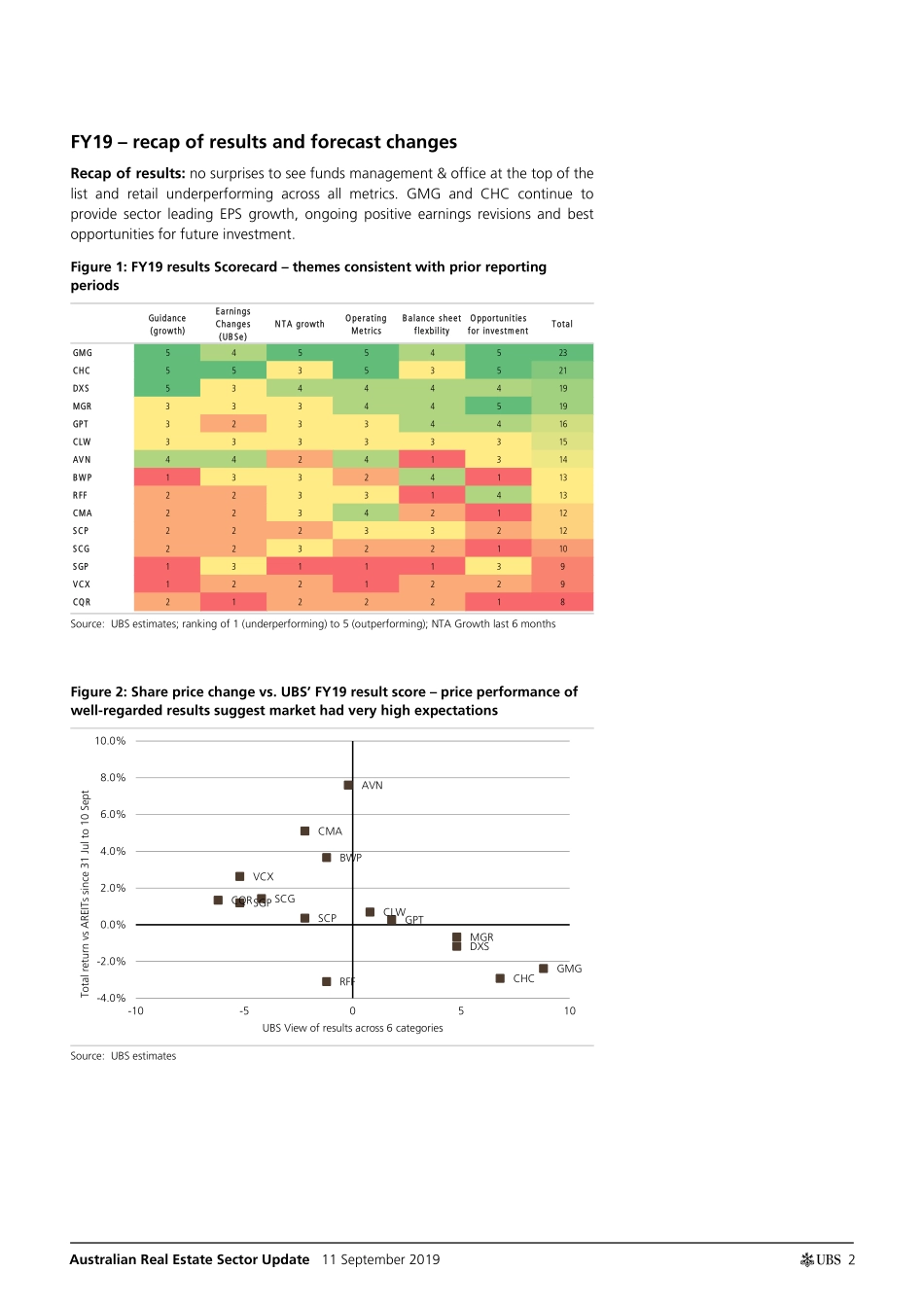

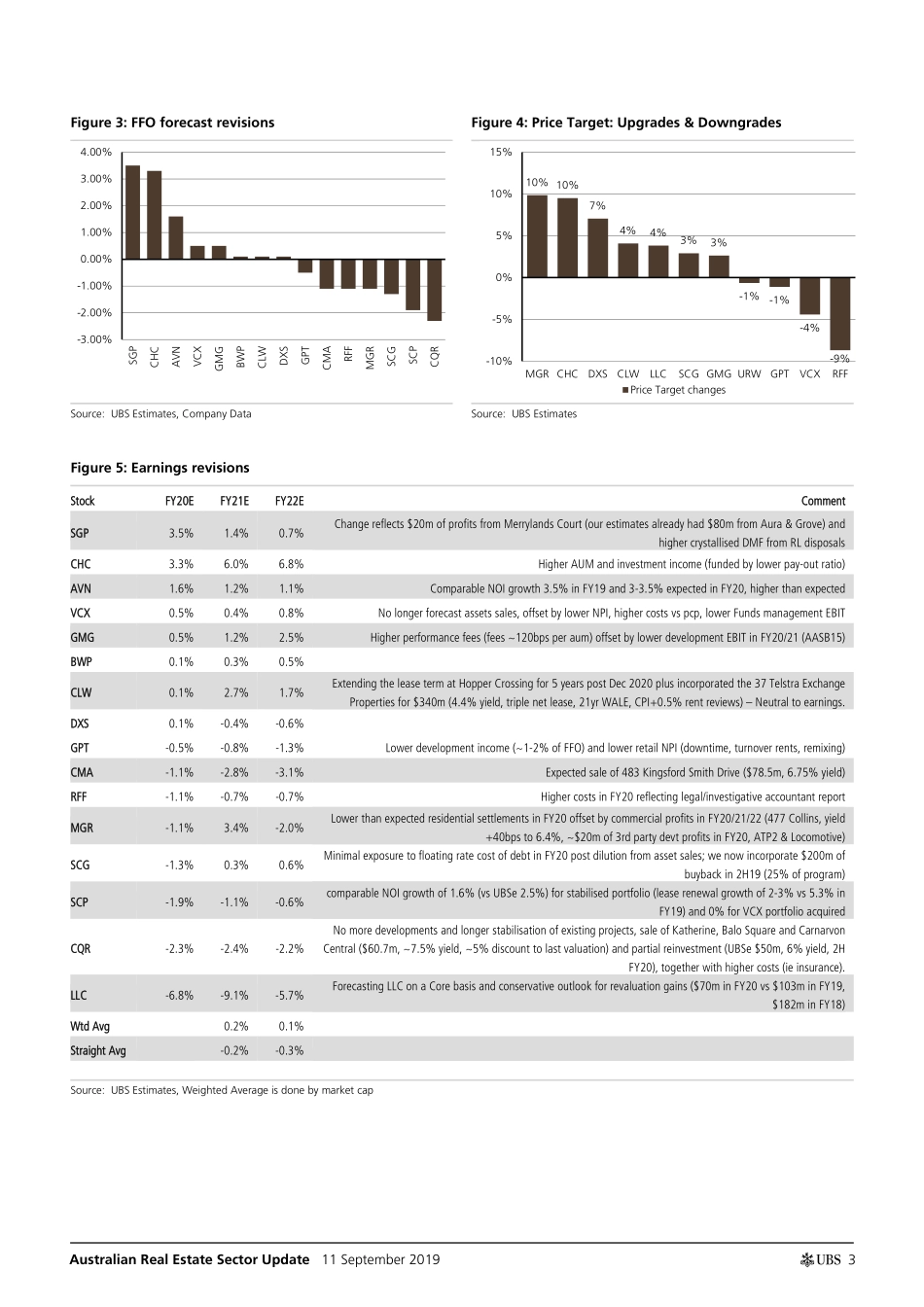

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Australia Ltd. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 19. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 11 September 2019 Australian Real Estate Sector Update FY19 Results – what did we learn? FY19 Real Estate reporting season draws to an end: What did we learn? FY19 results season highlighted once again the diverging performance of various sectors in Australian real estate. The operating metrics for retail deteriorated with no catalyst in sight while office, logistics and funds management kept pace with lofty expectations. The residential outlook remains cautious despite lending growth rebounding. Overall, UBS FFO estimates were revised lower for retail and upgraded for funds management while we are yet to see material earnings revisions for lower debt costs. We upgrade GMG to Buy (from Neutral). UBS Result score card: Which stocks to re-visit? We rank the REIT results across 6 different metrics (earnings growth/revisions, balance sheet, operating metrics, investment opportunities, NTA growth). Once again GMG and CHC lead the sector, but subsequent share price performance suggests market expectations were high combined with a rotation to value