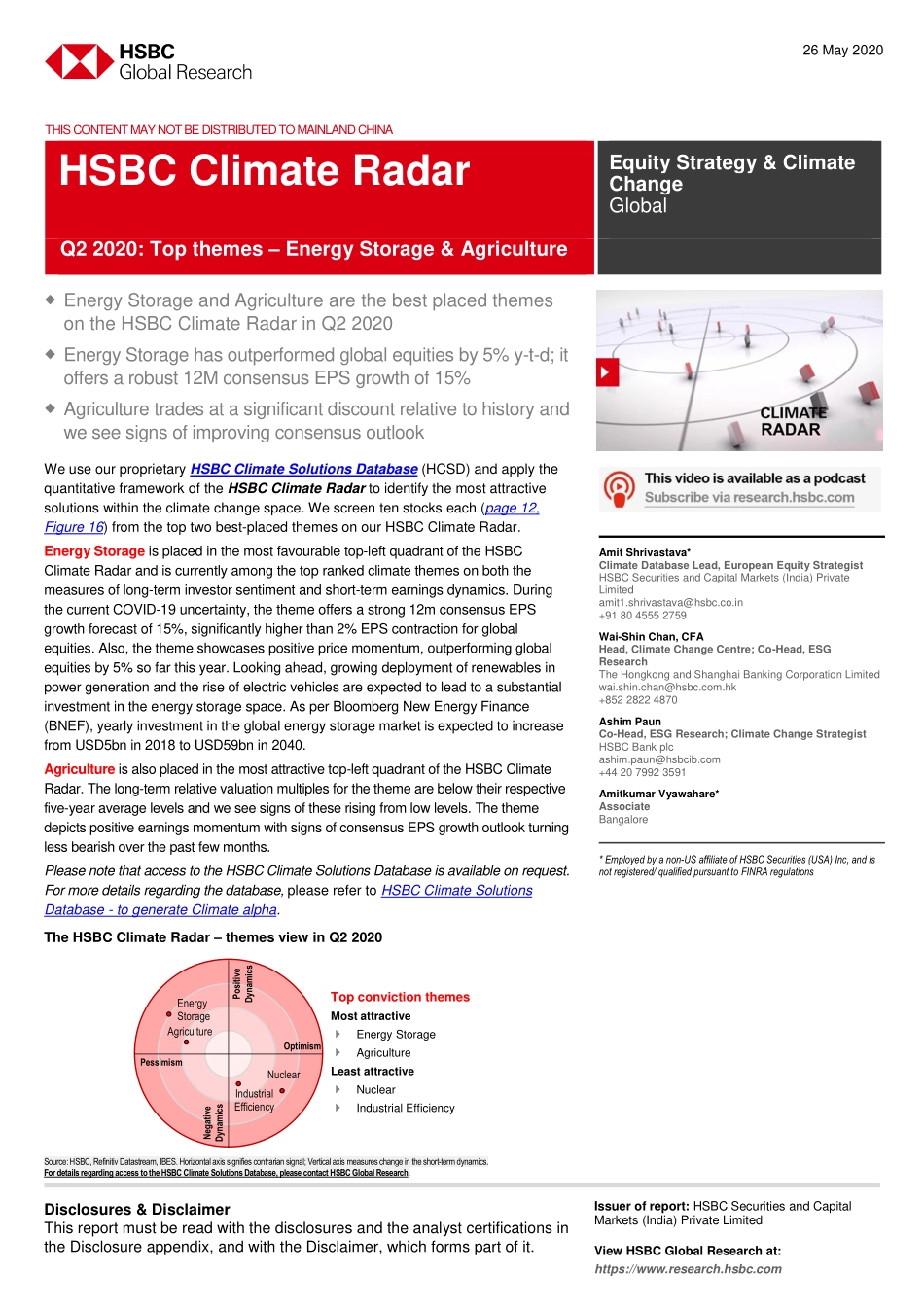

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: HSBC Securities and Capital Markets (India) Private Limited View HSBC Global Research at: https://www.research.hsbc.com THIS CONTENT MAY NOT BE DISTRIBUTED TO MAINLAND CHINA Energy Storage and Agriculture are the best placed themes on the HSBC Climate Radar in Q2 2020 Energy Storage has outperformed global equities by 5% y-t-d; it offers a robust 12M consensus EPS growth of 15% Agriculture trades at a significant discount relative to history and we see signs of improving consensus outlook We use our proprietary HSBC Climate Solutions Database (HCSD) and apply the quantitative framework of the HSBC Climate Radar to identify the most attractive solutions within the climate change space. We screen ten stocks each (page 12, Figure 16) from the top two best-placed themes on our HSBC Climate Radar. Energy Storage is placed in the most favourable top-left quadrant of the HSBC Climate Radar and is currently among the top ranked climate themes on both the measures of long-term investor sentiment and short-term earnings dynamics. During the current COVID-19 uncertainty, the theme offers a strong 12m consensus EPS growth forecast of 15%, significantly higher than 2% EPS contraction for global equities. Also, the theme showcases positive price momentum, outperforming global equities by 5% so far this year. Looking ahead, growing deployment of renewables in power generation and the rise of electric vehicles are expected to lead to a substantial investment in the energy storage space. As per Bloomberg New Energy Finance (BNEF), yearly investment in the global energy storage market is expected to increase from USD5bn in 2018 to USD59bn in 2040. Agriculture is also placed in the most attractive top-left quadrant of the HSBC Climate Radar. The long-term relative valuation multiples for the theme are below their respective five-year average levels and we see signs of these rising from low levels. The theme depicts positive earnings momentum with signs of consensus EPS growth outlook turning less bearish over the past few months. Please note that access to the HSBC Climate Solutions Database is available on request. For more details regarding the database, please refer to HSBC Climate Solutions Database - to generate Climate alpha. 26 May 2020 HSBC Climate Radar Equity Strategy & Climate Change Global Amit Shrivastava* Climate Database Lead, European Equity Strategist HSBC Securities and Capital Markets (India) Private Limited amit1.shrivastava@hsbc.co.in +91 80 4555 2759 Wai-Shin Chan, CFA Head, Climate Change Centre; Co-Head, ESG Research The Hongkong and Shanghai Banking Corporation Limited wai.shin.chan@hsbc.com.hk +852 2822 4870 Ashim Paun Co-Head,...