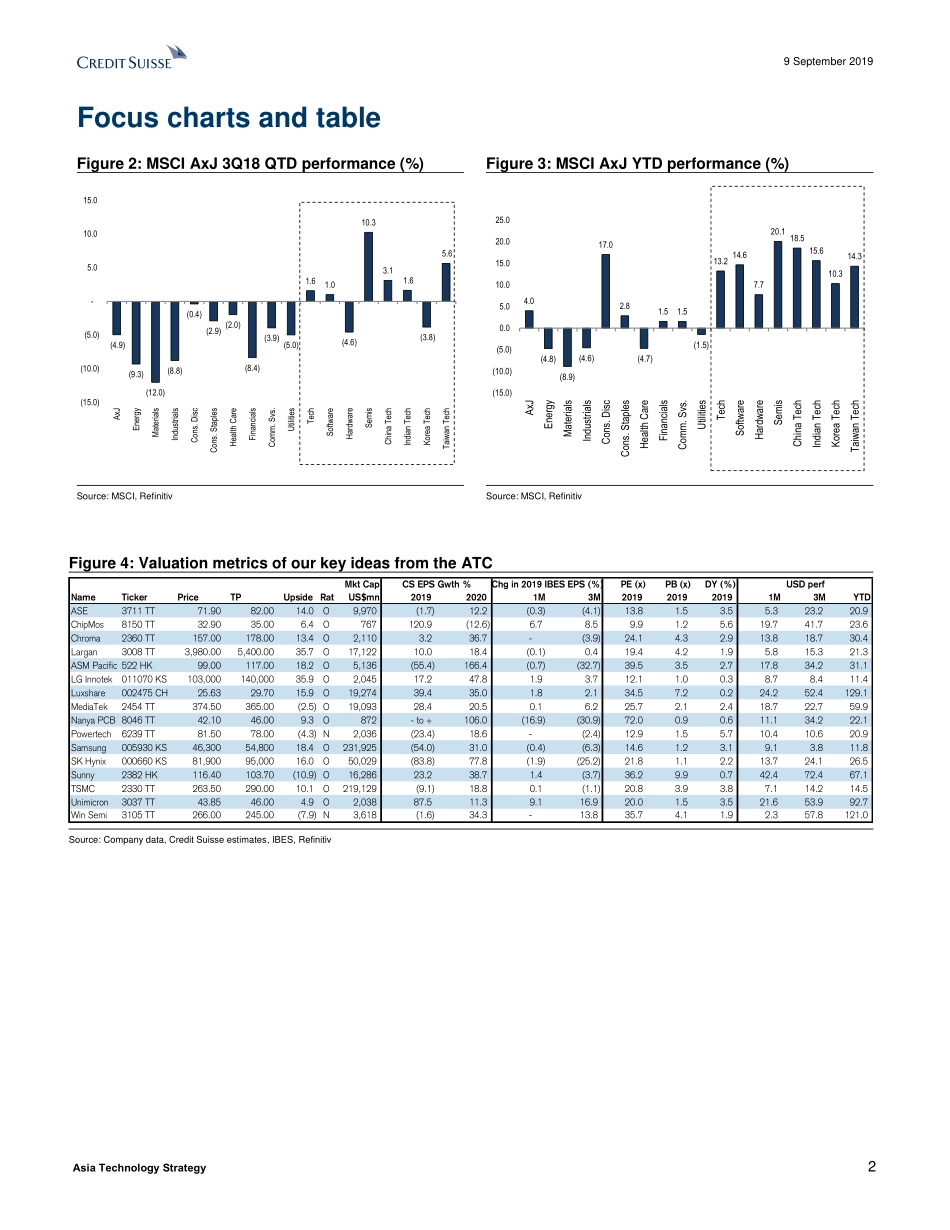

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 9 September 2019 Asia Pacific/Hong Kong Equity Research Technology Asia Technology Strategy Research Analysts Manish Nigam 852 2101 7067 manish.nigam@credit-suisse.com Clive Cheung 852 2101 7069 clive.cheung@credit-suisse.com Contributing Analysts Achal Sultania 44 20 7883 6884 achal.sultania@credit-suisse.com Billy Lee 852 2101 6529 billy.lee@credit-suisse.com Chaolien Tseng 852 2101 6795 chaolien.tseng@credit-suisse.com Chien Po Huang 886 2 2715 6342 chien-po.huang@credit-suisse.com Danny Chan 60 3 2723 2082 danny.chan@credit-suisse.com Haas Liu 886 2 2715 6365 haas.liu@credit-suisse.com Hideyuki Maekawa 81 3 4550 9723 hideyuki.maekawa@credit-suisse.com Jerry Su 886 2 2715 6361 jerry.su@credit-suisse.com Keon Han 82 2 3707 3740 keon.han@credit-suisse.com Kyna Wong 852 2101 6950 kyna.wong@credit-suisse.com Pauline Chen 886 2 2715 6323 pauline.chen@credit-suisse.com Quang Tung Le, CFA 44 20 7888 1799 quangtung.le@credit-suisse.com Randy Abrams, CFA 886 2 2715 6366 randy.abrams@credit-suisse.com Sang Uk Kim 82 2 3707 3795 sang.kim@credit-suisse.com Soyun Shin 82 2 3707 3736 soyun.shin@credit-suisse.com STRATEGY 20th ATC: More optimistic than we thought Figure 1: Outlook/sentiment of companies attending the ATC (%) Source: Company data, Credit Suisse estimates ■ 20th ATC just concluded. The 20th Asia Technology Conference (ATC; 4 to 6 Sep'19) was our biggest ever, with ~350 investors and ~110 companies attending the event. We also hosted a two-day conference in Korea in the two days prior to the ATC. This note highlights our analysts' summary comments from over 90 of these companies that attended the event. We also summarise the key overall takeaways from the conference. ■ Cautiously optimistic. Companies sounded about as positive as they have done at the last three ATCs. Investors were cautiously optimistic and some appeared to be willing to look past the current challenges. 5G was the most obvious optimistic theme across relevant companies. Positives were noted in memory, with evidence that overall server demand (mainly from hyperscalers) was showing some signs of revival. Semis, driven by share gains or content gains or linkages to the 5G theme, were in general more positive in their outlook. Outlook from downstream and components was, not surprisingly, mixed. Outlook for display, in general, was negative. We noted some complacency around both the Huawei and semi ...