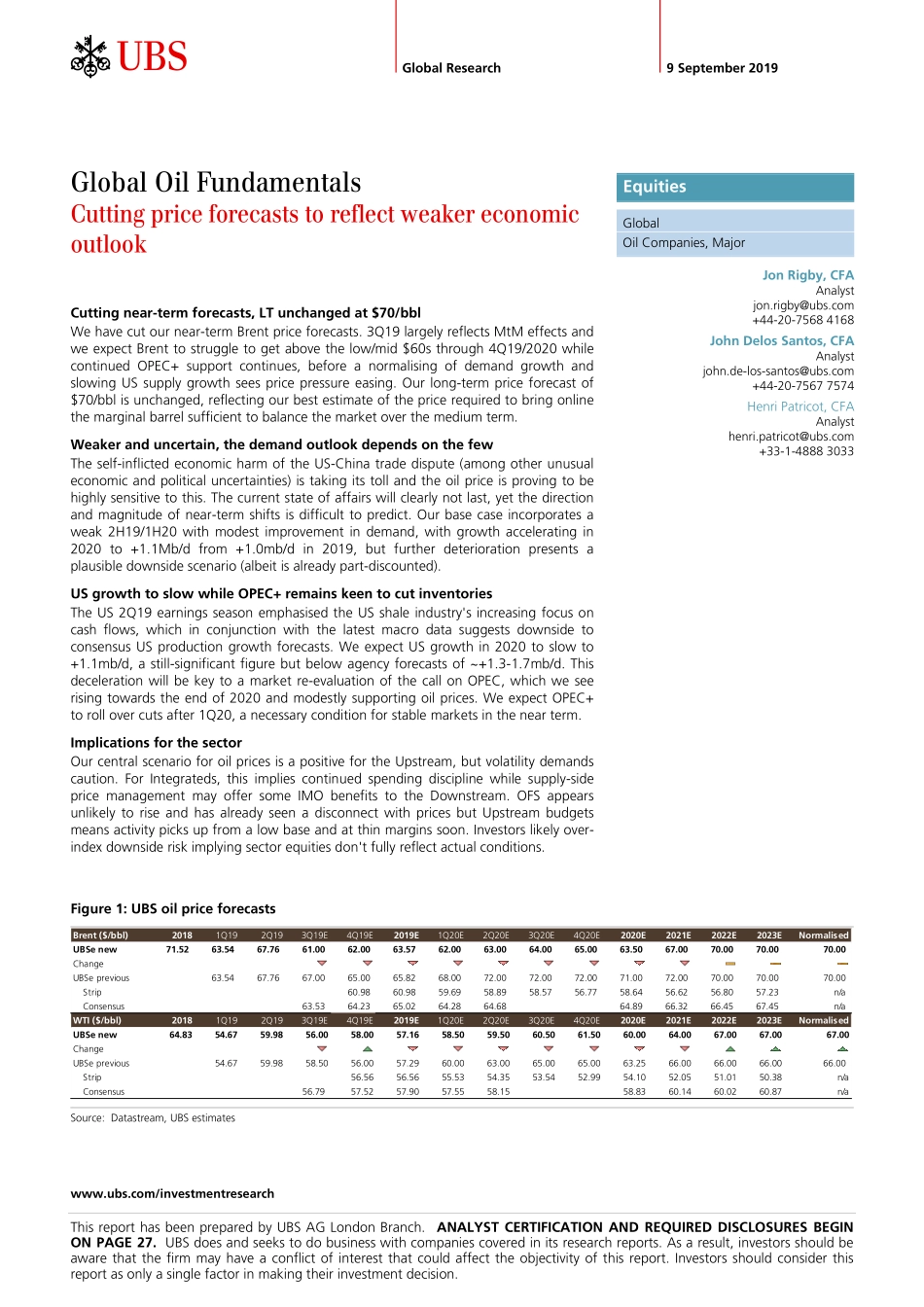

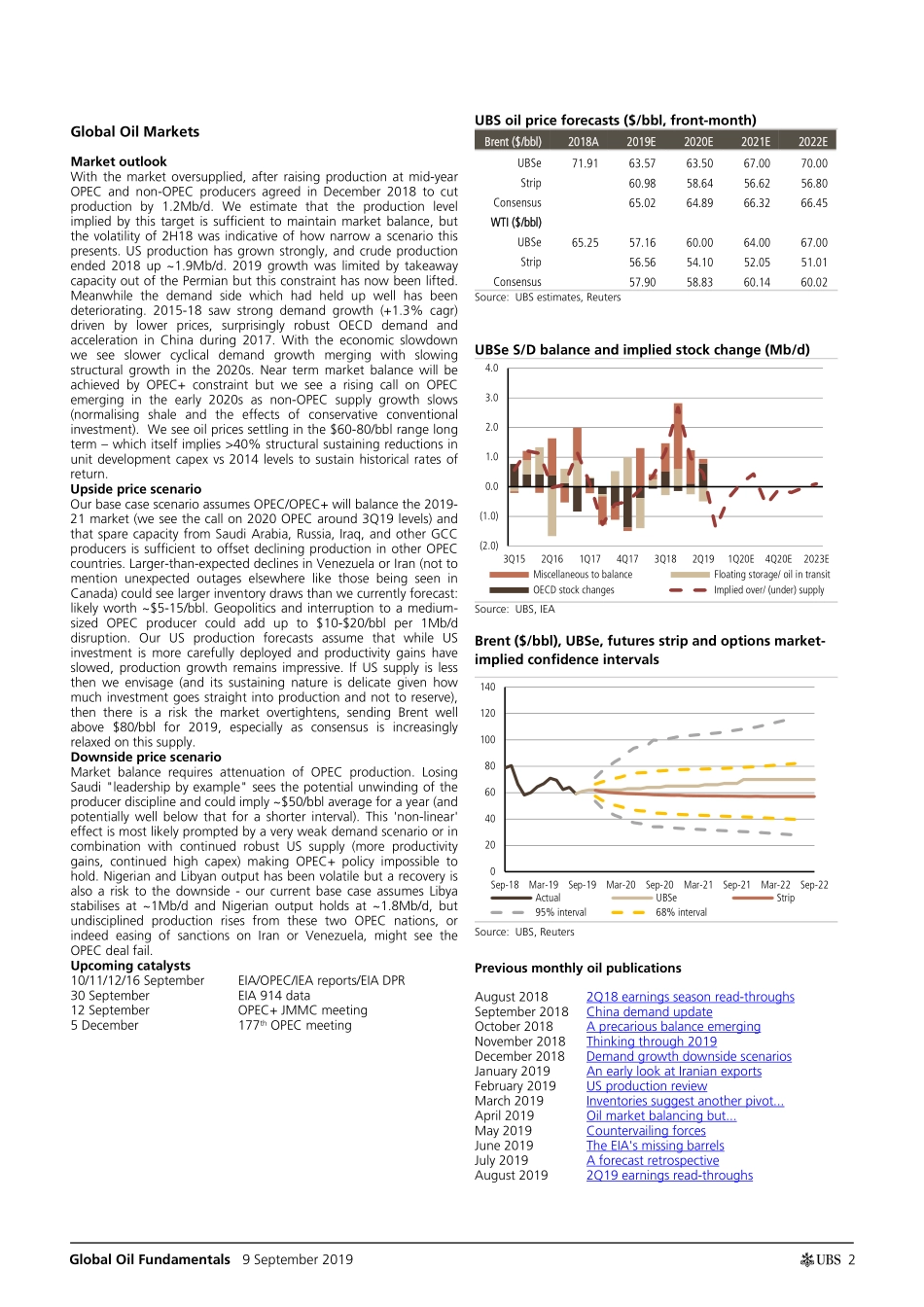

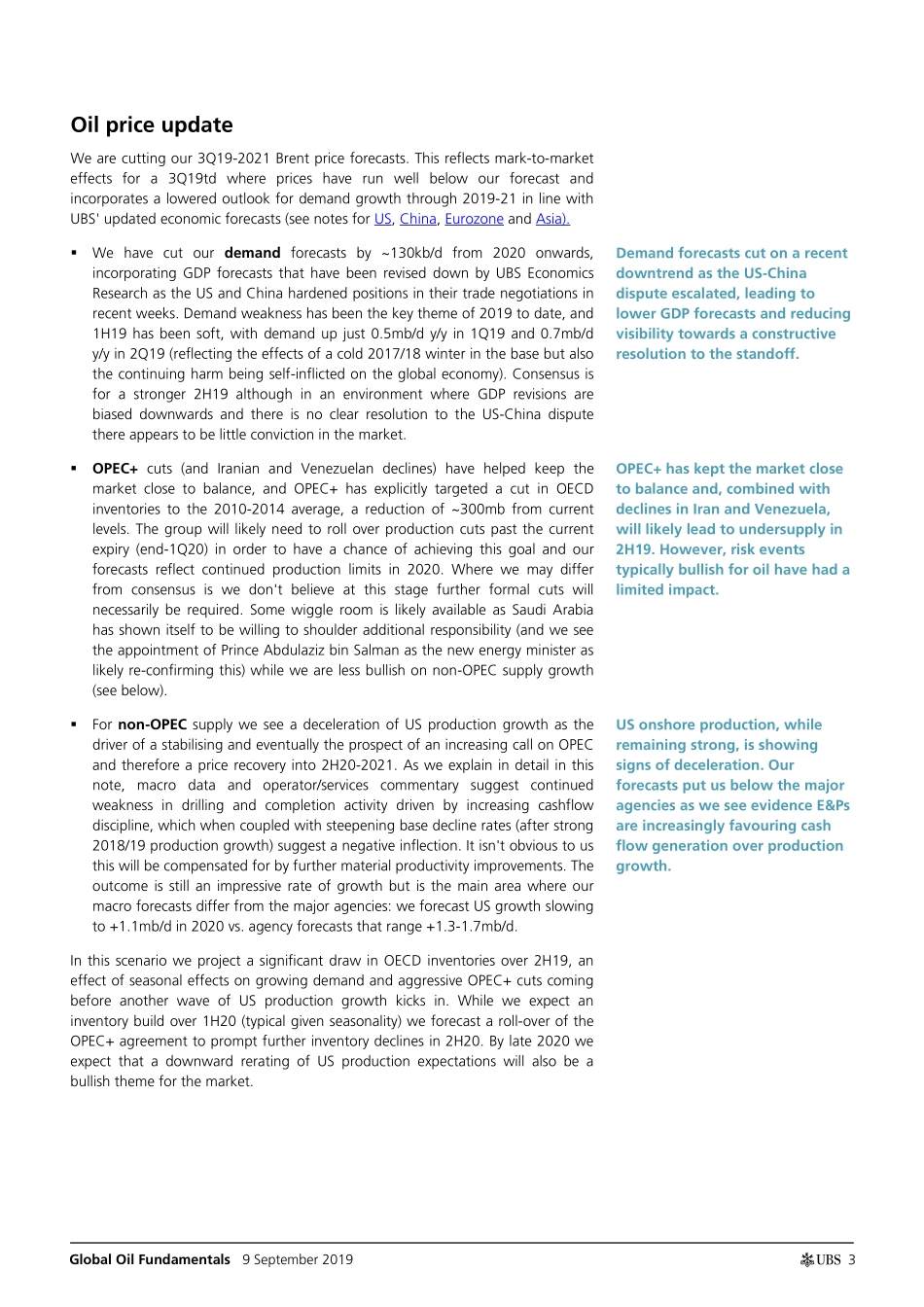

www.ubs.com/investmentresearch This report has been prepared by UBS AG London Branch. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 27. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 9 September 2019 Global Oil Fundamentals Cutting price forecasts to reflect weaker economic outlook Cutting near-term forecasts, LT unchanged at $70/bbl We have cut our near-term Brent price forecasts. 3Q19 largely reflects MtM effects and we expect Brent to struggle to get above the low/mid $60s through 4Q19/2020 while continued OPEC+ support continues, before a normalising of demand growth and slowing US supply growth sees price pressure easing. Our long-term price forecast of $70/bbl is unchanged, reflecting our best estimate of the price required to bring online the marginal