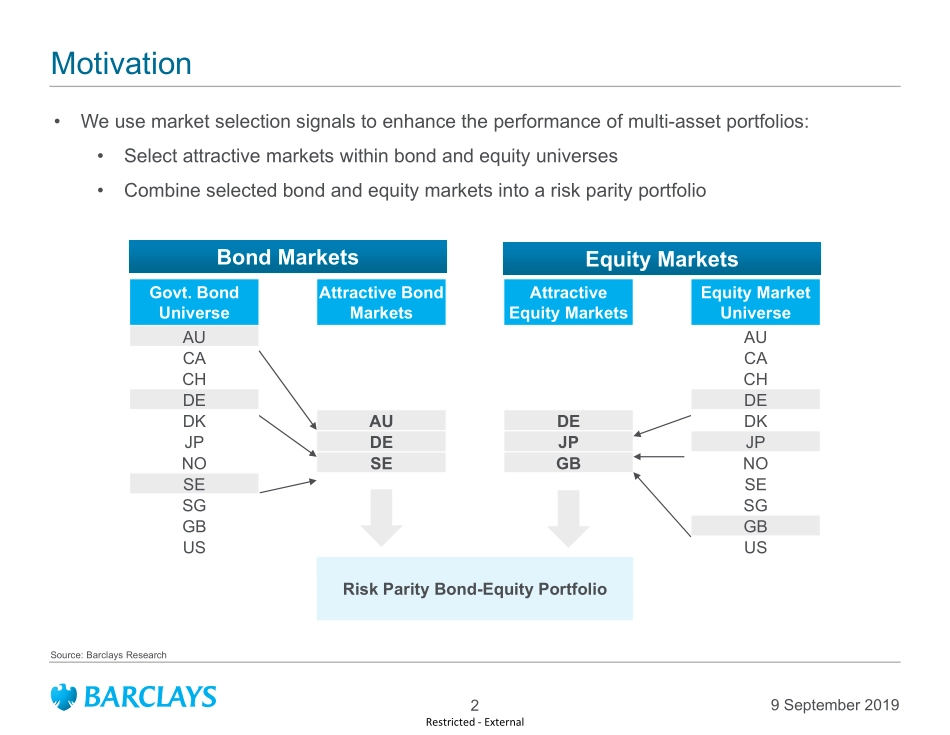

Restricted - ExternalSpecial Report | ResearchQuantitative Portfolio Strategy Performance and Characteristics of Carry-Based Risk Parity Portfolios09 September 2019Mathieu Dubois+44 20 3555 0083mathieu.dubois@barclays.com Barclays, UKSimon Polbennikov+44 20 3134 0752simon.polbennikov@barclays.comBarclays, UKAlbert Desclée+44 20 7773 3382albert.desclee@barclays.comBarclays, UKBarclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. This is a Special Report that is not an equity or a debt research report under U.S. FINRA Rules 2241-2242FOR ANALYST CERTIFICATION(S) PLEASE SEE PAGE 27FOR IMPORTANT FIXED INCOME RESEARCH DISCLOSURES, PLEASE SEE PAGE 27FOR IMPORTANT EQUITY RESEARCH DISCLOSURES, PLEASE SEE PAGE 29CORERestricted - ExternalMotivation2•We use market selection signals to enhance the performance of multi-asset portfolios:•Select attractive markets within bond and equity universes•Combine selected bond and equity markets into a risk parity portfolioGovt. Bond UniverseAttractive Bond MarketsAttractive Equity MarketsEquity Market UniverseAUAUCACACHCHDEDEDKAUDEDKJPDEJPJPNOSEGBNOSESESGSGGBGBUSUSRisk Parity Bond-Equity PortfolioSource: Barclays ResearchBond MarketsEquity Markets9 September 2019Restricted - ExternalIntroduction3•We use informative signals to select bond and equity markets, and use them to build risk-parity (RP) portfolios•Our methodology includes two steps•Select markets with attractive carry characteristics within bond and equity universes•Combine selected bond and equity markets into a risk-parity portfolio•Bond markets are selected using an adjusted carry measure called GRACE (Global Rates Adjusted Carry) developed by Barclays Research•Equity markets are selected using an informative signal that combines •growth-adjusted carry and •market environment variables•Carry-based risk parity (RP) portfolios outperformed passive RP portfolios investing in US Treasury bonds and US equities in a historical simulation starting in 2001•Long-short RP portfolios had attractive risk-adjusted returns9 September 2019Restricted - ExternalSelecting Bond Markets 49 September 2019Restricted - External• Carry investing style has been popular in different asset classes, see Carry, Koijen et Al., 2018• Carry can be defined as the return of a security assuming that market conditions remain unchanged over time• In Carry Strategies in Global Rates Markets, June 2017 we document the performance of carry strategies in global r...