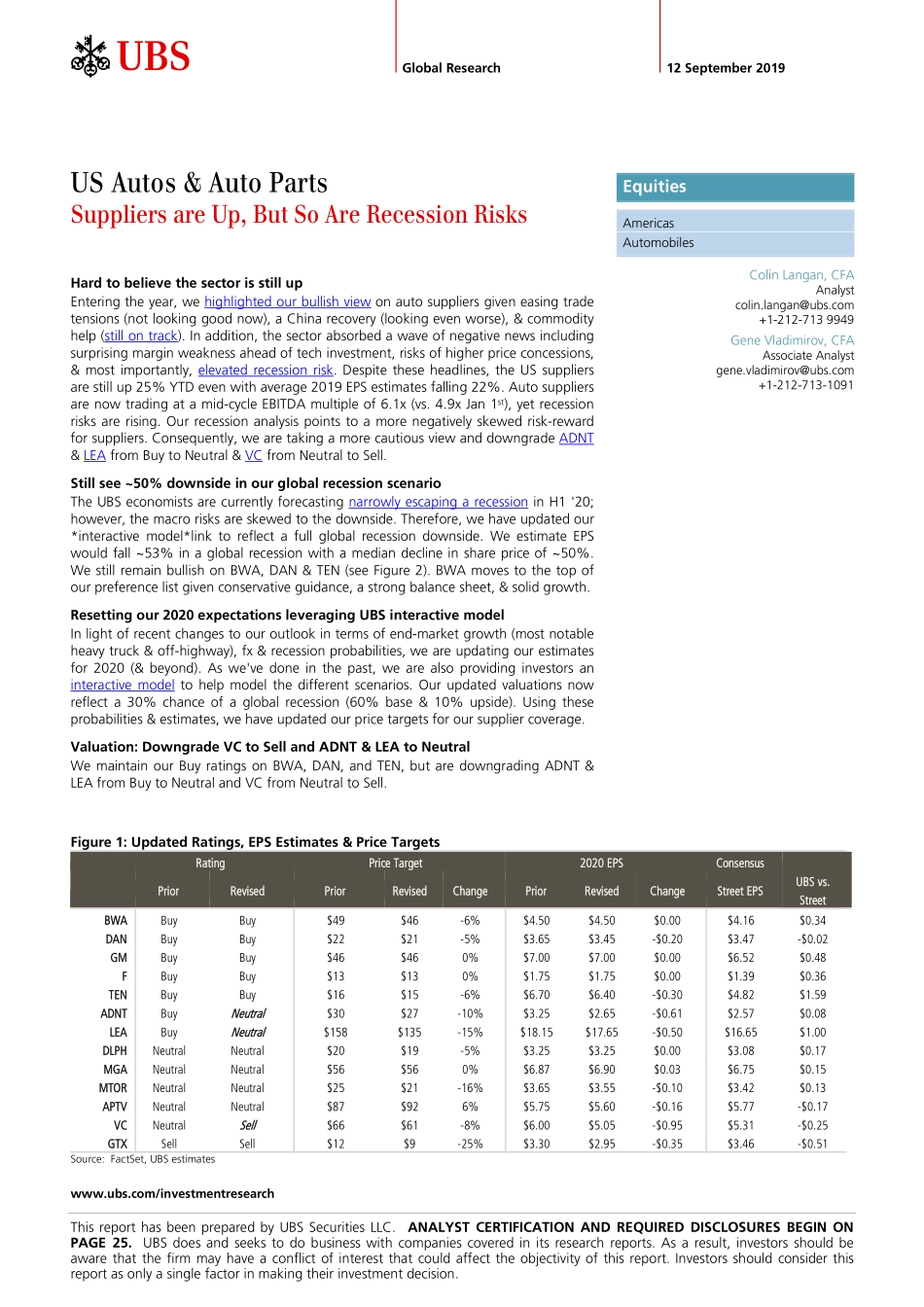

www.ubs.com/investmentresearch This report has been prepared by UBS Securities LLC. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 25. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 12 September 2019 US Autos & Auto Parts Suppliers are Up, But So Are Recession Risks Hard to believe the sector is still up Entering the year, we highlighted our bullish view on auto suppliers given easing trade tensions (not looking good now), a China recovery (looking even worse), & commodity help (still on track). In addition, the sector absorbed a wave of negative news including surprising margin weakness ahead of tech investment, risks of higher price concessions, & most importantly, elevated recession risk. Despite these headlines, the US suppliers are still up 25% YTD even with average 2019 EPS estimates falling 22%. Auto suppliers are now trading at a mid-cycle EBITDA multiple of 6.1x (vs. 4.9x Jan 1st), yet recession risks are rising. Our recession analysis points to a more negatively skewed risk-reward for suppliers. Consequently, we are taking a more cautious view and downgrade ADNT & LEA from Buy to Neutral & VC from Neutral to Sell. Still see ~50% downside in our global recession scenario The UBS economists are currently forecasting narrowly escaping a recession in H1 '20; however, the macro risks are skewed to the downside. Therefore, we have updated our *interactive model*link to reflect a full global recession downside. We estimate EPS would fall ~53% in a global recession with a median decline in share price of ~50%. We still remain bullish on BWA, DAN & TEN (see Figure 2). BWA moves to the top of our preference list given conservative guidance, a strong balance sheet, & solid growth. Resetting our 2020 expectations leveraging UBS interactive model In light of recent changes to our outlook in terms of end-market growth (most notable heavy truck & off-highway), fx & recession probabilities, we are updating our estimates for 2020 (& beyond). As we've done in the past, we are also providing investors an interactive model to help model the different scenarios. Our updated valuations now reflect a 30% chance of a global recession (60% base & 10% upside). Using these probabilities & estimates, we have updated our price targets for our supplier coverage. Valuation: Downgrade VC to Sell and ADNT & LEA to Neutral We maintain our Buy ratings on BWA, DAN, and TEN, but are downgrading ADNT & LEA from Buy to Neutral and VC from Neutral to Sell. Figure 1: Updated Ratings, EPS Estimates & Price Targets Rating Price Target 2020 EP...