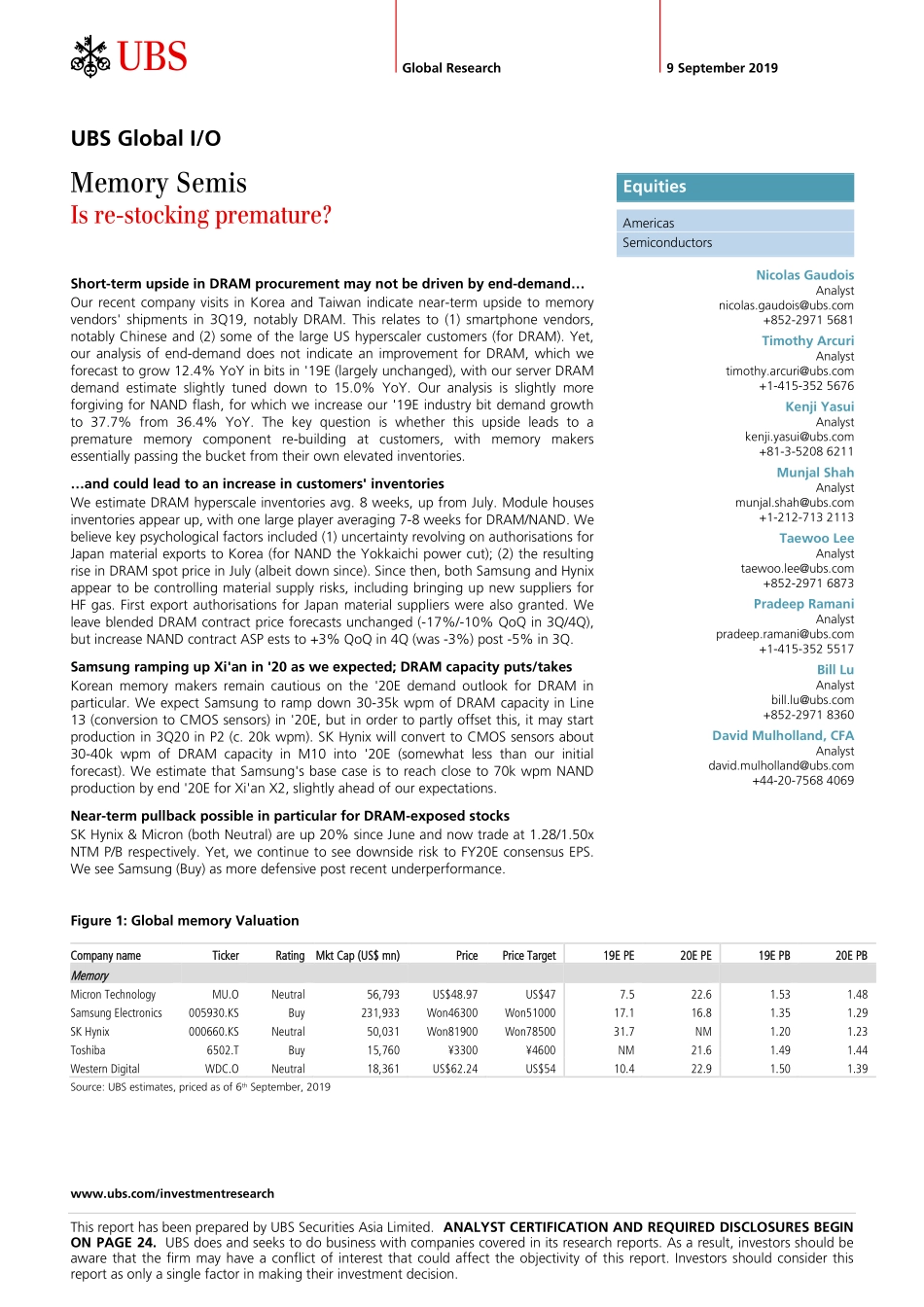

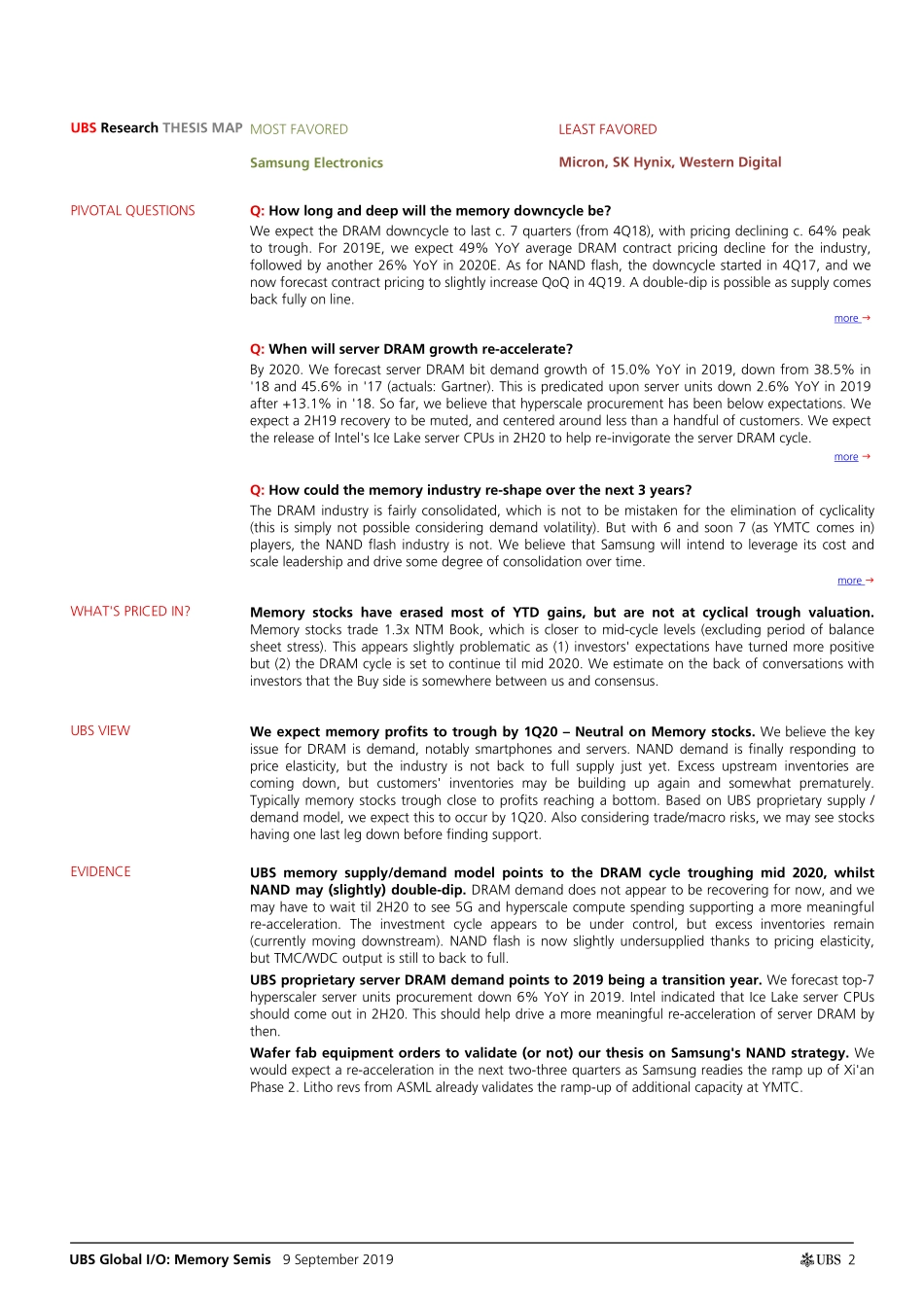

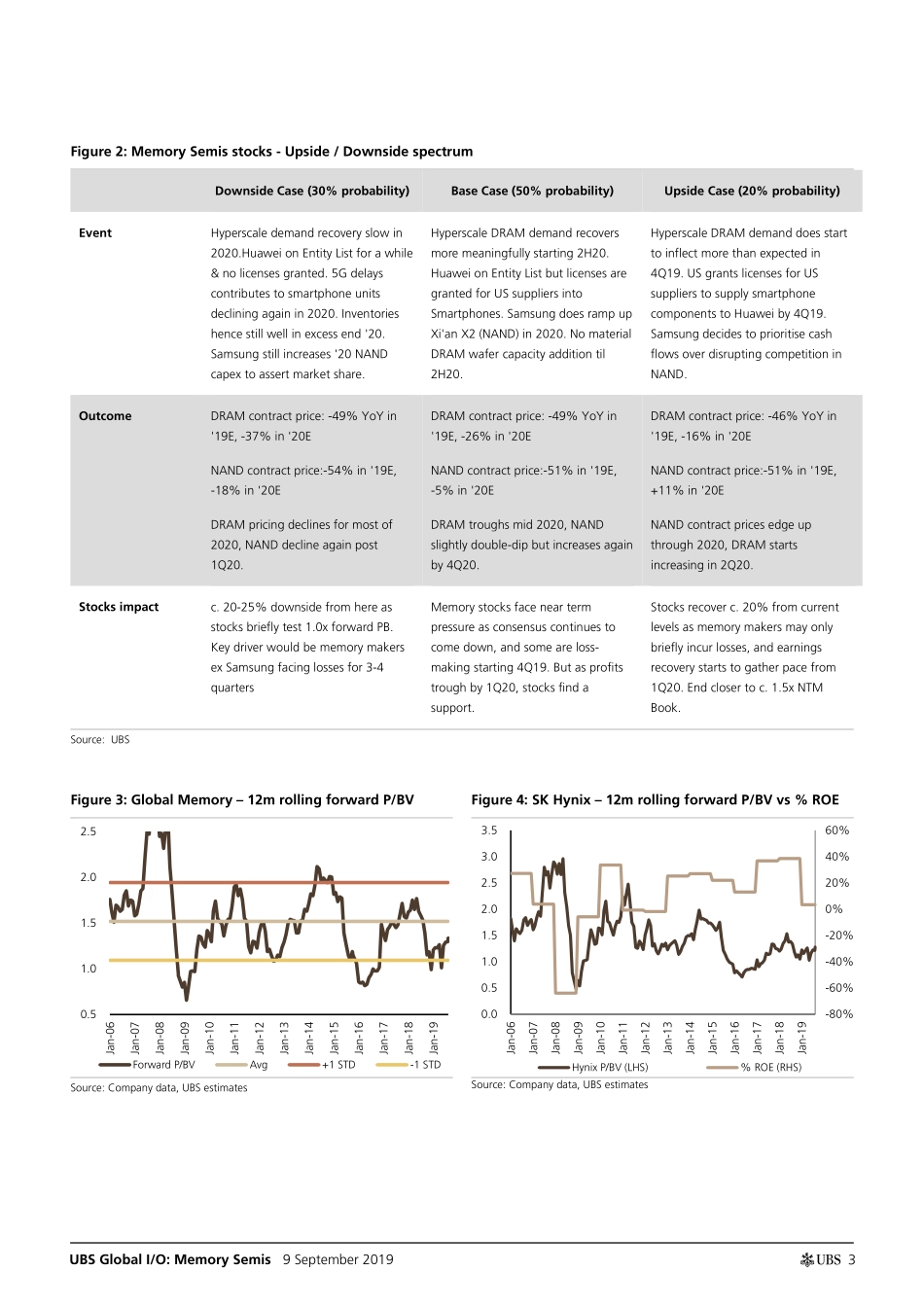

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Asia Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 24. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 9 September 2019 UBS Global I/O Memory Semis Is re-stocking premature? Short-term upside in DRAM procurement may not be driven by end-demand… Our recent company visits in Korea and Taiwan indicate near-term upside to memory vendors' shipments in 3Q19, notably DRAM. This relates to (1) smartphone vendors, notably Chinese and (2) some of the large US hyperscaler customers (for DRAM). Yet, our analysis of end-demand does not indicate an improvement for DRAM, which we forecast to grow 12.4% YoY in bits in '19E (largely unchanged), with our server DRAM demand estimate slightly tuned down to 