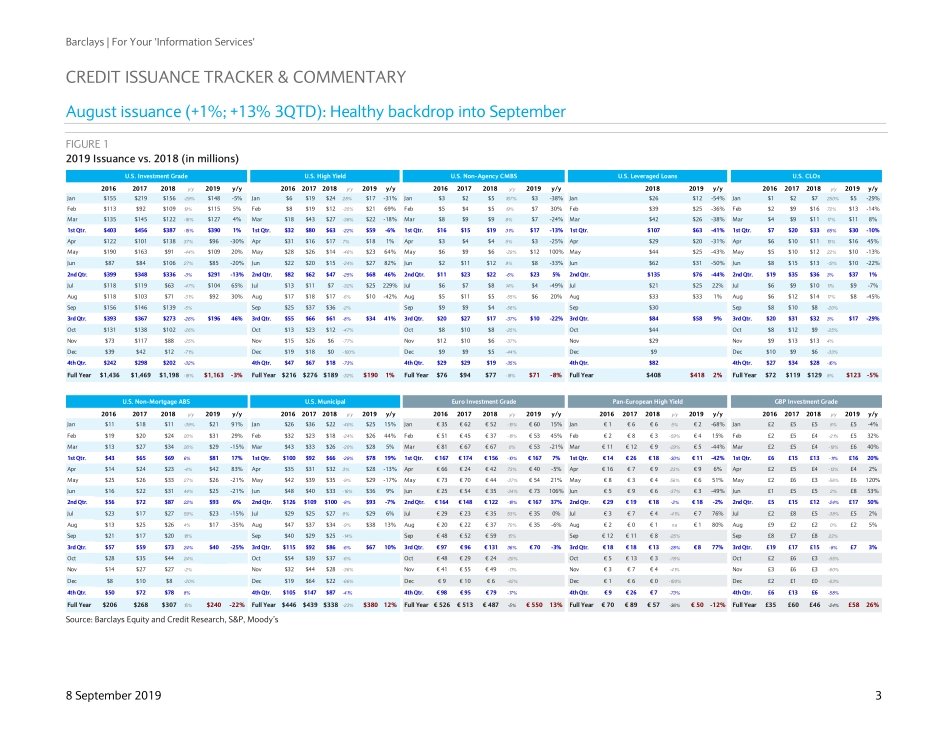

Equity Research 8 September 2019 CORE Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 32. Restricted - Internal For Your ‘Information Services’ Healthy Issuance & Mortgage Activity ahead of Barclays Financials Conference Credit Issuance (MCO/SPGI): August issuance was flattish, but 3Q-to-date issuance is now up ~13% & rising... i.e. with attractive funding conditions and calmer equity markets post-Labor Day, issuance got off to a robust start in September, particularly in U.S. IG ($75B last week was a record). …and while we stick with our +5-6% Ratings revenue growth estimates for 3Q (& +9-11% in 4Q), we see skew to the upside. Even with potential for geopolitical-driven bouts of market volatility, we expect low rates and tight spreads could lead to another round of opportunistic pull-forward activity. With that said, we would note that IG has been driving the recent pick-up in activity in the quarter; and other riskier/more transaction-oriented asset classes (leveraged loans; structured) have been more tepid – which is why we wait till end September to finalize #’s; and also get thoughts from CFO’s of MCO (9/9) & SPGI (9/10) – both among our preferred names as noted in Takeaways from (recent) productive HQ Visits (8/25). Index/ETF AUMs (MSCI/SPGI): Even with periods of volatility, it’s been a good year for equity markets (SPX +19%; ACWX +9% through 9/6); but ETF inflows have been lighter. For MSCI, if July-end AUM of $826B stayed flat for the rest of the year, growth would be +10%/+15% in 3Q/4Q. Subscription growth remains strong (+11%/+18% for MSCI/SPGI in 2Q); and volatility in July/Aug could be a benefit for SPGI (e.g., CME equity indices ADV +46%; CBOE index options +6%). MSCI presents 9/10, and we expect focus on various growth initiatives (ESG, factor, Beon), active-to-passive trends, and its BLK relationship. See HQ Visit Accentuates LT Tailwinds; OW (5/28). Mortgage Originations (EFX/TRU/FICO): Low rates continue to revise mortgage estimates higher – MBA now forecasting +15% growth in 2019 (vs. -1% to start the year), driven by strong refi activity (+38%) & steady purchase activity (+6%). Estimates for +33%/+18% in 3Q/4Q clearly implies some upside vs. EFX’s relatively conservative guidance (slight decline in inquiries for 2019; +3%/+4% 3Q/4Q) – but we also note that the bureaus typically generate more revenue per mortgage on a purchase origination (more data/pulls required). EFX has the larger mortgage mix (~19%), but...