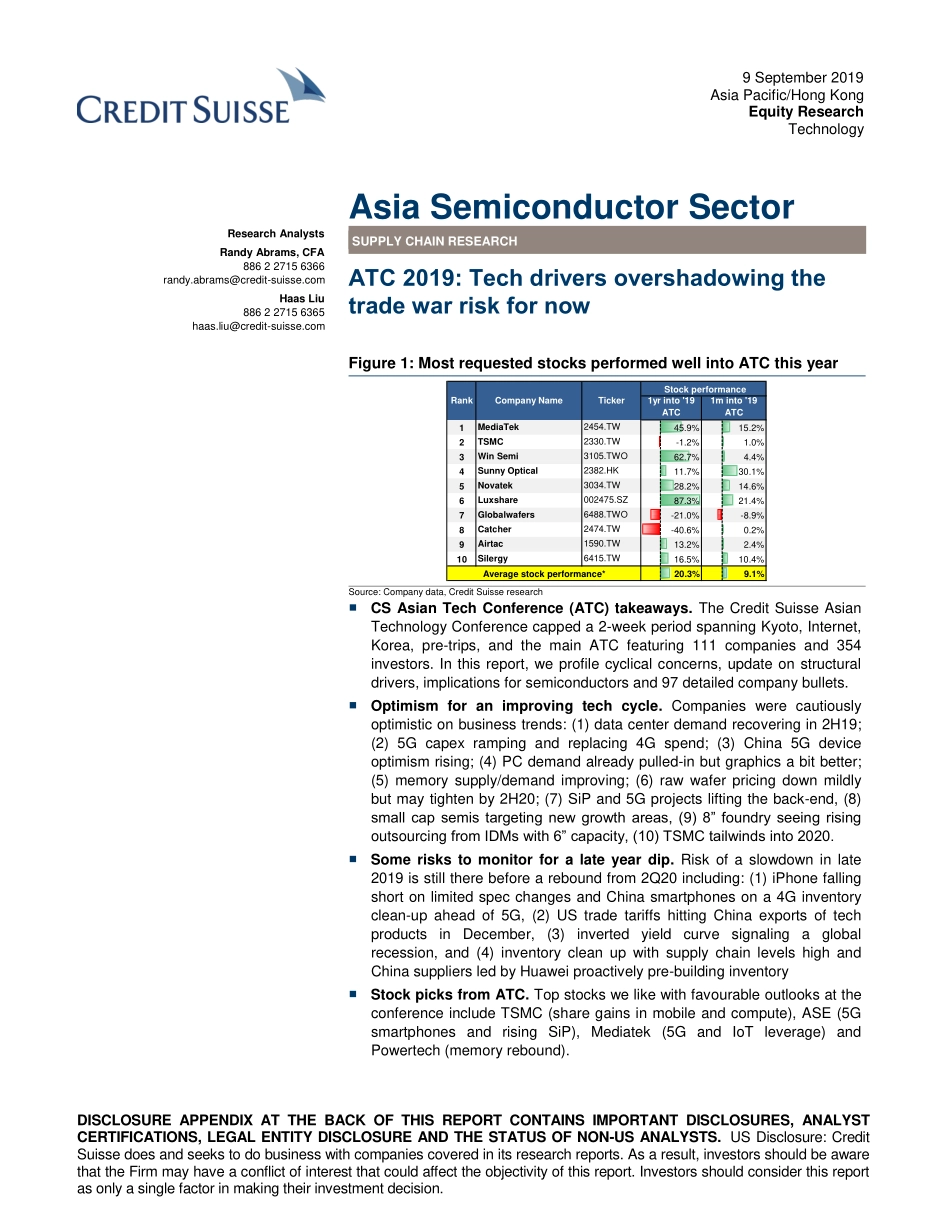

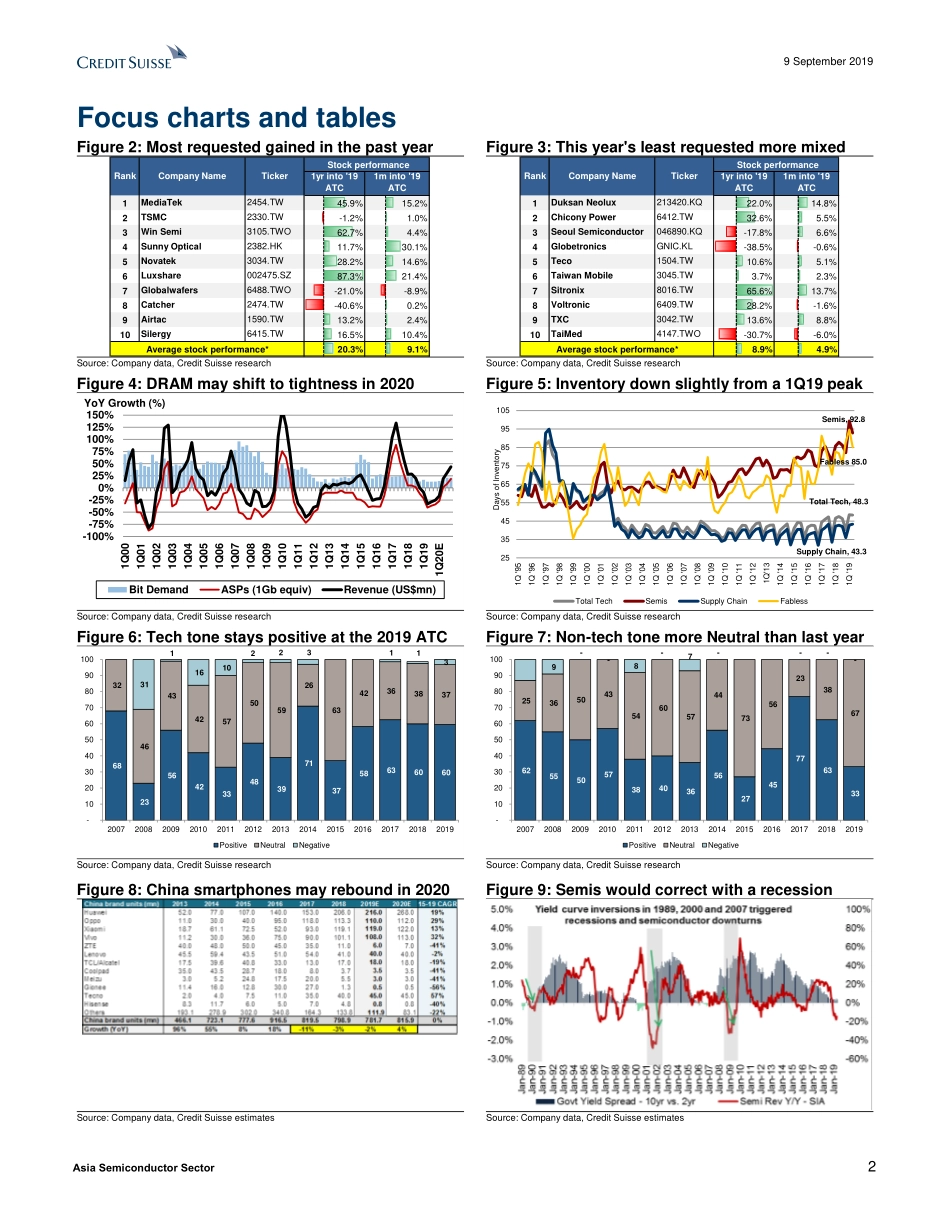

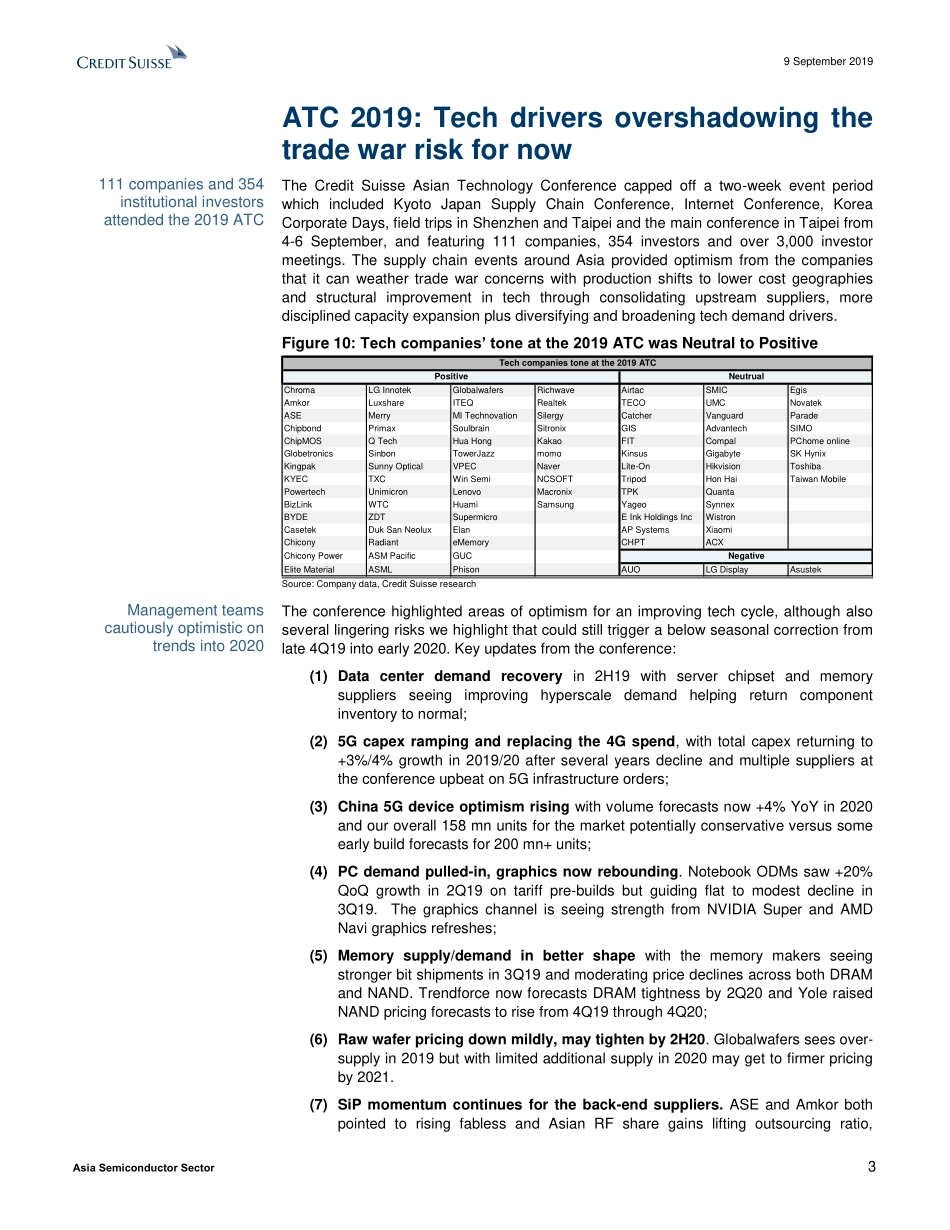

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 9 September 2019 Asia Pacific/Hong Kong Equity Research Technology Asia Semiconductor Sector Research Analysts Randy Abrams, CFA 886 2 2715 6366 randy.abrams@credit-suisse.com Haas Liu 886 2 2715 6365 haas.liu@credit-suisse.com SUPPLY CHAIN RESEARCH ATC 2019: Tech drivers overshadowing the trade war risk for now Figure 1: Most requested stocks performed well into ATC this year Source: Company data, Credit Suisse research ■ CS Asian Tech Conference (ATC) takeaways. The Credit Suisse Asian Technology Conference capped a 2-week period spanning Kyoto, Internet, Korea, pre-trips, and the main ATC featuring 111 companies and 354 investors. In this report, we profile cyclical