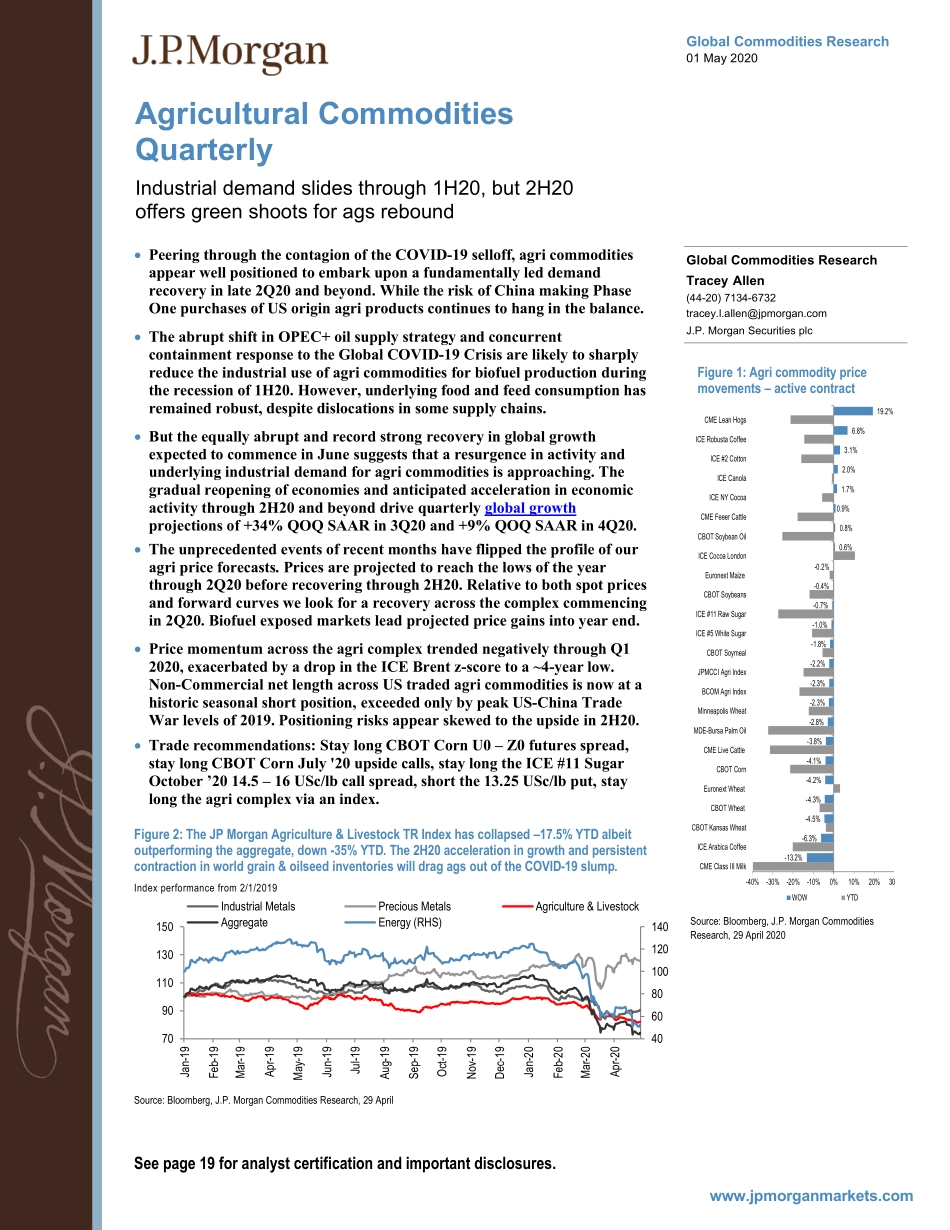

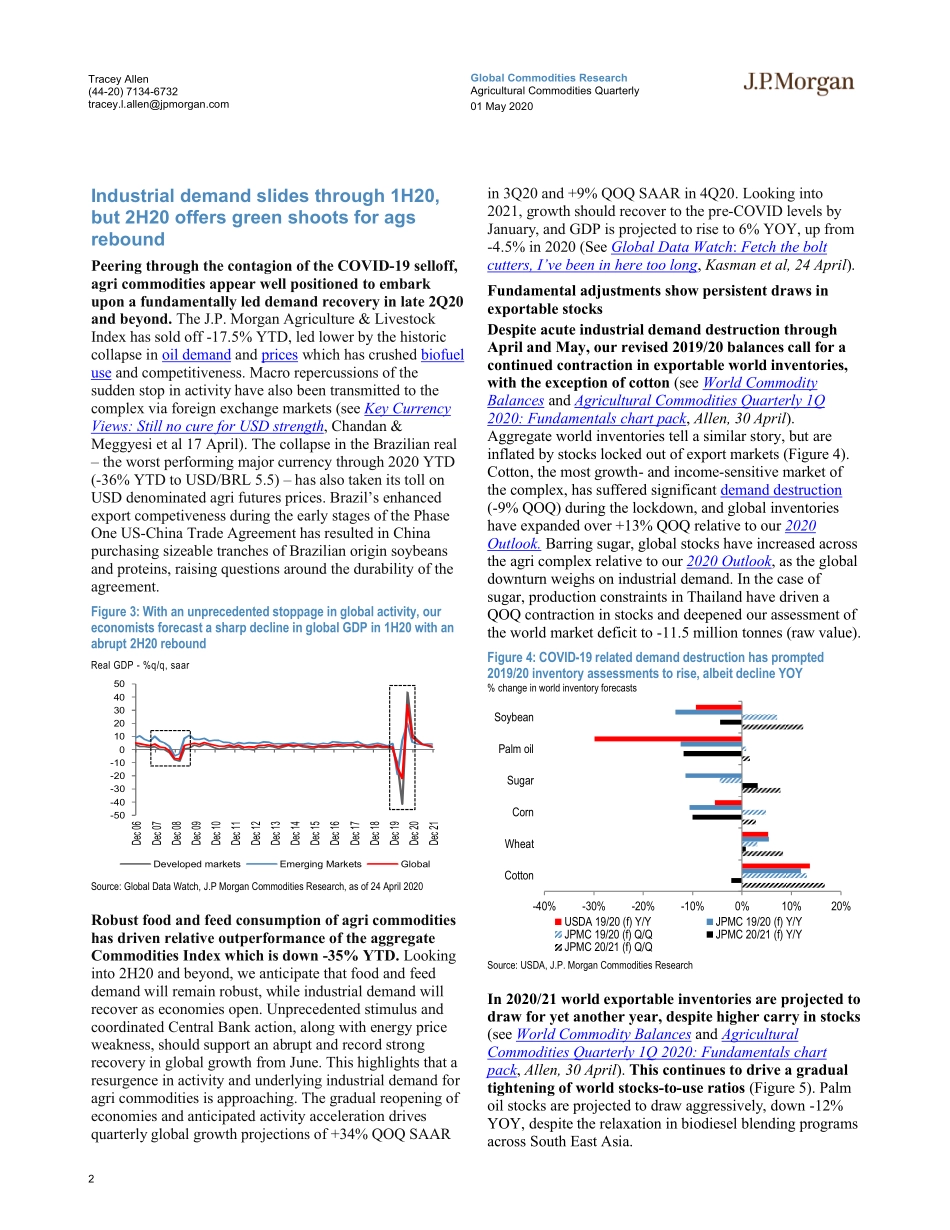

Global Commodities Research01 May 2020 Agricultural Commodities QuarterlyIndustrial demand slides through 1H20, but 2H20 offers green shoots for ags reboundGlobal Commodities ResearchTracey Allen(44-20) 7134-6732tracey.l.allen@jpmorgan.comJ.P. Morgan Securities plcSee page 19 for analyst certification and important disclosures.www.jpmorganmarkets.com Peering through the contagion of the COVID-19 selloff, agri commodities appear well positioned to embark upon a fundamentally led demand recovery in late 2Q20 and beyond. While the risk of China making Phase One purchases of US origin agri products continues to hang in the balance. The abrupt shift in OPEC+ oil supply strategy and concurrent containment response to the Global COVID-19 Crisis are likely to sharplyreduce the industrial use of agri commodities for biofuel production during the recession of 1H20. However, underlying food and feed consumption has remained robust, despite dislocations in some supply chains. But the equally abrupt and record strong recovery in global growthexpected to commence in June suggests that a resurgence in activity and underlying industrial demand for agri commodities is approaching. The gradual reopening of economies and anticipated acceleration in economic activity through 2H20 and beyond drive quarterly global growthprojections of +34% QOQ SAAR in 3Q20 and +9% QOQ SAAR in 4Q20. The unprecedented events of