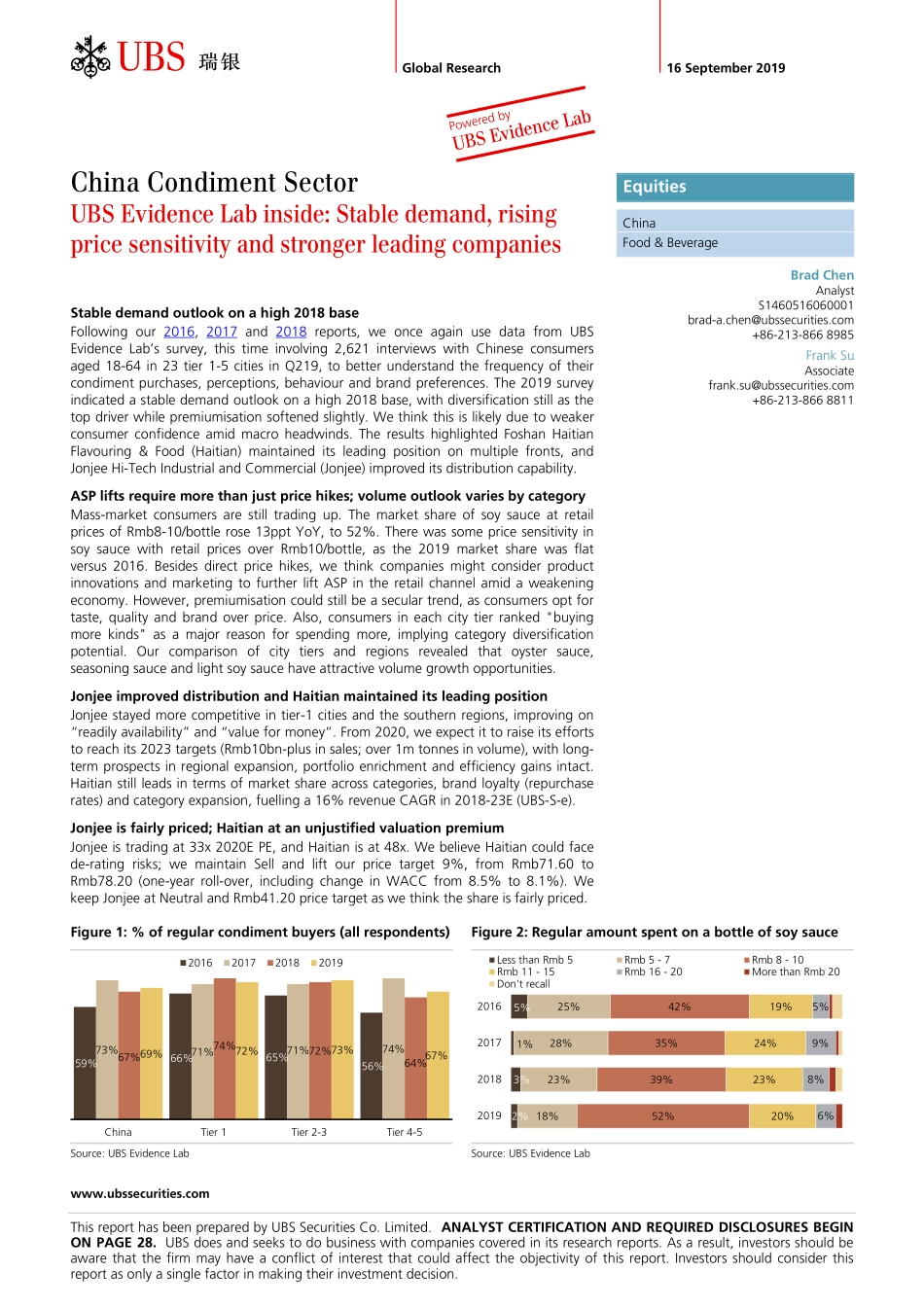

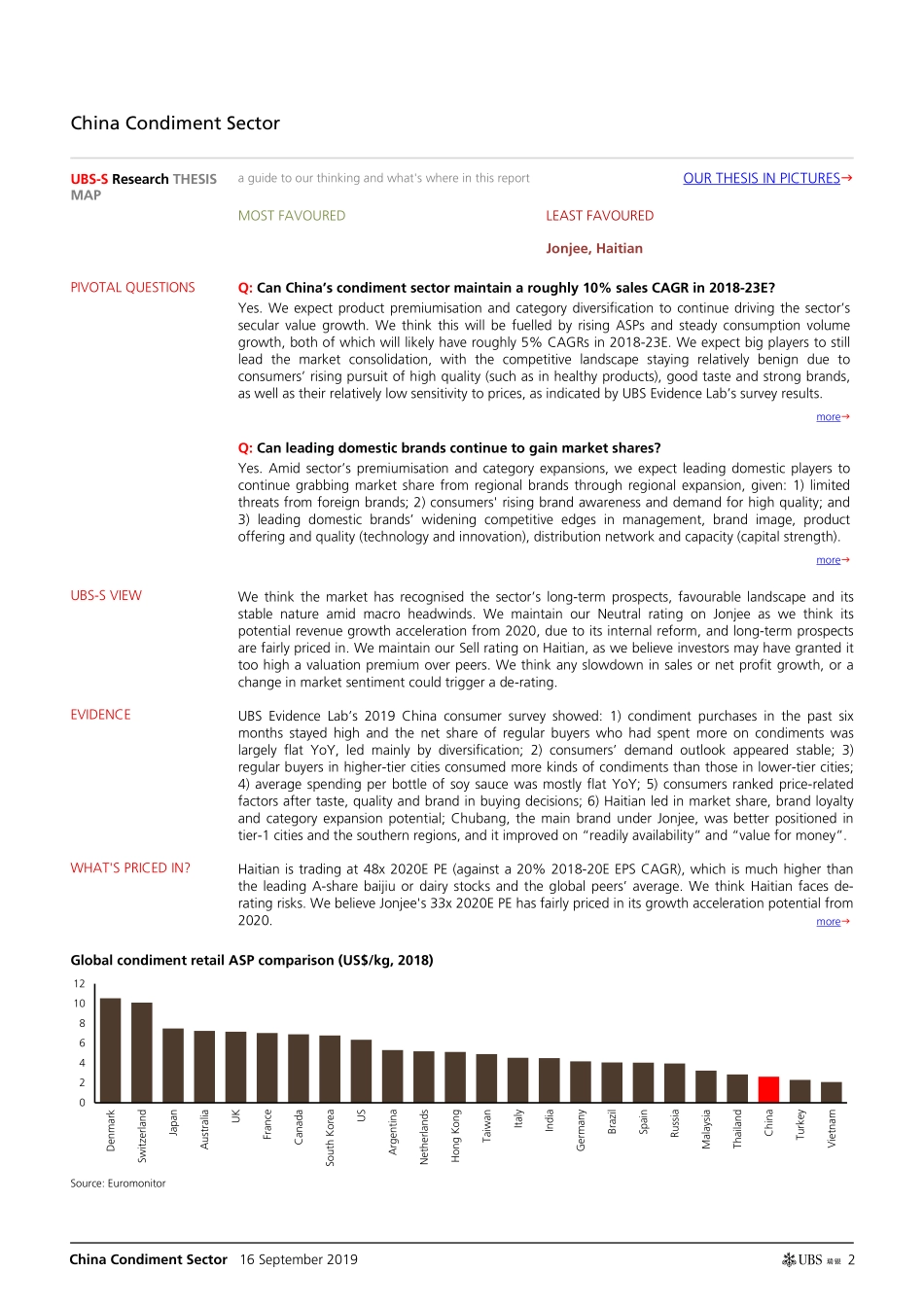

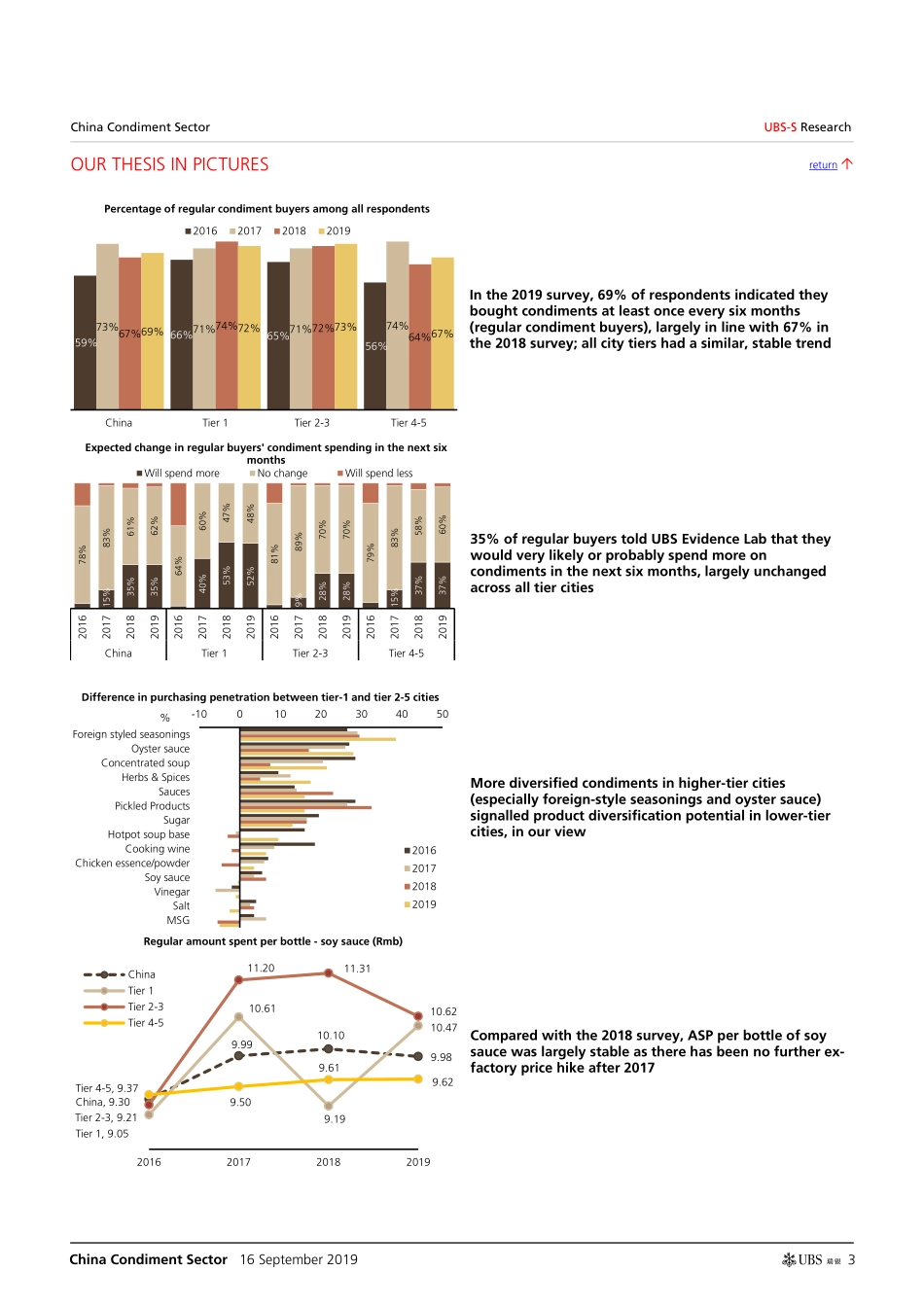

www.ubssecurities.com This report has been prepared by UBS Securities Co. Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 28. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. abc Global Research 16 September 2019 China Condiment Sector UBS Evidence Lab inside: Stable demand, rising price sensitivity and stronger leading companies Stable demand outlook on a high 2018 base Following our 2016, 2017 and 2018 reports, we once again use data from UBS Evidence Lab’s survey, this time involving 2,621 interviews with Chinese consumers aged 18-64 in 23 tier 1-5 cities in Q219, to better understand the frequency of their condiment purchases, perceptions, behaviour and brand preferences. The 2019 survey indicated a stable demand outlook on a high 2018 base, with diversification