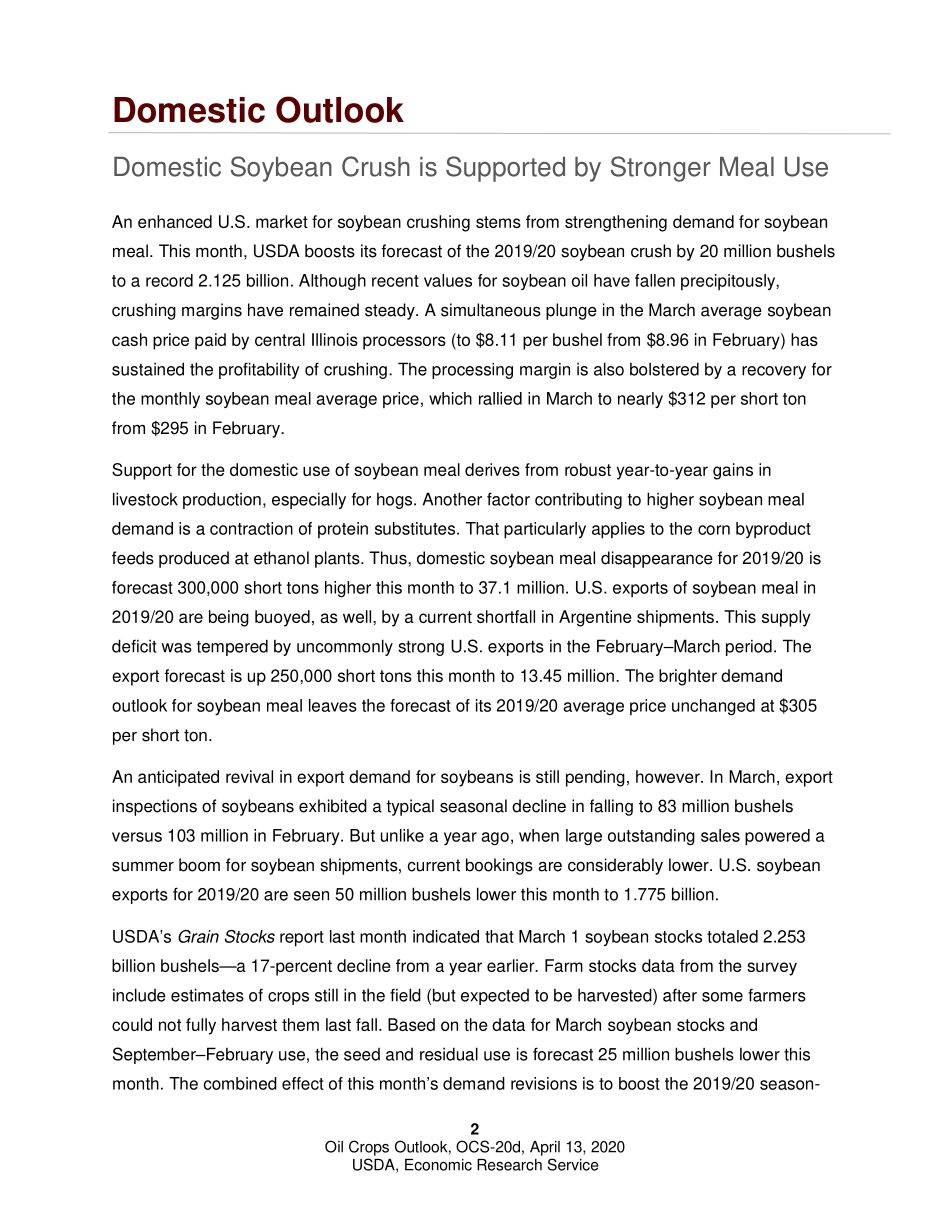

Approved by USDA’s World Agricultural Outlook Board Oil Crops Outlook Mark Ash U.S. Soybean Product Exports Gain from Lagging Argentine Trade This month, USDA boosts its forecast of the 2019/20 soybean crush by 20 million bushels to a record 2.125 billion, based on steady soybean meal demand. A current shortfall in Argentine shipments raises forecast soybean meal exports by 250,000 short tons this month to 13.45 million. A higher crush is more than offset by a decline for soybean exports (by 50 million bushels to 1.775 billion). Demand revisions boost the 2019/20 season-ending stocks forecast by 55 million bushels to 480 million. 0510152025Sep 5Oct 10Nov 14Dec 19Jan 23Feb 27Apr 2May 7Jun 11Jul 16Aug 20Million metric tonsSource: USDA, Foreign Agricultural Service, Export Sales.Figure 1Outstanding U.S. export soybean sales lack signs of previous summer revivals 2016/172017/182018/192019/20Economic Research Service | Situation and Outlook Report Next release is May 14, 2020 OCS-20d | April 13, 2020 2 Oil Crops Outlook, OCS-20d, April 13, 2020 USDA, Economic Research Service Domestic Outlook Domestic Soybean Crush is Supported by Stronger Meal Use An enhanced U.S. market for soybean crushing stems from strengthening demand for soybean meal. This month, USDA boosts its forecast of the 2019/20 soybean crush by 20 million bushels to a record 2.125 billion. Although recent values for soybean oil have fallen precipitously, crushing margins have remained steady. A simultaneous plunge in the March average soybean cash price paid by central Illinois processors (to $8.11 per bushel from $8.96 in February) has sustained the profitability of crushing. The processing margin is also bolstered by a recovery for the monthly soybean meal average price, which rallied in March to nearly $312 per short ton from $295 in February. Support for the domestic use of soybean meal derives from robust year-to-year gains in livestock production, especially for hogs. Another factor contributing to higher soybean meal demand is a contraction of protein substitutes. That particularly applies to the corn byproduct feeds produced at ethanol plants. Thus, domestic soybean meal disappearance for 2019/20 is forecast 300,000 short tons higher this month to 37.1 million. U.S. exports of soybean meal in 2019/20 are being buoyed, as well, by a current shortfall in Argentine shipments. This supply deficit was tempered by uncommonly strong U.S. exports in the February–March period. The export forecast is up 250,000 short tons this month to 13.45 million. The brighter demand outlook for soybean meal leaves the forecast of its 2019/20 average price unchanged at $305 per short ton. An anticipated revival in export demand for soybeans is still pending, however. In March, export inspections of soybeans exhibited a typical seasonal decline in falling to 83 million bushels versus 103 mi...