barrel sufficient to balance the market over the medium term. Weaker and uncertain, the demand outlook depends on the few The self-inflicted economic harm of the US-China trade dispute (among other unusual economic and political uncertainties) is taking its toll and the oil price is proving to be highly sensitive to this. The current state of affairs will clearly not last, yet the direction and magnitude of near-term shifts is difficult to predict. Our base case incorporates a weak 2H19/1H20 with modest improvement in demand, with growth accelerating in 2020 to +1.1Mb/d from +1.0mb/d in 2019, but further deterioration presents a plausible downside scenario (albeit is already part-discounted). US growth to slow while OPEC+ remains keen to cut inventories The US 2Q19 earnings season emphasised the US shale industry's increasing focus on cash flows, which in conjunction with the latest macro data suggests downside to consensus US production growth forecasts. We expect US growth in 2020 to slow to +1.1mb/d, a still-significant figure but below agency forecasts of ~+1.3-1.7mb/d. This deceleration will be key to a market re-evaluation of the call on OPEC, which we see rising towards the end of 2020 and modestly supporting oil prices. We expect OPEC+ to roll over cuts after 1Q20, a necessary condition for stable markets in the near term. Implications for the sector Our central scenario for oil prices is a positive for the Upstream, but volatility demands caution. For Integrateds, this implies continued spending discipline while supply-side price management may offer some IMO benefits to the Downstream. OFS appears unlikely to rise and has already seen a disconnect with prices but Upstream budgets means activity picks up from a low base and at thin margins soon. Investors likely ove...