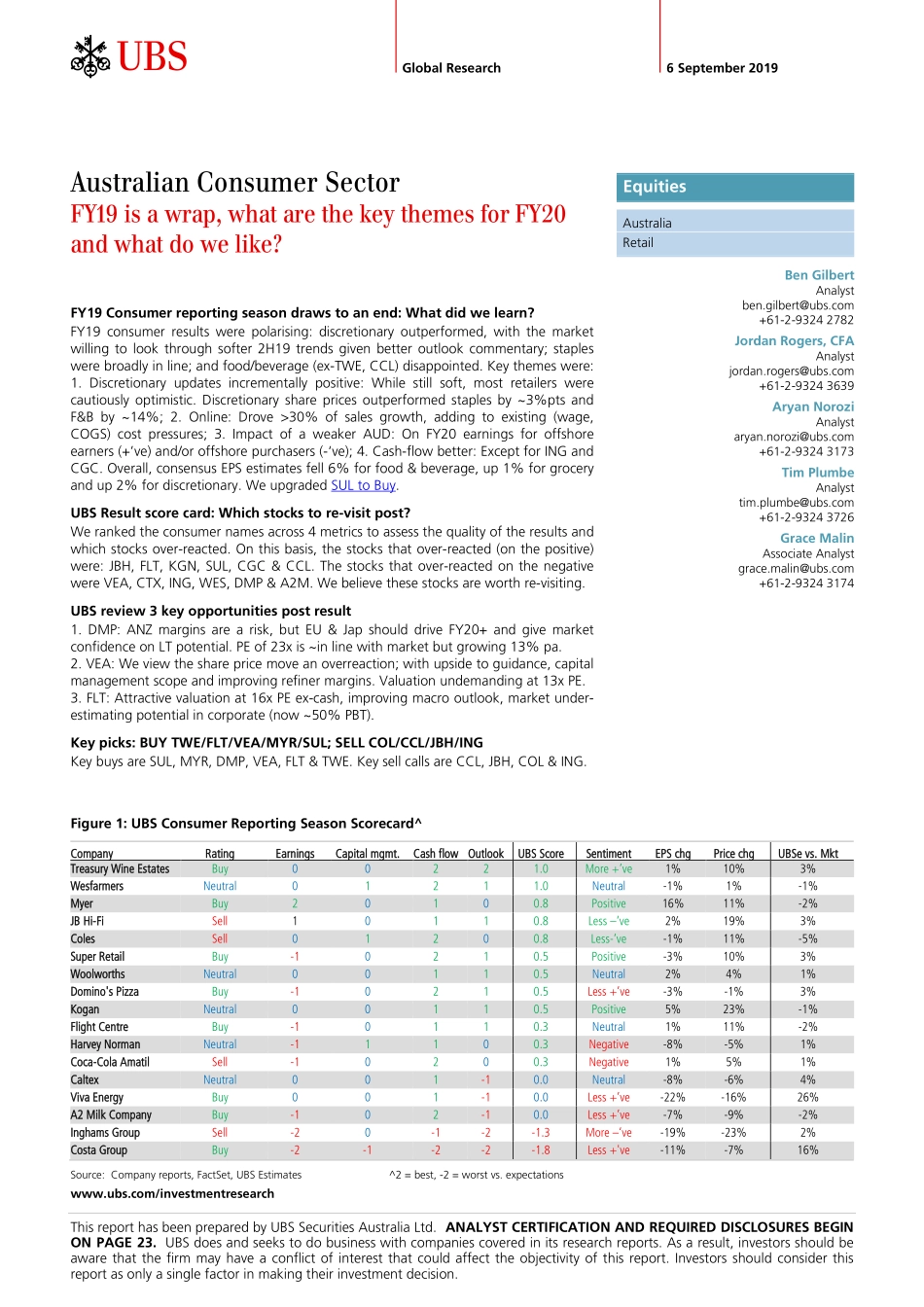

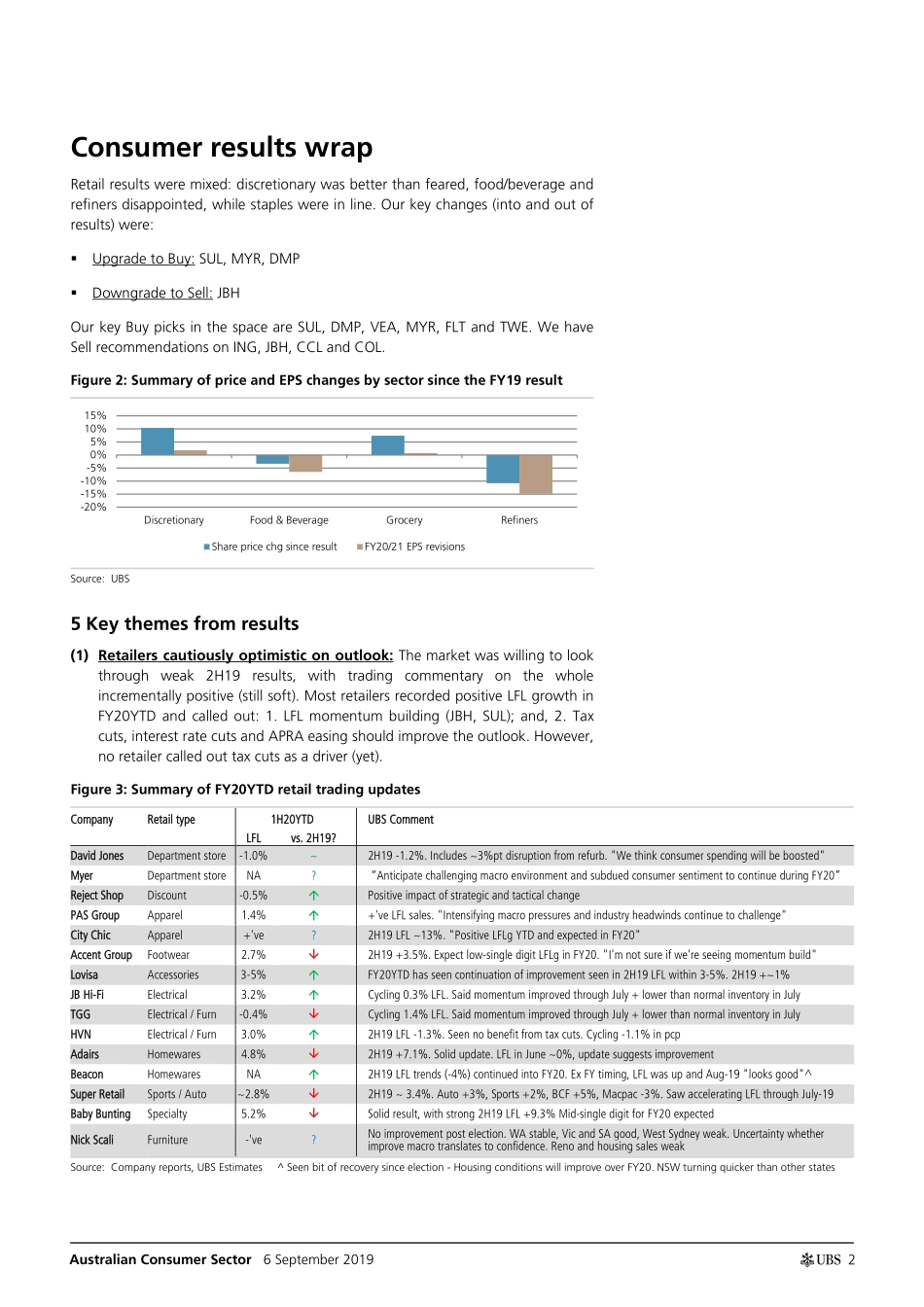

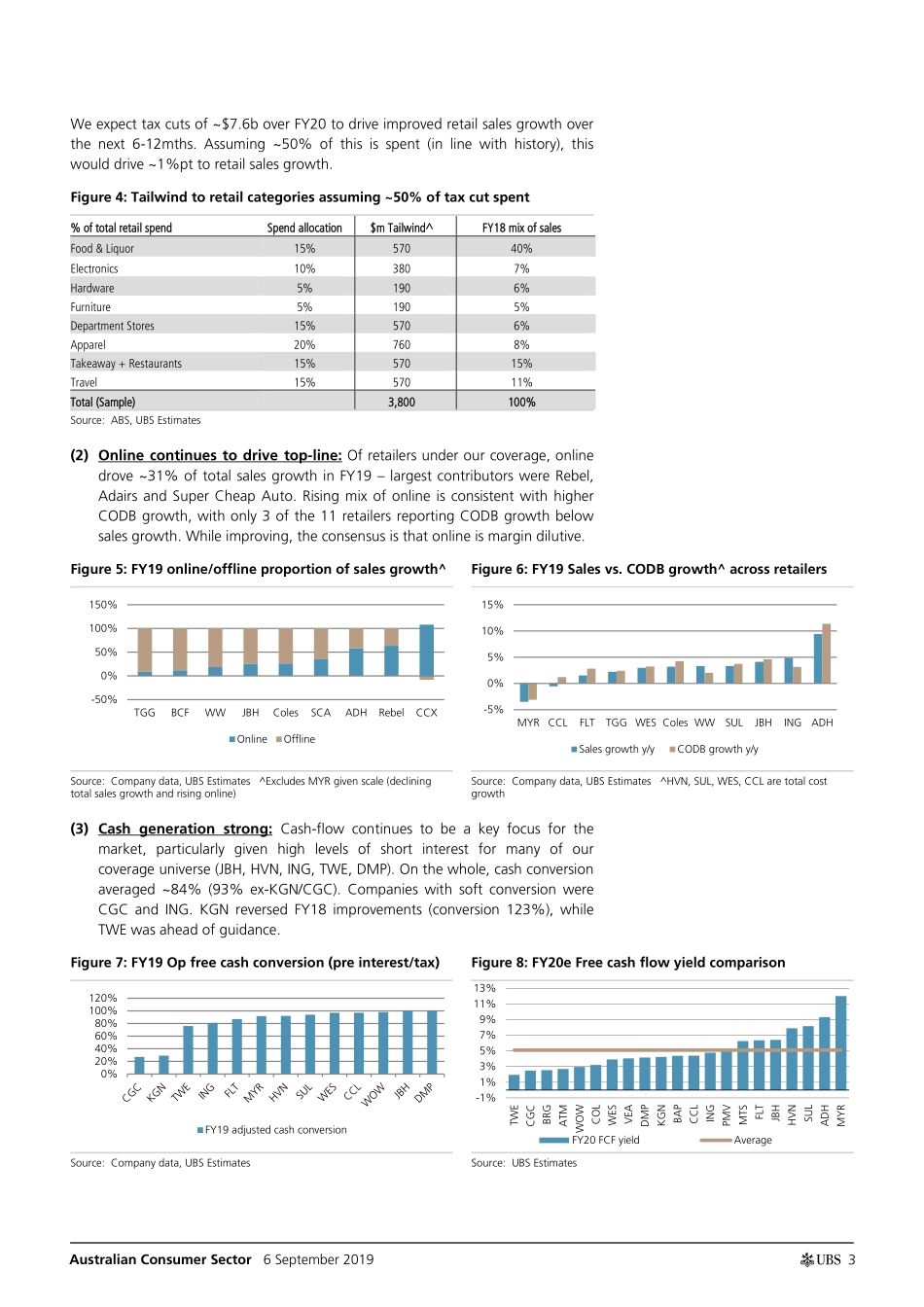

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Australia Ltd. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 23. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 6 September 2019 Australian Consumer Sector FY19 is a wrap, what are the key themes for FY20 and what do we like? FY19 Consumer reporting season draws to an end: What did we learn? FY19 consumer results were polarising: discretionary outperformed, with the market willing to look through softer 2H19 trends given better outlook commentary; staples were broadly in line; and food/beverage (ex-TWE, CCL) disappointed. Key themes were: 1. Discretionary updates incrementally positive: While still soft, most retailers were cautiously optimistic. Discretionary share prices outperformed