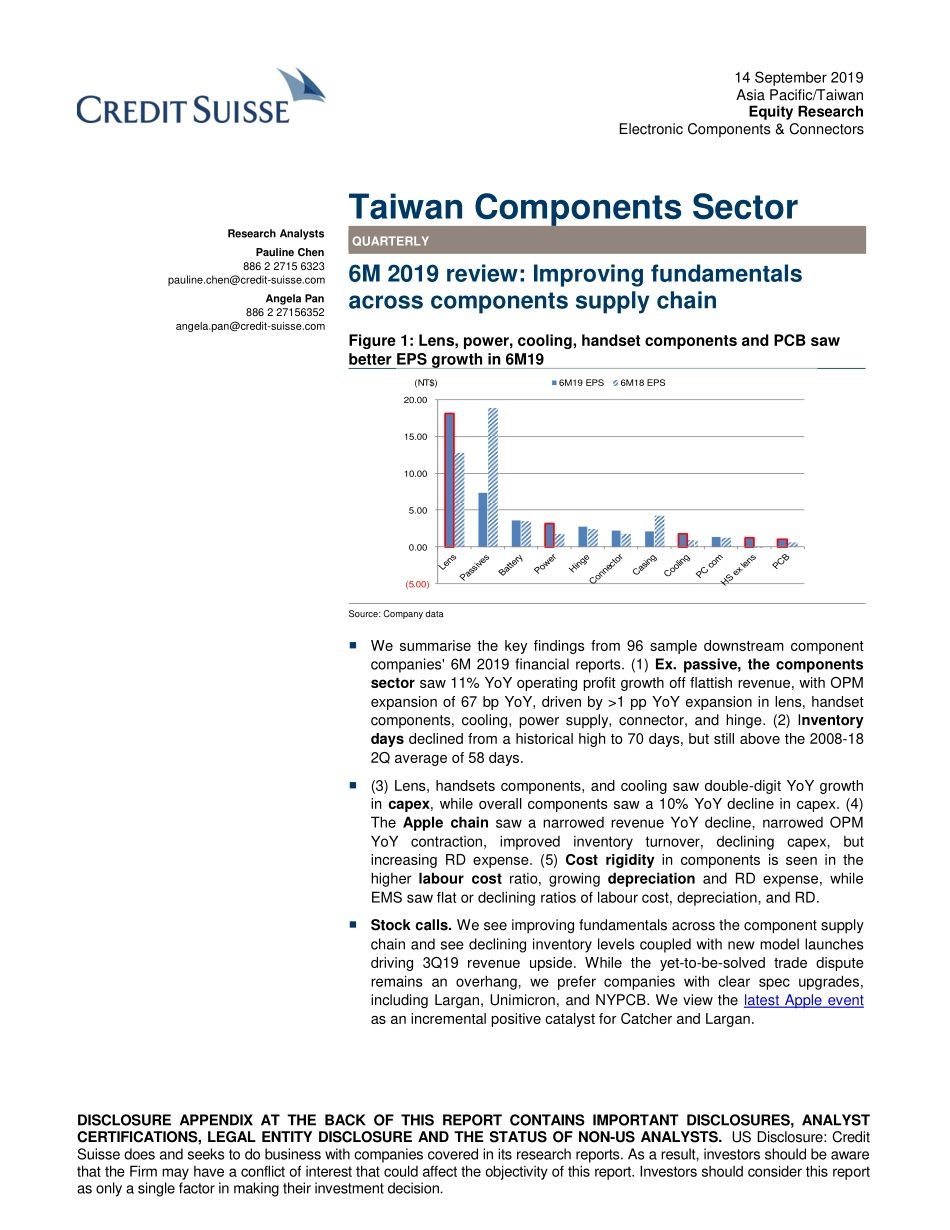

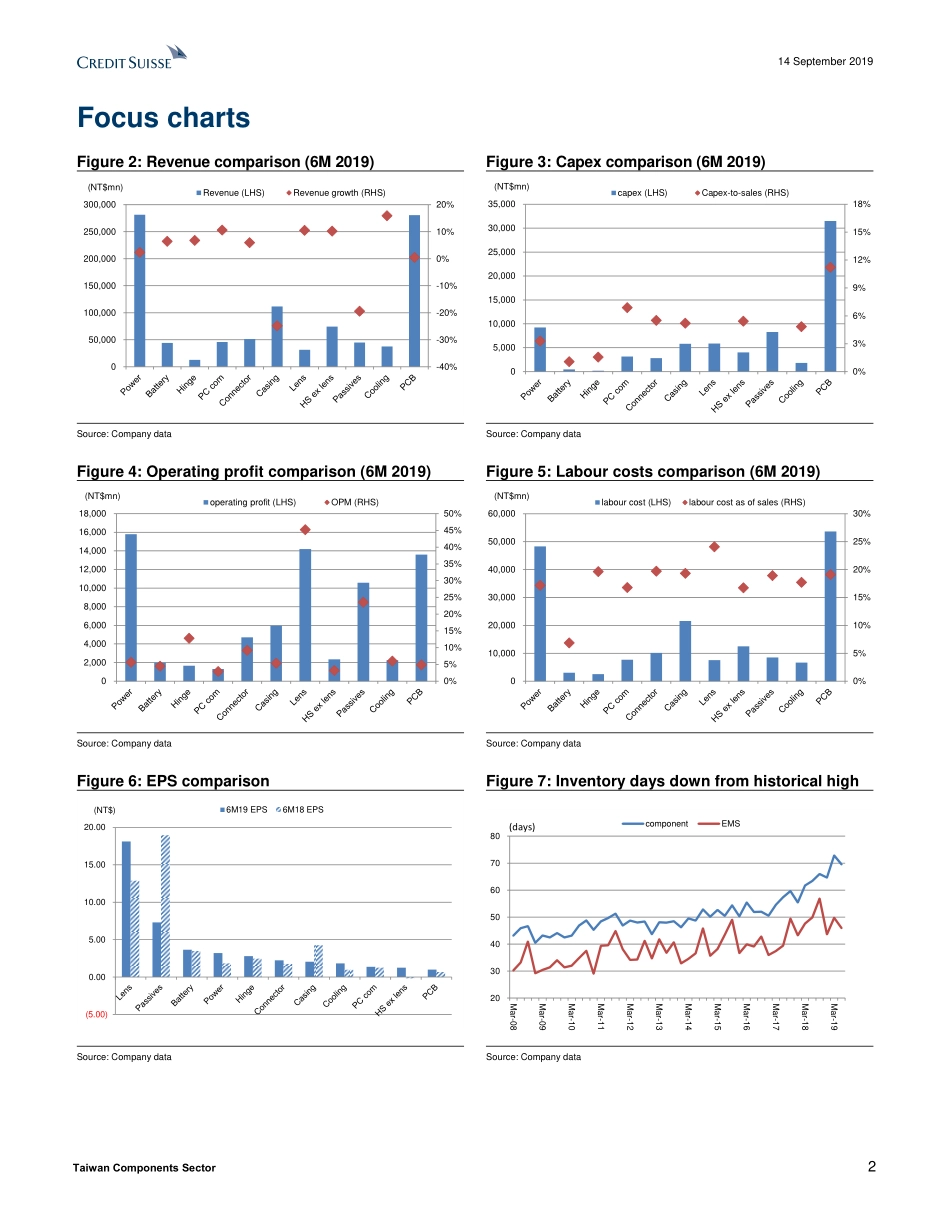

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 14 September 2019 Asia Pacific/Taiwan Equity Research Electronic Components & Connectors Taiwan Components Sector Research Analysts Pauline Chen 886 2 2715 6323 pauline.chen@credit-suisse.com Angela Pan 886 2 27156352 angela.pan@credit-suisse.com QUARTERLY 6M 2019 review: Improving fundamentals across components supply chain Figure 1: Lens, power, cooling, handset components and PCB saw better EPS growth in 6M19 Source: Company data ■ We summarise the key findings from 96 sample downstream component companies' 6M 2019 financial reports. (1) Ex. passive, the components sector saw 11% YoY operating profit growth off flattish revenue, with OPM expansion of 67 bp YoY, driven by >1 pp YoY expansion in lens, handset components, cooling, power supply, connector, and hinge. (2) Inventory days declined from a historical high to 70 days, but still above the 2008-18 2Q average of 58 days. ■ (3) Lens, handsets components, and cooling saw double-digit YoY growth in capex, while overall components saw a 10% YoY decline in capex. (4) The Apple chain saw a narrowed revenue YoY decline, narrowed OPM YoY contraction, improved inventory