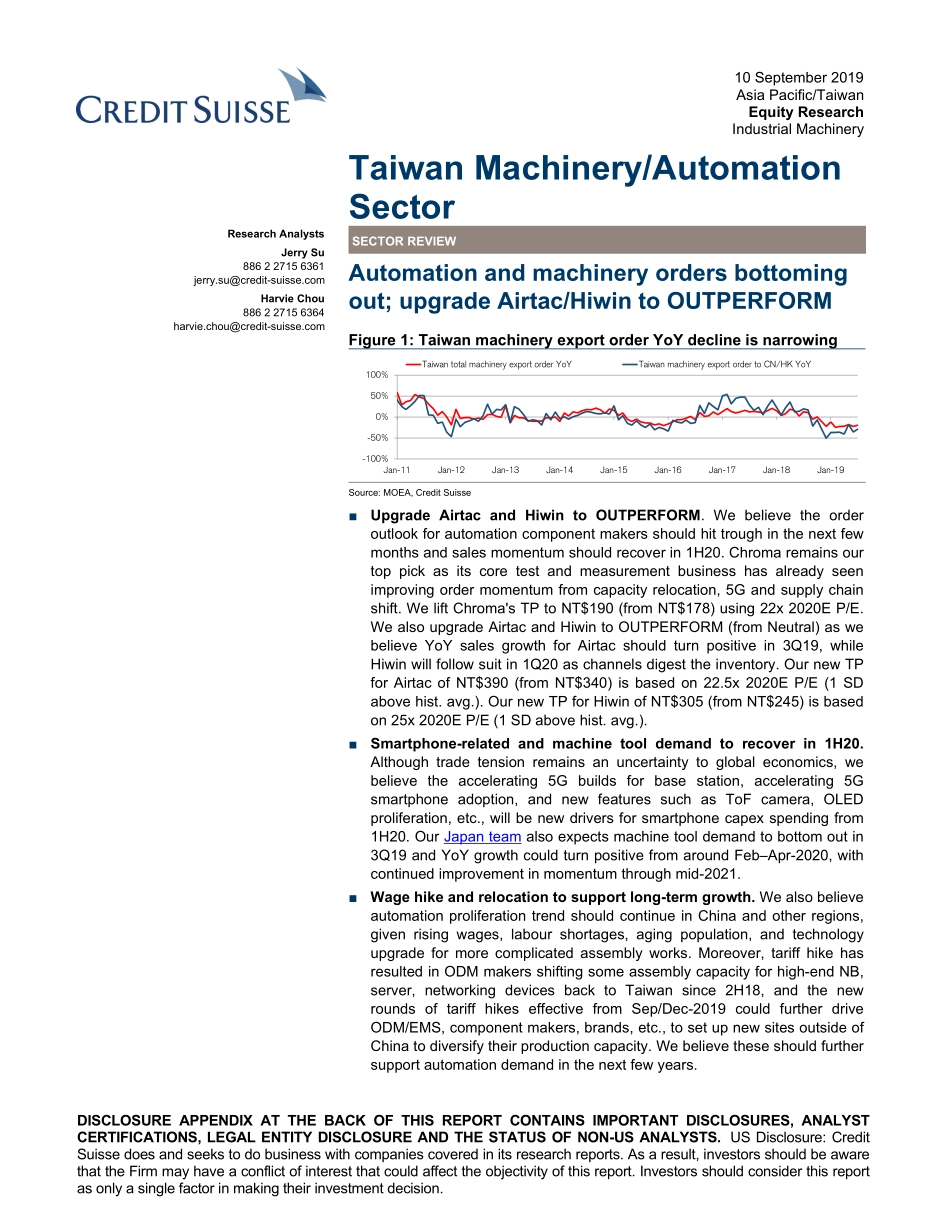

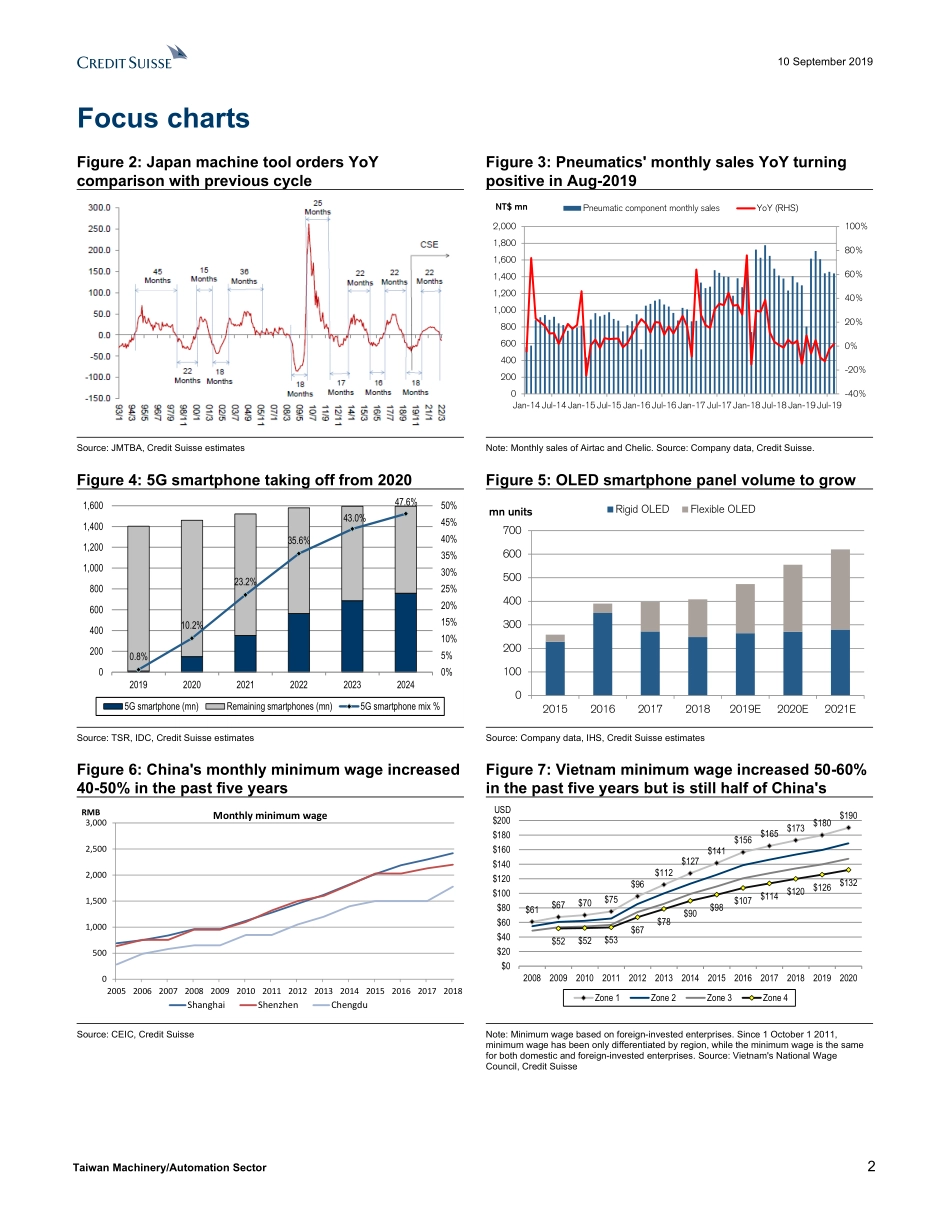

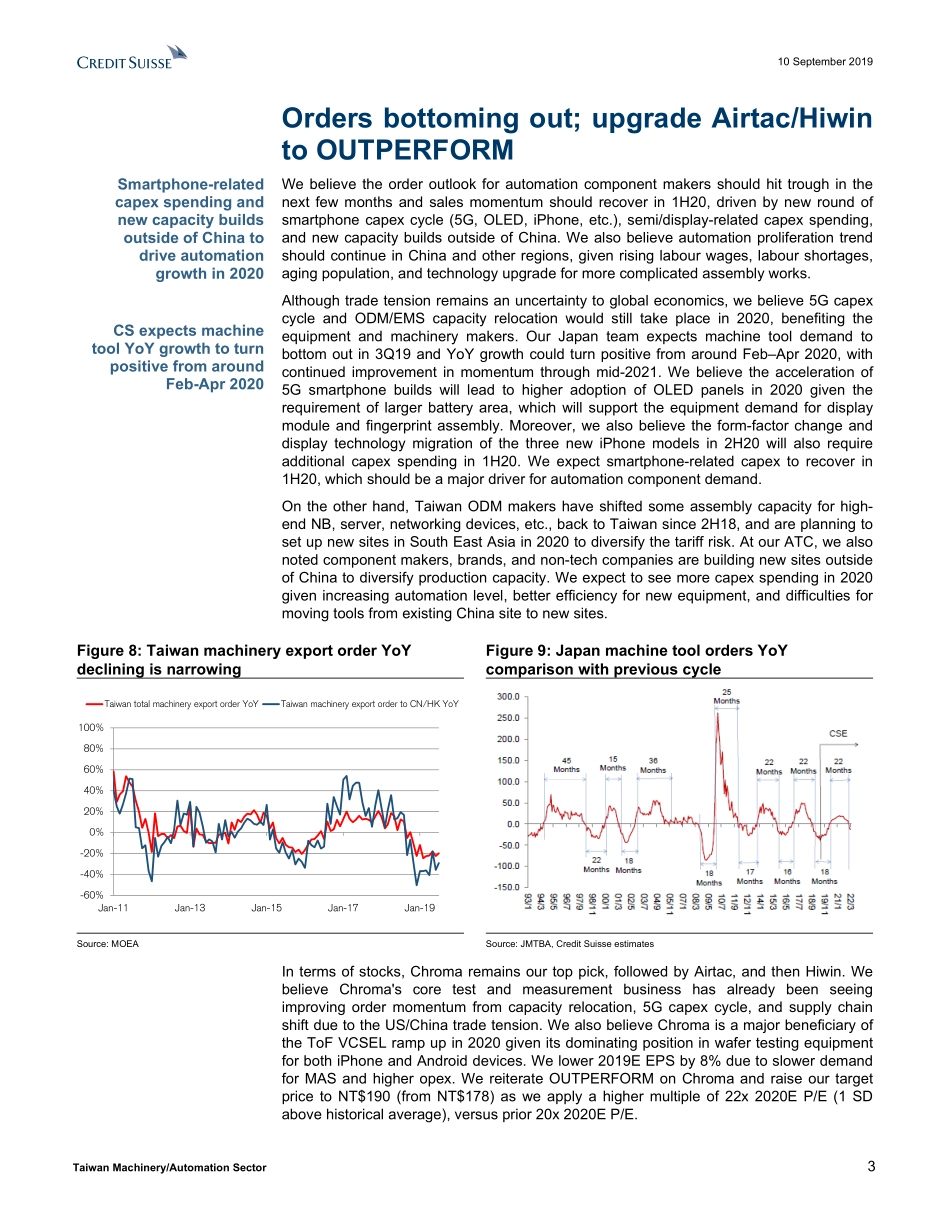

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. 10 September 2019Asia Pacific/TaiwanEquity ResearchIndustrial Machinery Taiwan Machinery/Automation Sector SECTOR REVIEWResearch AnalystsJerry Su886 2 2715 6361jerry.su@credit-suisse.comHarvie Chou886 2 2715 6364harvie.chou@credit-suisse.comAutomation and machinery orders bottoming out; upgrade Airtac/Hiwin to OUTPERFORMFigure 1: Taiwan machinery export order YoY decline is narrowing-100%-50%0%50%100%Jan-11Jan-12Jan-13Jan-14Jan-15Jan-16Jan-17Jan-18Jan-19Taiwan total machinery export order YoYTaiwan machinery export order to CN/HK YoYSource: MOEA, Credit Suisse■Upgrade Airtac and Hiwin to OUTPERFORM. We believe the order outlook for automation component makers should hit