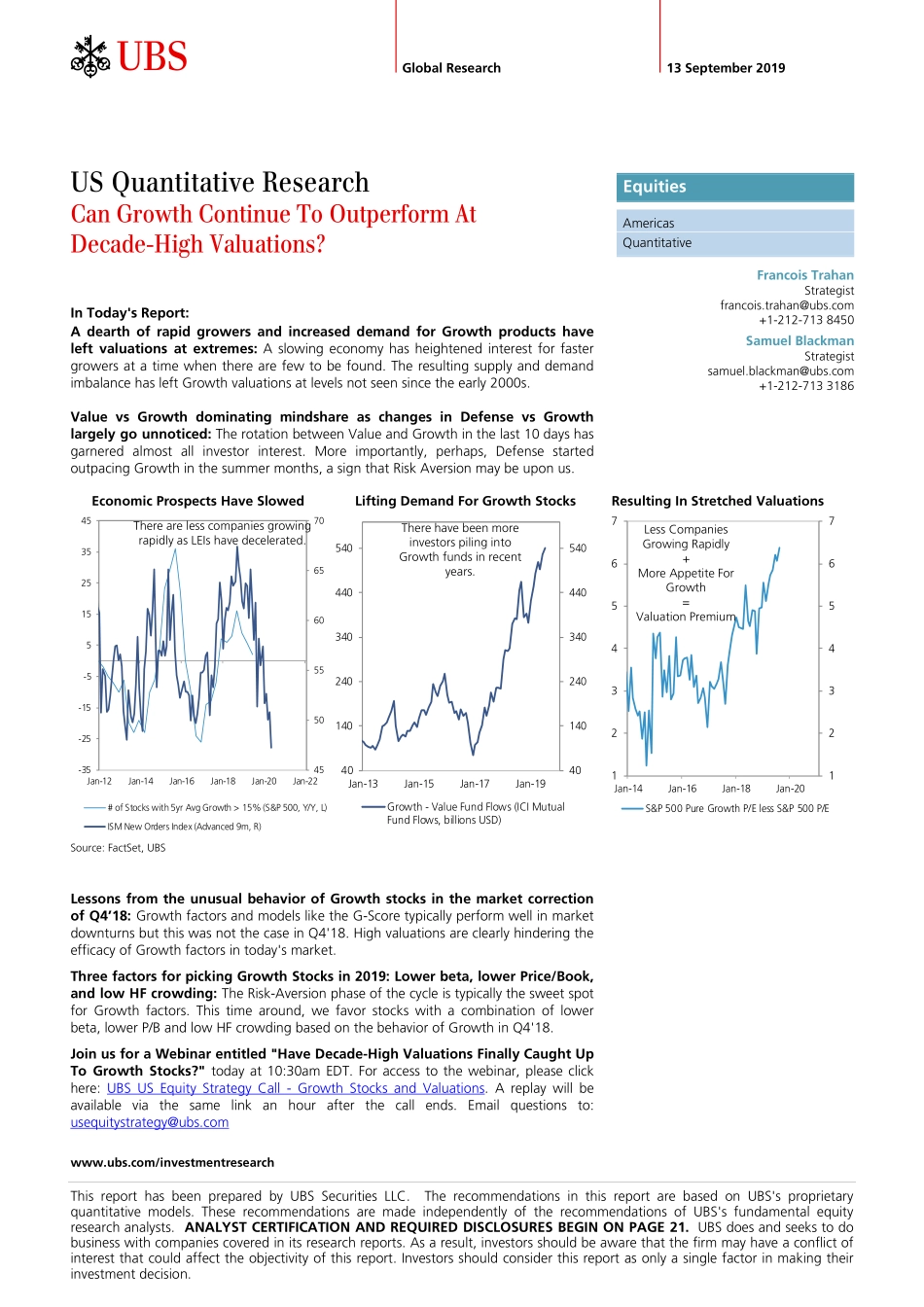

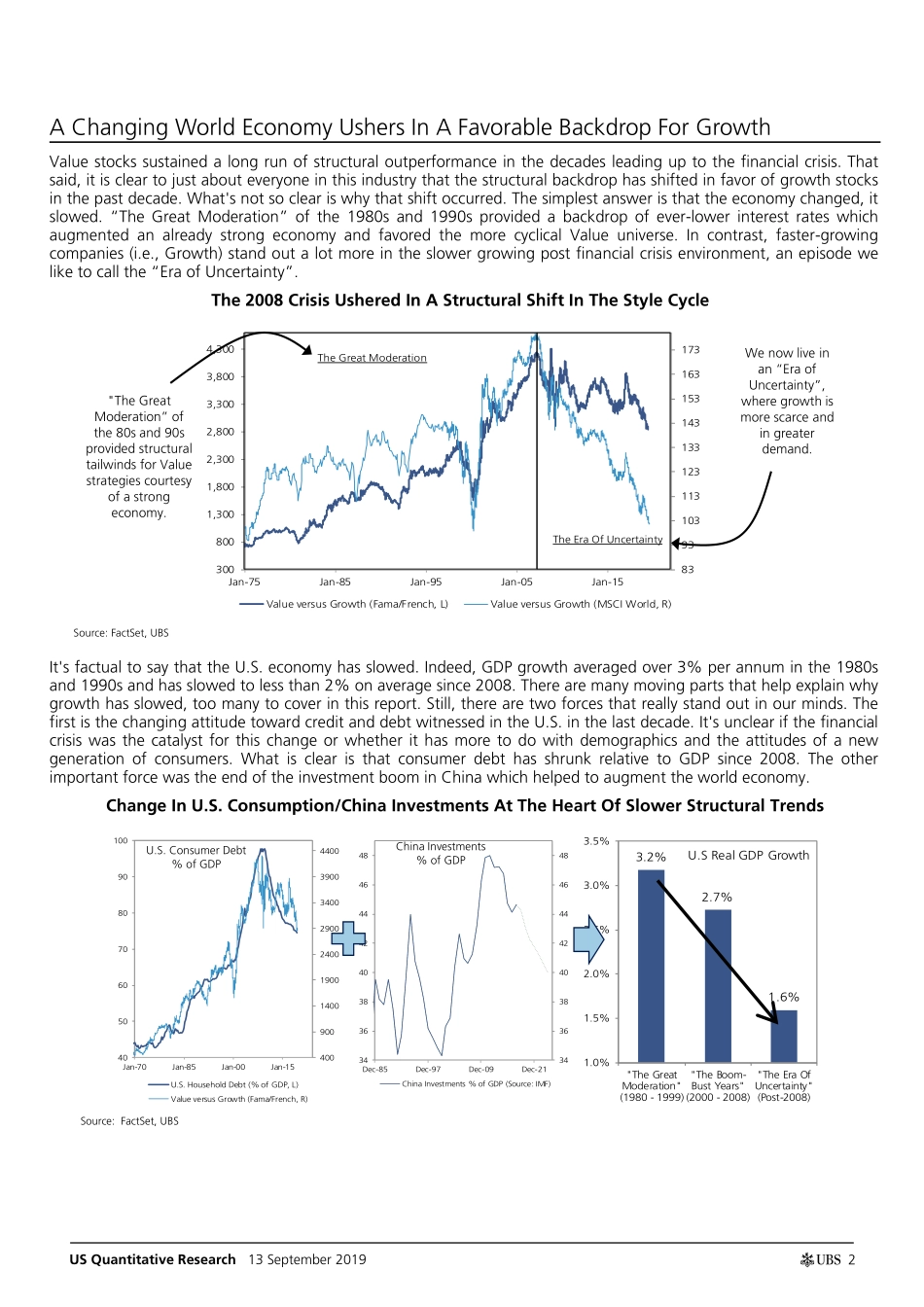

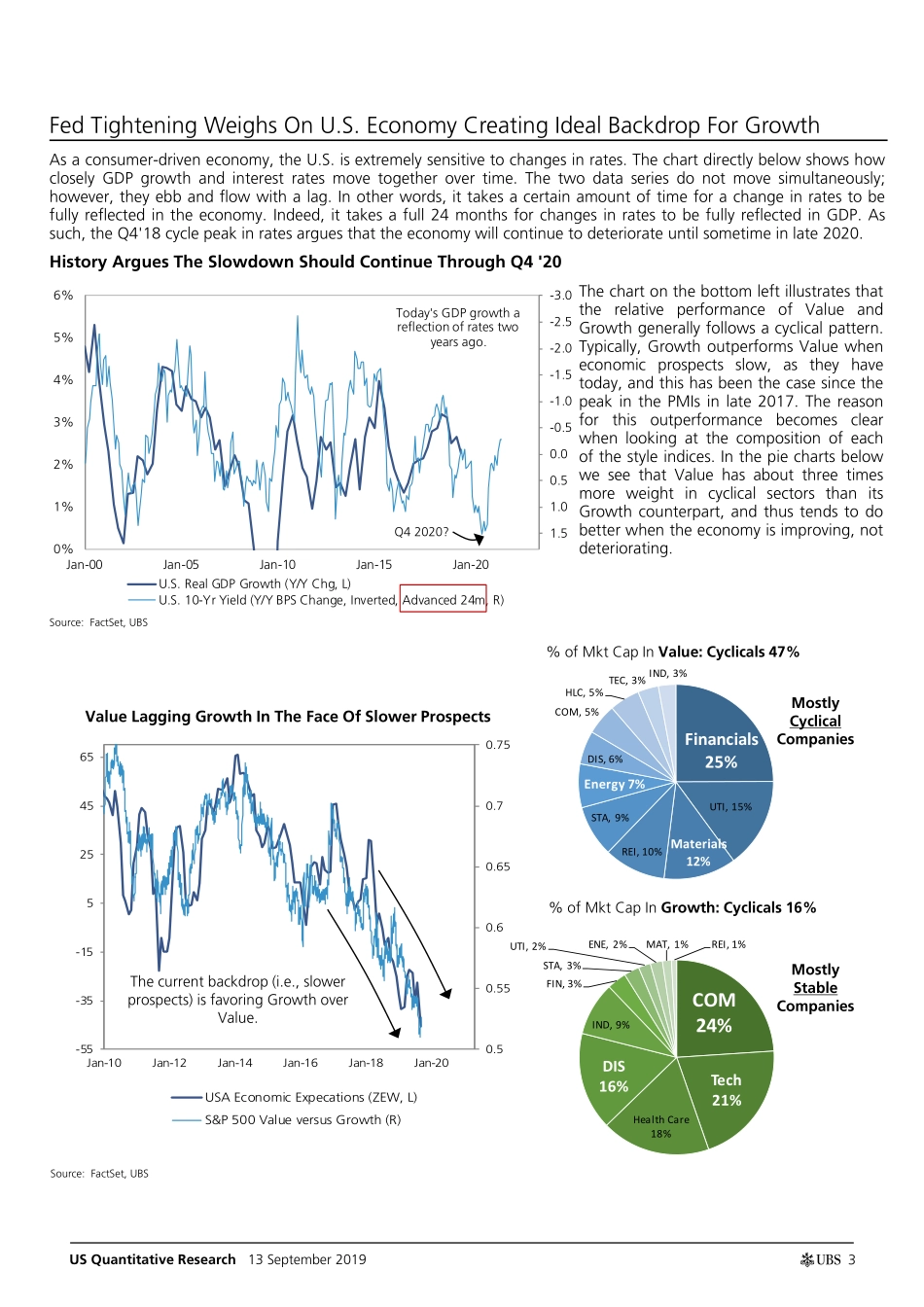

www.ubs.com/investmentresearch This report has been prepared by UBS Securities LLC. The recommendations in this report are based on UBS's proprietary quantitative models. These recommendations are made independently of the recommendations of UBS's fundamental equity research analysts. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 21. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 13 September 2019 US Quantitative Research Can Growth Continue To Outperform At Decade-High Valuations? In Today's Report: A dearth of rapid growers and increased demand for Growth products have left valuations at extremes: A slowing economy has heightened interest for faster growers at a time when there are few to be found. The resulting supply and demand imbalance has left Growth