still as the top driver while premiumisation softened slightly. We think this is likely due to weaker consumer confidence amid macro headwinds. The results highlighted Foshan Haitian Flavouring & Food (Haitian) maintained its leading position on multiple fronts, and Jonjee Hi-Tech Industrial and Commercial (Jonjee) improved its distribution capability. ASP lifts require more than just price hikes; volume outlook varies by category Mass-market consumers are still trading up. The market share of soy sauce at retail prices of Rmb8-10/bottle rose 13ppt YoY, to 52%. There was some price sensitivity in soy sauce with retail prices over Rmb10/bottle, as the 2019 market share was flat versus 2016. Besides direct price hikes, we think companies might consider product innovations and marketing to further lift ASP in the retail channel amid a weakening economy. However, premiumisation could still be a secular trend, as consumers opt for taste, quality and brand over price. Also, consumers in each city tier ranked "buying more kinds" as a major reason for spending more, implying category diversification potential. Our comparison of city tiers and regions revealed that oyster sauce, seasoning sauce and light soy sauce have attractive volume growth opportunities. Jonjee improved distribution and Haitian maintained its leading position Jonjee stayed more competitive in tier-1 cities and the southern regions, improving on “readily availability” and “value for money”. From 2020, we expect it to raise its efforts to reach its 2023 targets (Rmb10bn-plus in sales; over 1m tonnes in volume), with long-term prospects in regional expansion, portfolio enrichment and efficiency gains intact. Haitian still leads in terms of market share across categories, brand loyalty (repurchase rates) and category expansion, fuell...