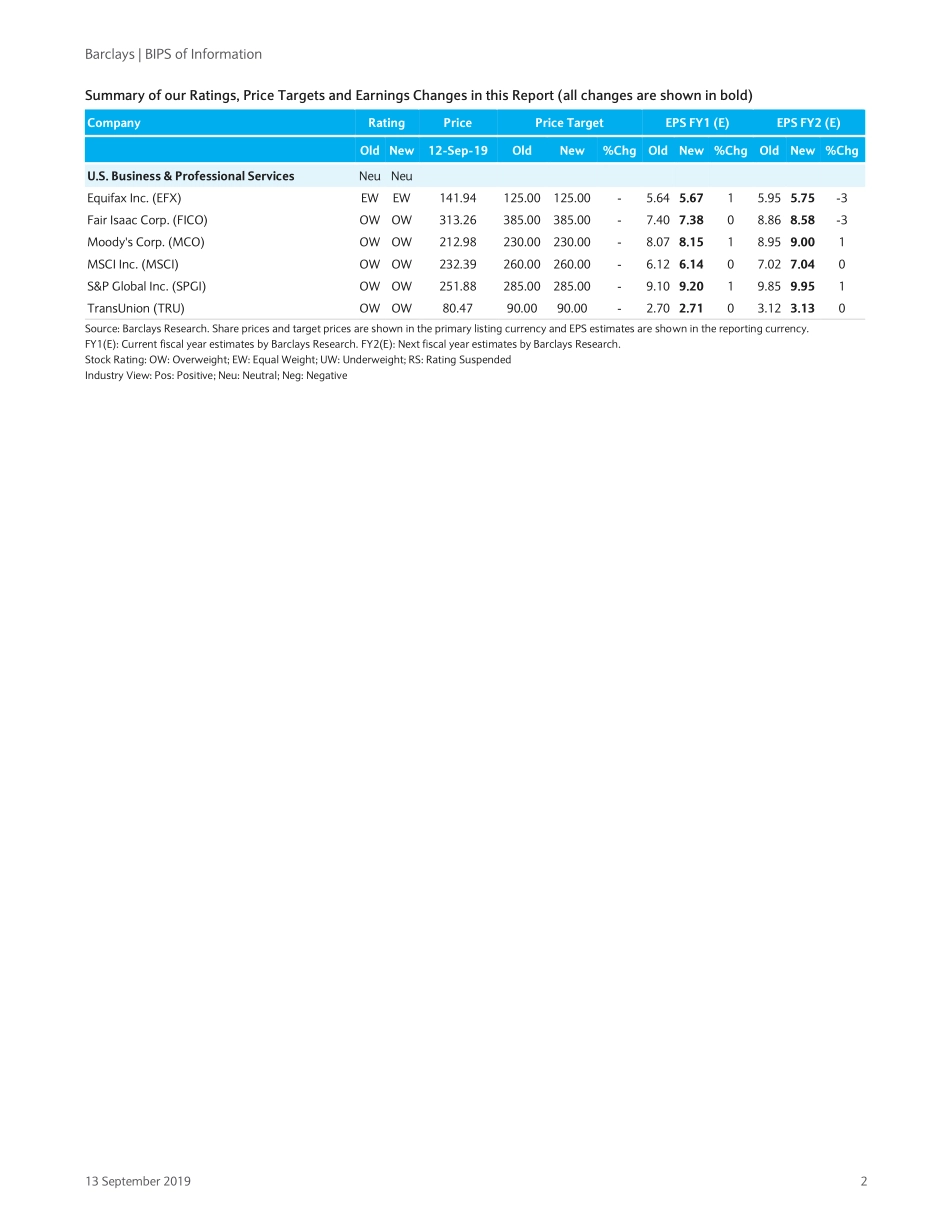

Equity Research 13 September 2019 CORE Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 36. Restricted - Internal BIPS of Information Constructive Views from Financial Conf. Matching record attendance at our 17th annual Financial Services Conference was demand for our financial info names – albeit with weak stock performance this week (during 9/9-9/11/19 Info names -5% vs. SPX +1%) belying constructive commentary. Given the sizable run YTD (info +50% vs. SPX +19%) and most trading at all-time-highs, a pullback is not surprising. In fact, we agree with Barclays strategist that it was likely a “healthy value rotation” and that “we do not think choppy markets are gone for good” – i.e. there could be more volatility, with which comes potential entry points. Within this backdrop, we reiterate our OW ratings on 6 of 7 names in attendance – SPGI (multiple levers of earnings potential); MCO (issuance-friendly backdrop); MSCI (active-to-passive runway; ESG); VRSK (defensive stalwart); TRU (broad-based growth; healthy consumer) and FICO (strong pricing story alongside software transition). For EFX (EW), commentary is improving, but we stay on the sidelines until signs of the tech transformation and non-mortgage U.S. financial growth become more evident. Credit Bureaus – Leading with innovation, aided by a healthy consumer: TRU, EFX and FICO echoed the same commentary at last week’s CB Day (which featured EXPN as well); but more importantly, so too did their lender customers on the macro (JPM, COF, AXP, DFS, among others). For TRU, CFO highlighted the breadth of opportunities to leverage its data across verticals (e.g. media, insurance, fraud/ID) & geographies (e.g. Colombia, India, UK) with some expected noise in HK (only ~2% of revs). With EFX, mortgage clearly helps 2H, but the company also signaled improved USIS visibility as it works through its tech transformation. We stick with ~5% organic growth in 2020 but lower EPS by 3% as we clean up for interest (to fund settlement) and higher depreciation. Finally, FICO’s new CFO pointed to continued runway for special pricing (in card; and still in mortgage and auto) and steady progress on the software cloud transition (still in 3rd/4th inning). We remain as constructive as ever but lower FY20 EPS by ~3% to reflect how FICO typically guides conservatively (report 4Q19 in Nov.). Market Data (SPGI, MCO, MSCI) – Several tailwinds at their backs: a) For issuance, both MCO and SPGI highlighted ...