turnover, declining capex, but increasing RD expense. (5) Cost rigidity in components is seen in the higher labour cost ratio, growing depreciation and RD expense, while EMS saw flat or declining ratios of labour cost, depreciation, and RD. ■ Stock calls. We see improving fundamentals across the component supply chain and see declining inventory levels coupled with new model launches driving 3Q19 revenue upside. While the yet-to-be-solved trade dispute remains an overhang, we prefer companies with clear spec upgrades, including Largan, Unimicron, and NYPCB. We view the latest Apple event as an incremental positive catalyst for Catcher and Largan. (5.00)0.005.0010.0015.0020.006M19 EPS6M18 EPS(NT$) 14 September 2019 Taiwan Components Sector 2 Focus charts Figure 2: Revenue comparison (6M 2019) Figure 3: Capex comparison (6M 2019) Source: Company data Source: Company data Figure 4: Operating profit comparison (6M 2019) Figure 5: Labour costs comparison (6M 2019) Source: Company data Source: Company data Figure 6: EPS comparison Figure 7: Inventory days down from historical high Source: Company data Source: Company data -40%-30%-20%-10%0%10%20%050,000100,000150,000200,000250,000300,000Revenue (LHS)Revenue growth (RHS)(NT$mn)0%3%6%9%12%15%18%05,00010,000...