15.0% YoY. Our analysis is slightly more forgiving for NAND flash, for which we increase our '19E industry bit demand growth to 37.7% from 36.4% YoY. The key question is whether this upside leads to a premature memory component re-building at customers, with memory makers essentially passing the bucket from their own elevated inventories. …and could lead to an increase in customers' inventories We estimate DRAM hyperscale inventories avg. 8 weeks, up from July. Module houses inventories appear up, with one large player averaging 7-8 weeks for DRAM/NAND. We believe key psychological factors included (1) uncertainty revolving on authorisations for Japan material exports to Korea (for NAND the Yokkaichi power cut); (2) the resulting rise in DRAM spot price in July (albeit down since). Since then, both Samsung and Hynix appear to be controlling material supply risks, including bringing up new suppliers for HF gas. First export authorisations for Japan material suppliers were also granted. We leave blended DRAM contract price forecasts unchanged (-17%/-10% QoQ in 3Q/4Q), but increase NAND contract ASP ests to +3% QoQ in 4Q (was -3%) post -5% in 3Q. Samsung ramping up Xi'an in '20 as we expected; DRAM capacity puts/takes Korean memory makers remain cautious on the '20E demand outlook for DRAM in particular. We expect Samsung to ramp down 30-35k wpm of DRAM capacity in Line 13 (conversion to CMOS sensors) in '20E, but in order to partly offset this, it may start production in 3Q20 in P2 (c. 20k wpm). SK Hynix will convert to CMOS sensors about 30-40k wpm of DRAM capacity in M10 into '20E (somewhat less than our initial forecast). We estimate that Samsung's base case is to reach close to 70k wpm NAND production by end '20E for Xi'an X2, slightly ahead o...