staples by ~3%pts and F&B by ~14%; 2. Online: Drove >30% of sales growth, adding to existing (wage, COGS) cost pressures; 3. Impact of a weaker AUD: On FY20 earnings for offshore earners (+’ve) and/or offshore purchasers (-‘ve); 4. Cash-flow better: Except for ING and CGC. Overall, consensus EPS estimates fell 6% for food & beverage, up 1% for grocery and up 2% for discretionary. We upgraded SUL to Buy. UBS Result score card: Which stocks to re-visit post? We ranked the consumer names across 4 metrics to assess the quality of the results and which stocks over-reacted. On this basis, the stocks that over-reacted (on the positive) were: JBH, FLT, KGN, SUL, CGC & CCL. The stocks that over-reacted on the negative were VEA, CTX, ING, WES, DMP & A2M. We believe these stocks are worth re-visiting. UBS review 3 key opportunities post result 1. DMP: ANZ margins are a risk, but EU & Jap should drive FY20+ and give market confidence on LT potential. PE of 23x is ~in line with market but growing 13% pa. 2. VEA: We view the share price move an overreaction; with upside to guidance, capital management scope and improving refiner margins. Valuation undemanding at 13x PE. 3. FLT: Attractive valuation at 16x PE ex-cash, improving macro outlook, market under-estimating potential in corporate (now ~50% PBT). Key picks: BUY TWE/FLT/VEA/MYR/SUL; SELL COL/CCL/JBH/ING Key buys are SUL, MYR, DMP, VEA, FLT & TWE. Key sell calls are CCL, JBH, COL & ING. Figure 1: UBS Consumer Reporting Season Scorecard^ Company Rating Earnings Capital mgmt. Cash flow Outlook UBS Score Sentiment EPS chg Price chg UBSe vs. Mkt Treasury Wine Estates Buy 0 0 2 2 1.0 More +’ve 1% 10% 3% Wesfarmers Neutral 0 1 2 1 1.0 Neutral -1% 1% -1% Myer Buy 2 0 1 0 0.8 Positive 16% 11% -2% JB Hi-Fi Sell 1...