concerns, update on structural drivers, implications for semiconductors and 97 detailed company bullets. ■ Optimism for an improving tech cycle. Companies were cautiously optimistic on business trends: (1) data center demand recovering in 2H19; (2) 5G capex ramping and replacing 4G spend; (3) China 5G device optimism rising; (4) PC demand already pulled-in but graphics a bit better; (5) memory supply/demand improving; (6) raw wafer pricing down mildly but may tighten by 2H20; (7) SiP and 5G projects lifting the back-end, (8) small cap semis targeting new growth areas, (9) 8” foundry seeing rising outsourcing from IDMs with 6” capacity, (10) TSMC tailwinds into 2020. ■ Some risks to monitor for a late year dip. Risk of a slowdown in late 2019 is still there before a rebound from 2Q20 including: (1) iPhone falling short on limited spec changes and China smartphones on a 4G inventory clean-up ahead of 5G, (2) US trade tariffs hitting China exports of tech products in December, (3) inverted yield curve signaling a global recession, and (4) inventory clean up with supply chain levels high and China suppliers led by Huawei proactively pre-building inventory ■ Stock picks from ATC. Top stocks we like with favourable outlooks at the conference include TSMC (share gains in mobile and compute), ASE (5G smartphones and rising SiP), Mediatek (5G and IoT leverage) and Powertech (memory rebound). 1yr into '19 ATC1m into '19 ATC1MediaTek2454.TW45.9%15.2%2TSMC2330.TW-1.2%1.0%3Win Semi3105.TWO62.7%4.4%4Sunny Optical2382.HK11.7%30.1%5Novatek3034.TW28.2%14.6%6Luxshare002475.SZ87.3%21.4%7Globalwafers6488.TWO-21.0%-8.9%8Catcher2474.TW-40.6%0.2%9Airtac1590.TW13.2%2.4%10Silergy6415.TW16.5%10.4%20.3%9.1%Average stock perform...