valuations at levels not seen since the early 2000s. Value vs Growth dominating mindshare as changes in Defense vs Growth largely go unnoticed: The rotation between Value and Growth in the last 10 days has garnered almost all investor interest. More importantly, perhaps, Defense started outpacing Growth in the summer months, a sign that Risk Aversion may be upon us. Source: FactSet, UBS Lessons from the unusual behavior of Growth stocks in the market correction of Q4’18: Growth factors and models like the G-Score typically perform well in market downturns but this was not the case in Q4'18. High valuations are clearly hindering the efficacy of Growth factors in today's market. Three factors for picking Growth Stocks in 2019: Lower beta, lower Price/Book, and low HF crowding: The Risk-Aversion phase of the cycle is typically the sweet spot for Growth factors. This time around, we favor stocks with a combination of lower beta, lower P/B and low HF crowding based on the behavior of Growth in Q4'18. Join us for a Webinar entitled "Have Decade-High Valuations Finally Caught Up To Growth Stocks?" today at 10:30am EDT. For access to the webinar, please click here: UBS US Equity Strategy Call - Growth Stocks and Valuations. A replay will be available via the same link an hour after the call ends. Email questions to: usequitystrategy@ubs.com 4014024034044054040140240340440540Jan-13Jan-15Jan-17Jan-19Growth - Value Fund Flows (ICI MutualFund Flows, billions USD)455055606570-35-25-15-5515253545Jan-12Jan-14Jan-16Jan-18Jan-20Jan-22# of Stocks with 5yr Avg Growth > 15% (S&P 500, Y/Y, L)ISM New Orders Index (Advanced 9m, R)Economic Prospects Have Slowed Lifting Demand For Growth StocksResulting In Stretched Valuations12345671234567Jan-14Jan-16Jan-18Jan-20S&P 500 Pure Growth P/E less S&P 500 P/EThere have bee...