trough in the next few months and sales momentum should recover in 1H20. Chroma remains our top pick as its core test and measurement business has already seen improving order momentum from capacity relocation, 5G and supply chain shift. We lift Chroma's TP to NT$190 (from NT$178) using 22x 2020E P/E. We also upgrade Airtac and Hiwin to OUTPERFORM (from Neutral) as we believe YoY sales growth for Airtac should turn positive in 3Q19, while Hiwin will follow suit in 1Q20 as channels digest the inventory. Our new TP for Airtac of NT$390 (from NT$340) is based on 22.5x 2020E P/E (1 SD above hist. avg.). Our new TP for Hiwin of NT$305 (from NT$245) is based on 25x 2020E P/E (1 SD above hist. avg.).■Smartphone-related and machine tool demand to recover in 1H20. Although trade tension remains an uncertainty to global economics, we believe the accelerating 5G builds for base station, accelerating 5G smartphone adoption, and new features such as ToF camera, OLED proliferation, etc., will be new drivers for smartphone capex spending from 1H20. Our Japan team also expects machine tool demand to bottom out in 3Q19 and YoY growth could turn positive from around Feb–Apr-2020, with continued improvement in momentum through mid-2021.■Wage hike and relocation to support long-term growth. We also believe automation proliferation trend should continue in China and other regions, given rising wages, labour shortages, aging population, and technology upgrade for more complicated assembly works. Moreover, tariff hike has resulted in ODM makers shifting some assembly capacity for high-end NB, server, networking devices back to Taiwan since 2H18, and the new rounds of tariff hikes effective from Sep/Dec-2019 could furt...