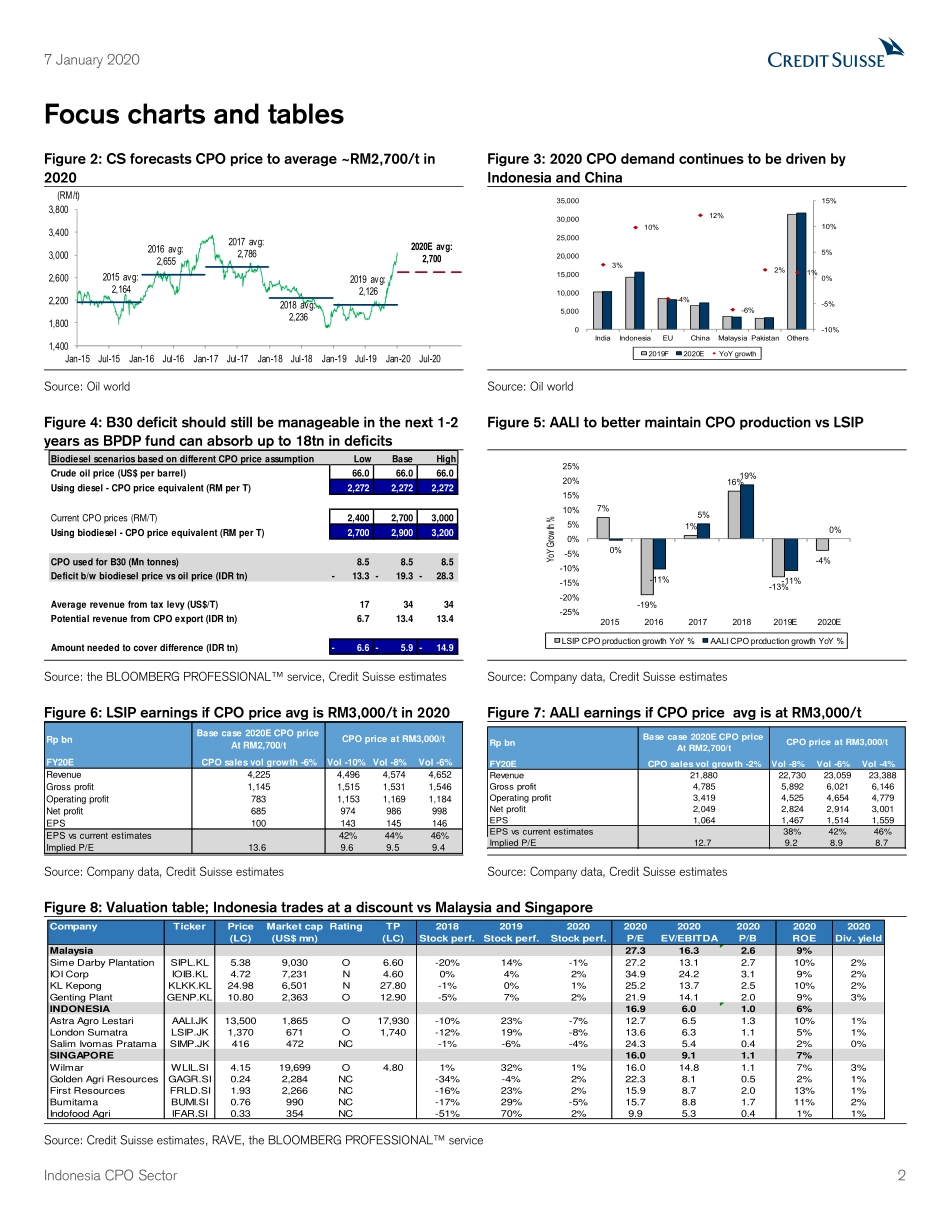

Indonesia CPO Sector Cyclical recovery amid supply hurdles Agricultural Products & Agribusiness | Initiation Figure 1: Stronger 2020 CPO demand vs production Source: MPOB, Credit Suisse estimates ■ CS forecasts CPO price to average at RM2,700/t in 2020. We expect the palm oil industry to undergo a rapid reduction in stockpile as production decelerates while demand continues to grow. Several reasons why we believe CPO price will hold up are: (1) Muted palm oil production growth in 2020, (2) Buying from China and India likely to persist and (3) Indonesia’s B30 biodiesel mandate to be fully implemented. ■ Supply deficit for longer: Production growth is expected to slow down due to a combination of low fertilizer application in 2019, dry weather impact and lower new planting & replanting done in recent years; by 2020, the total CPO production (Oil World) is set to decline by 0.6% YoY. On the demand side, CPO demand is expected (Oil World) to grow higher at 3%YoY in 2020, driven by Indonesia (+10% YoY) and China (+12% YoY) in 2020. ■ Biodiesel to provide long-term CPO demand: The B30 policy that has been implemented starting 1 January 2020 will increase biodiesel demand by 3% in 2020. Longer term, the government has also started to look into feasibility for B40 & B50. We believe that this policy will be maintained in the coming years as it will help reduce Indonesia’s dependence on oil imports. ■ We initiate coverage on AALI and LSIP with OUTPERFORM ratings: We forecast AALI revenue/NPAT to grow by 24%/341% in 2020E, and LSIP revenue/NPAT to grow by 16%/256% in 2020E as profitability returns to 2016/17 levels. Our preferred picks are AALI > LSIP. We prefer AALI as it should be able to better maintain its production volumes through plasma and third-party purchases. We believe there is additional earnings upside of 30-40% in 2020 if CPO price were to hold up at the current levels (RM3,000/t). ■ Key risks to our call: (1) decline in oil prices resulting in lower biodiesel demand; (2) sustained palm oil production in 2020 due to more favourable weather conditions and (3) strengthening of Rupiah vs USD. 13.6%4.9%-0.6%11.1%3.0%-8%-4%0%4%8%12%16%200820092010201120122013201420152016201720182019FProductionConsumption7 January 2020 Equity Research Asia Pacific | Indonesia DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Research Analysts Samuel Pratama 62 21 255 37906 samuel.pratama@cred...