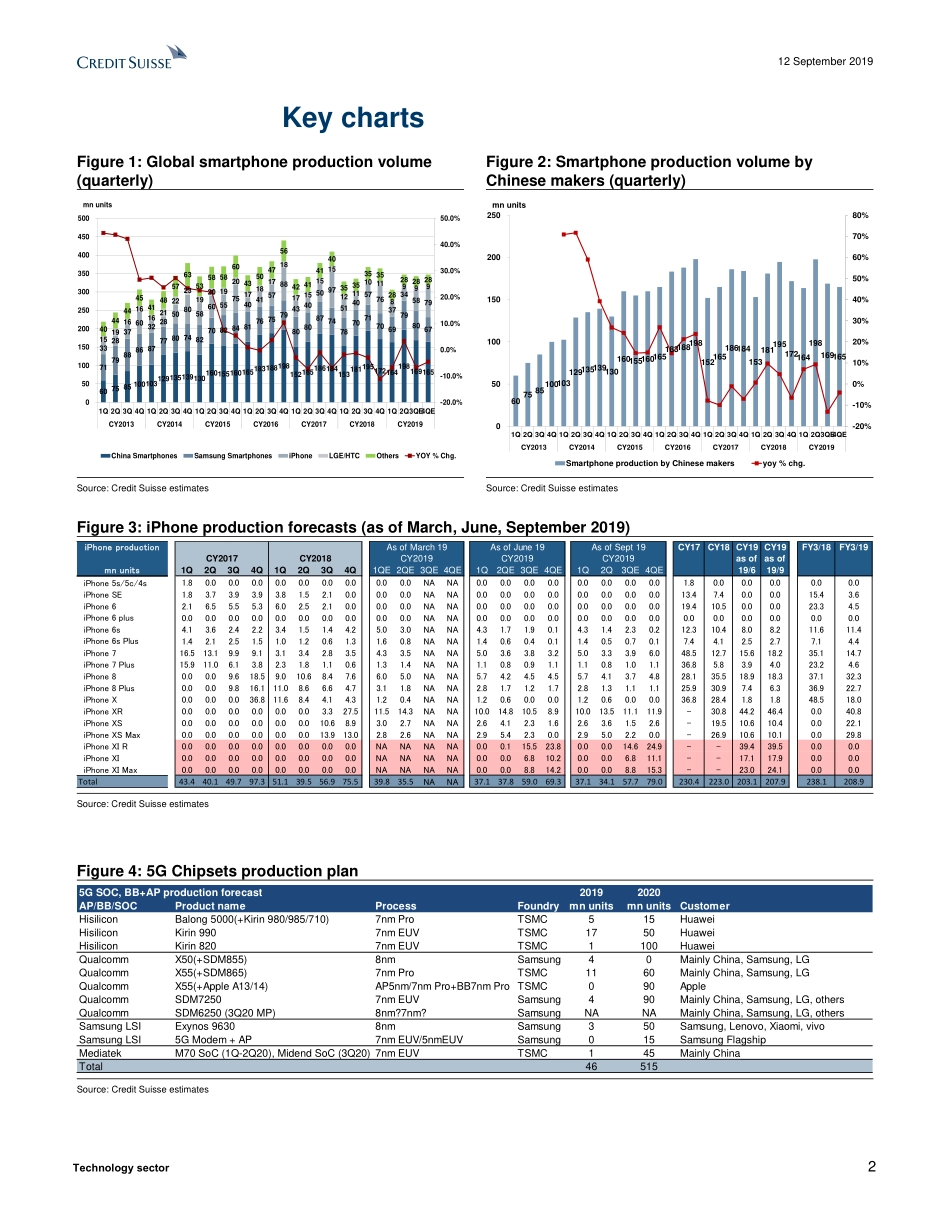

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 12 September 2019 Asia Pacific/Japan Equity Research Technology Technology sector Research Analysts Akinori Kanemoto 81 3 4550 7363 akinori.kanemoto@credit-suisse.com Hideyuki Maekawa 81 3 4550 9723 hideyuki.maekawa@credit-suisse.com Mika Nishimura 81 3 4550 7369 mika.nishimura@credit-suisse.com Yoshiyasu Takemura 81 3 4550 7358 yoshiyasu.takemura@credit-suisse.com Sayaka Shimonishi 81 3 4550 7364 sayaka.shimonishi@credit-suisse.com Daisuke Tanimoto 81 3 4550 7371 daisuke.tanimoto@credit-suisse.com COMMENT Asia feedback (Hardware): “5G fanfare” in 2020 albeit short-term adjustment risk at Jan–Mar ■ Summary: We conducted our periodic survey of the Korean, Taiwanese and Chinese tech markets in late Aug–early Sep. As in our previous survey, end demand shows no sign of picking up. Despite ongoing inventory adjustments, chiefly in Greater China, channel inventories of automotive applications remain a burden, but we see improvement in MLCCs and other IT-related products. On the other hand, we expect a rush in smartphone, PC, TV, and other hardware demand ahead of US tariffs, and makers are likely to expedite component procurement and finished-product output in preparation for the Lunar New Year. Add in the risk of LTE-smartphone output adjustments before 5G rollout, and we see a risk of output adjustments heading into Jan–Mar. That said, expectations for 5G are rising sharply as 2020 approaches; 2020 production plans point to total 5G chipset output over 500mn units, and the industry seems increasingly upbeat on the outlook for 5G smartphones. ■ Focal points in hardware & devices: (1) Makers target 5G-chipset output of 500mn units in 2020, and 5G smartphone output is likely to reach 250–300mn units—a boon for RF front ends; (2) Chinese smartphone output plans point to only a slight QoQ decline in Oct–Dec, but we flag the risk of LTE smartphone output adjustments before full rollout of 5G models in Mar–Apr CY20; (3) Apple apparently plans to produce 200mn iPhones in 2019 but is likely to follow its usual habit of revising forecasts after watching new model sales and has likely expedited production (mainly previous models) from Jan–Mar CY20, when we see a risk of adjustments before the new iPhone SE launches. iPhone plans as of early September call for output of 208mn units in 2019 (including 81mn for 2019 models). (4) Smartphone-related makers ...