REITs. Conversely all retail REITs have outperformed the sector since the beginning of August despite results and outlook underwhelming. Key themes to drive sector returns post reporting season Residential: SGP – we can't see resi volumes recovering enough by FY21 (ie +50-60%) to replace one-off asset sale profits in FY20. Office: we expect concerns over a moderation in fundamentals will be overshadowed by further cap rate cap rate compression in FY20. Funds Management: increasing revenue per $AUM by performance fees (we expect GMG performance fees to remain strong for a number of years vs CHC max out in FY20) and more capital is needed to facilitate growth in AUM (lower DPS pay out ratio for CHC). Retail: conditions deteriorating are not consistent with debt funded buybacks. Development: getting ready for the next office cycle as an unprecedented level of logistics land bank restocking is occurring (we like GPT & MGR's development pipeline to add FFO/NAV in the short term). Real Estate Preferences: Most Preferred and Least Preferred Most Preferred: GMG, LLC, DXS, GPT. Least Preferred: SGP, MGR, VCX, SCG. Equities Australia Real Estate Grant McCasker, CFA Analyst grant.mccasker@ubs.com +61-2-9324 3626 Sam Merrick Associate Analyst sam.merrick@ubs.com +61-2-9324 2434 Australian Real Estate Sector Update 11 Septemb...