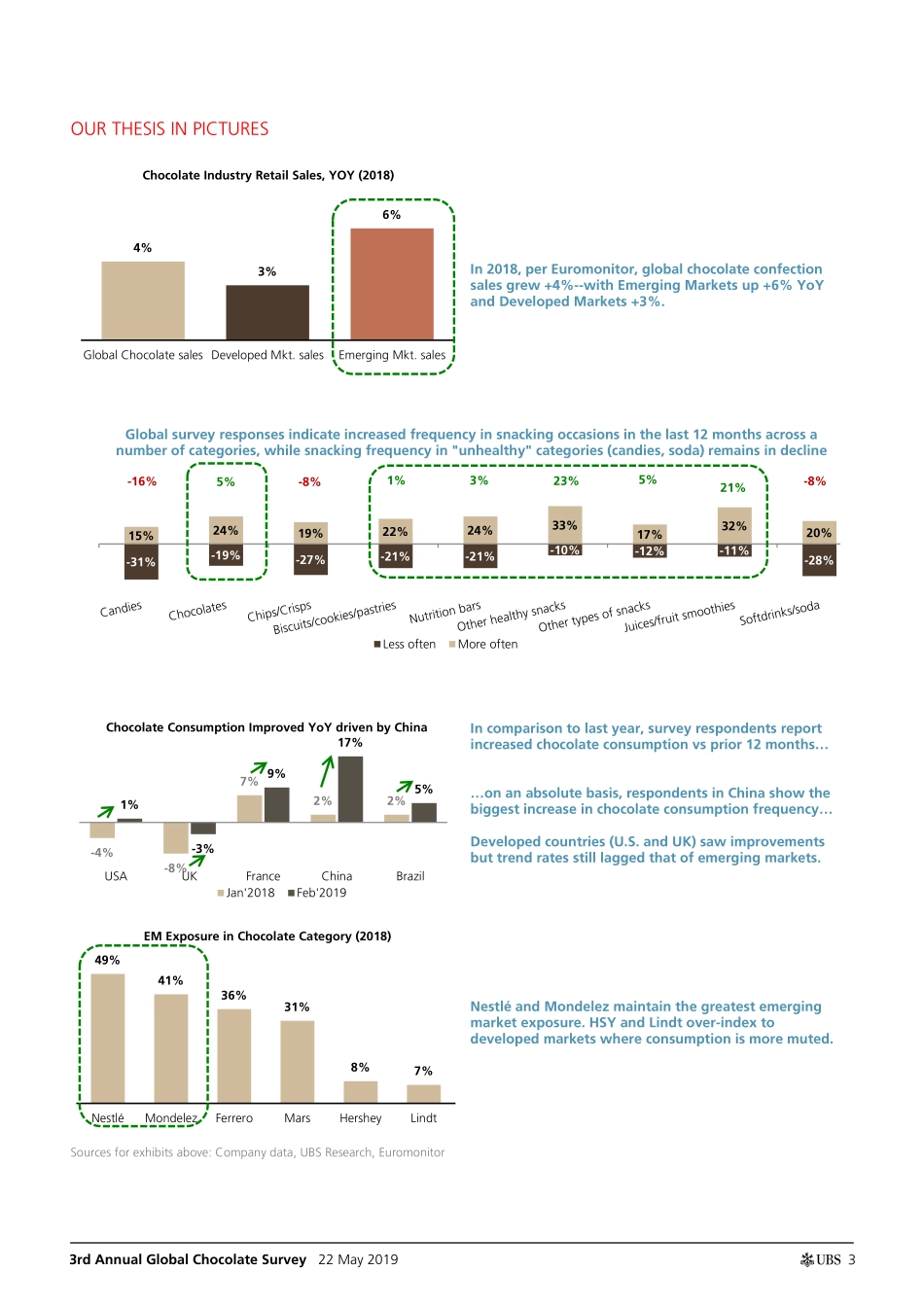

www.ubs.com/investmentresearch This report has been prepared by UBS Securities LLC. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 38. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 22 May 2019 3rd Annual Global Chocolate Survey UBS Evidence Lab inside: Consumers Step-up Snacking Frequency Key findings from 3rd Annual Global Chocolate Report In the 3rd annual survey of 3,400 consumers we analyze UBS Evidence Lab data to examine category drivers and consumer brand preferences in the USD$109 billion global chocolate confectionary market. Our key findings include: (1) survey respondents purchased snack & chocolate products more frequently than in the prior year period; (2) EM chocolate consumption accelerated in '18 due to greater frequency, increased HH penetration, and trade-up; (3) US chocolate sales slowed in '18, lagging Europe and EM trends; (4) premium chocolate brand sales outpaced that of value brands; (5) private label penetration rates remain low and unchanged at 6%. Increased consumer confidence is boosting purchase consideration & trade-up Per UBS Evidence Lab, global survey respondents claim their chocolate consumption frequency increased +5pp relative to the prior 12-month period, led by strong demand step-up in EMs (China). When we further unpacked global respondent data, we learned that consumers described themselves as being less price sensitive and showed a greater willingness to spend on snacks vs the prior year. Given respondent willingness to trade-up in quality for better tasting products, we expect value priced brand sales should continue to lag premium brands. Stock calls: Buy Mondelez, Nestlé, and Barry. Sell Hershey and Lindt Within our coverage of chocolate, we identify portfolios with exposure to emerging markets (Mondelez & Nestlé, Buy) and premium brands as best positioned. Mondelez enjoys 'white space' from recently entering two of the largest chocolate markets, the US & China, and is winning new distribution in SE Asia while activating local brands. On a relative basis, we are cautious on Hershey (Sell) given its premium valuation, outsized exposure to the US market and value price points, and recent market share losses (to Mars, Ferrero). For Buy-rated Barry, emerging market prospects, business model improvements (product mix, product assortment) and the benefits of sustainable chocolate sourcing are not fully reflected in the valuation. Lindt's elevated multiple could contract given its diminishing LFL sales outperformance vs. peers. Nestlé, a high conviction Buy, has limited chocolate exposure given the recent...