recent months have flipped the profile of ouragri price forecasts. Prices are projected to reach the lows of the year through 2Q20 before recovering through 2H20. Relative to both spot prices and forward curves we look for a recovery across the complex commencing in 2Q20. Biofuel exposed markets lead projected price gains into year end. Price momentum across the agri complex trended negatively through Q1 2020, exacerbated by a drop in the ICE Brent z-score to a ~4-year low. Non-Commercial net length across US traded agri commodities is now at a historic seasonal short position, exceeded only by peak US-China Trade War levels of 2019. Positioning risks appear skewed to the upside in 2H20. Trade recommendations: Stay long CBOT Corn U0 – Z0 futures spread, stay long CBOT Corn July '20 upside calls, stay long the ICE #11 Sugar October ’20 14.5 – 16 USc/lb call spread, short the 13.25 USc/lb put, stay long the agri complex via an index.Figure 2: The JP Morgan Agriculture & Livestock TR Index has collapsed –17.5% YTD albeit outperforming the aggregate, down -35% YTD. The 2H20 acceleration in growth and persistentcontraction in world grain & oilseed inventories will drag ags out of the COVID-19 slump.Index performance from 2/1/2019Source: Bloomberg, J.P. Morgan Commodities Research, 29 April4060801001201407090110130150Jan-19Feb-19Mar-19Apr-19May-19Jun-19Jul-19Aug-19Sep-19Oct-19Nov-19Dec-19Jan-20Feb-20Mar-20Apr-20Industrial MetalsPrecious MetalsAgriculture & LivestockAggregat...