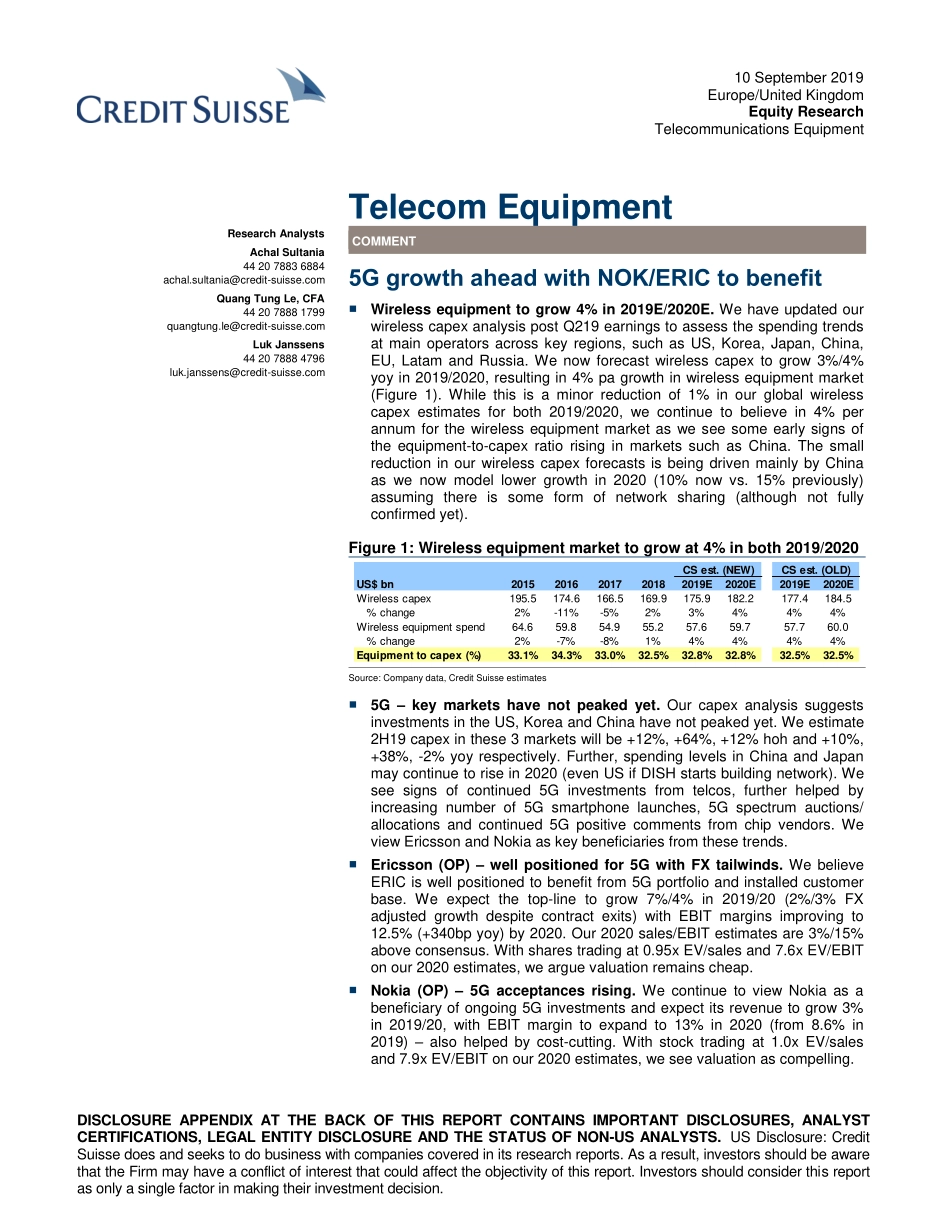

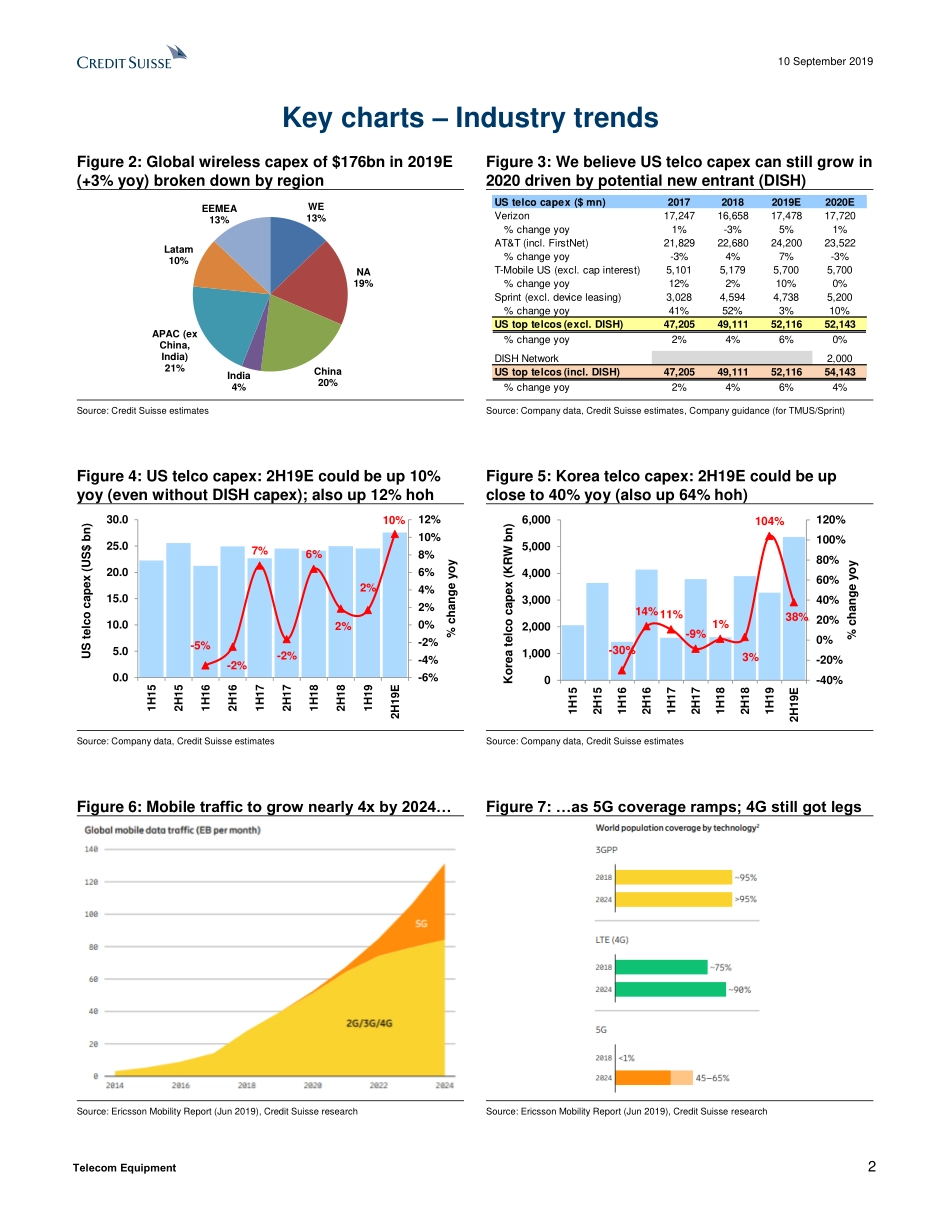

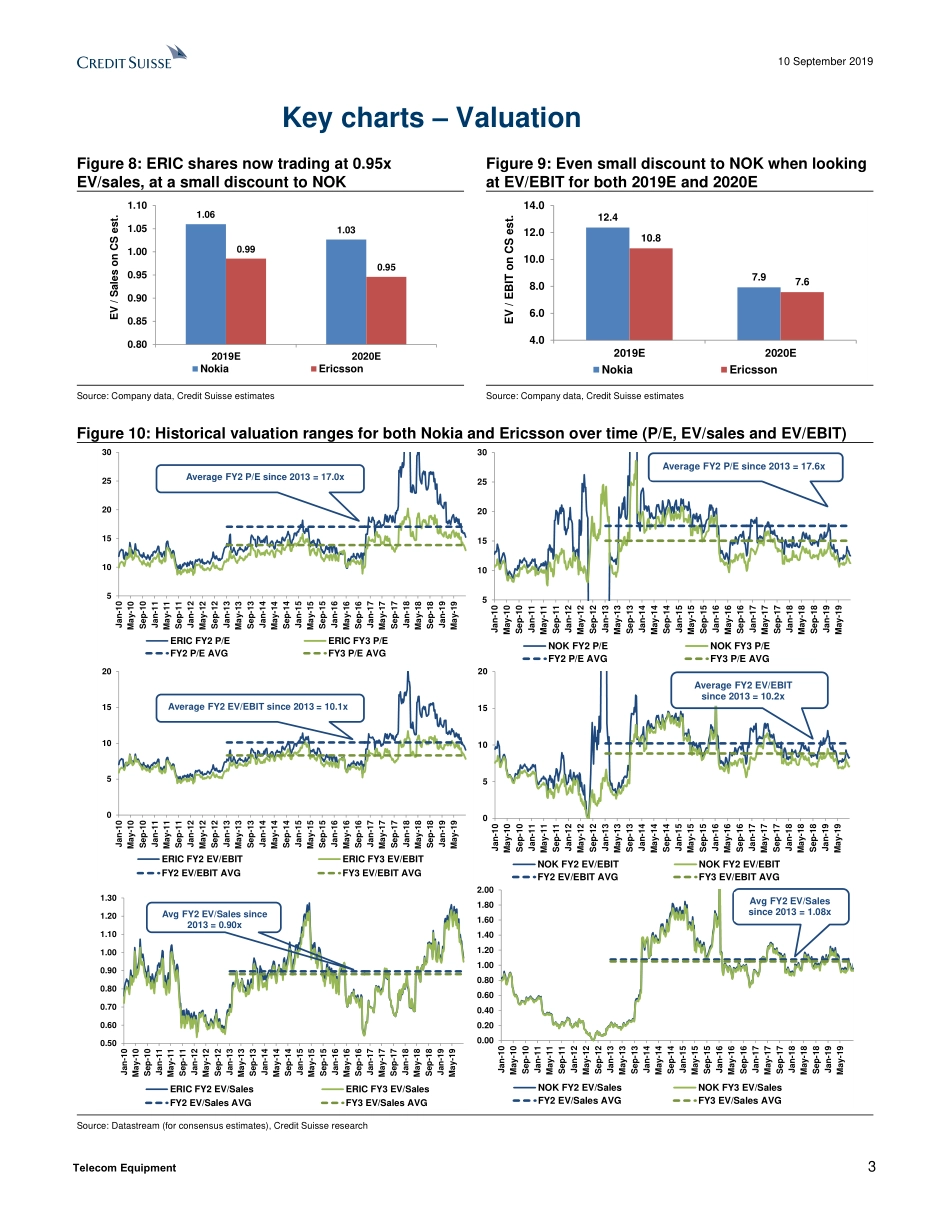

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 10 September 2019 Europe/United Kingdom Equity Research Telecommunications Equipment Telecom Equipment Research Analysts Achal Sultania 44 20 7883 6884 achal.sultania@credit-suisse.com Quang Tung Le, CFA 44 20 7888 1799 quangtung.le@credit-suisse.com Luk Janssens 44 20 7888 4796 luk.janssens@credit-suisse.com COMMENT 5G growth ahead with NOK/ERIC to benefit ■ Wireless equipment to grow 4% in 2019E/2020E. We have updated our wireless capex analysis post Q219 earnings to assess the spending trends at main operators across key regions, such as US, Korea, Japan, China, EU, Latam and Russia. We now forecast wireless capex to grow 3%/4% yoy in 2019/2020, resulting in 4% pa growth in wireless equipment market (Figure 1). While this is a minor reduction of 1% in our global wireless capex estimates for both 2019/2020, we continue to believe in 4% per annum for the wireless equipment market as we see some early signs of the equipment-to-capex ratio rising in markets such as China. The small reduction in our wireless capex forecasts is being driven mainly by China as we now model lower growth in 2020 (10% now vs. 15% previously) assuming there is some form of network sharing (although not fully confirmed yet). Figure 1: Wireless equipment market to grow at 4% in both 2019/2020 Source: Company data, Credit Suisse estimates ■ 5G – key markets have not peaked yet. Our capex analysis suggests investments in the US, Korea and China have not peaked yet. We estimate 2H19 capex in these 3 markets will be +12%, +64%, +12% hoh and +10%, +38%, -2% yoy respectively. Further, spending levels in China and Japan may continue to rise in 2020 (even US if DISH starts building network). We see signs of continued 5G investments from telcos, further helped by increasing number of 5G smartphone launches, 5G spectrum auctions/ allocations and continued 5G positive comments from chip vendors. We view Ericsson and Nokia as key beneficiaries from these trends. ■ Ericsson (OP) – well positioned for 5G with FX tailwinds. We believe ERIC is well positioned to benefit from 5G portfolio and installed customer base. We expect the top-line to grow 7%/4% in 2019/20 (2%/3% FX adjusted growth despite contract exits) with EBIT margins improving to 12.5% (+340bp yoy) by 2020. Our 2020 sales/EBIT estimates are 3%/15% above consensus. With shares trading at 0.95x EV/sales ...