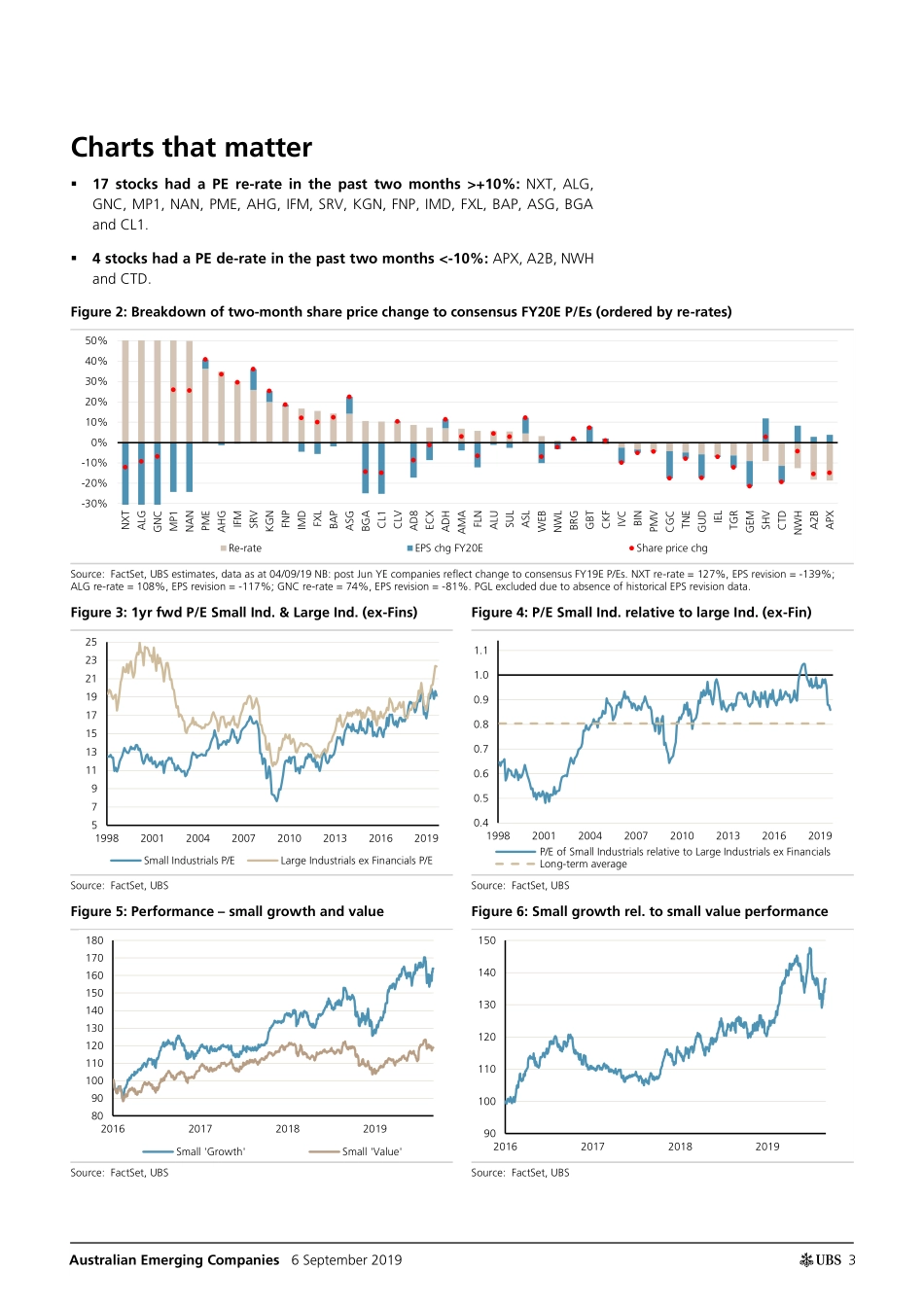

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Australia Ltd. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 24. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 6 September 2019 Australian Emerging Companies August reporting: Post-match analysis Earnings momentum skewed to downside and re-rates dominate Over the past two months, we have seen negative consensus EPS revisions of >-5% for 40% of our coverage universe for FY20E, compared to 16% recording revisions of >+5%. However, positive P/E ratio re-rates have again been prevalent, with 38% of stocks recording a re-rate of >+10% vs 9% recording a de-rate of >-10%. Key positive earnings revisions (>+5%): SHV, SRV, ASG, NWH, GBT, ASL, and KGN. Key negative earnings revisions (>-5%): NXT, ALG, GNC, CL1, BGA, NAN, MP1, AD8, CGC, GEM, FLN, GUD, WEB, ECX, CTD, IVC, TGR and FXL. Key FY20E P/E re-rates (>+10%): NXT, ALG, GNC, MP1, NAN, PME, AHG, IFM, SRV, KGN, FNP, IMD, FXL, BAP, ASG, BGA and CL1. Key FY20E P/E de-rates (>-10%): APX, A2B, NWH and CTD. Time to Buy Smalls? Weaker EPS revisions meant the market reaction to small cap reporting season was softer than large caps. This performance has seen the PE discount of small caps rise to the highest since 2012. Higher PE discounts are correlated with outperformance by small caps in the next 12 months. UBS modelling suggests the level of the PE discount today means that small caps could outperform large caps over the next year by ~3%. Factor Screen supports WEB, APX and IMD Post the August reporting season, we have screened our coverage list by quintiles for: 1) valuation (EV/EBITDA, P/E, P/B, Dividend Yield); 2) growth (3yr EBITDA & EPS CAGR); 3) consensus estimate revisions (FY20-21E EBITDA & EPS); 4) balance sheet leverage (ND/EBITDA); and, 5) Return on Capital Employed (ROCE). We have then ranked each quintile for most upside to most downside to our current price target. When analysing the top ranked and bottom ranked quintiles: Most upside: WEB, APX and IMD. Most downside: IVC, FXL and GUD. What would we own? Across our Emerging Companies coverage, key Buys are: APX, ASG, ASL, CL1, CTD, ECX, GNC, MP1, NWH, NXT, PGL and WEB. Our key Sells are GUD, IEL, IVC and TNE. Figure 1: UBS Small Cap Coverage Key Picks & Sells: Summary of FY19 results Source: FactSet, UBS estimates Note: 1st 12 companies are key picks, next 4 are key sells; EPS Revision = FY20E Consensus chg.; Margins = EBIT margin vs. pcp; Cash flow = Operating cash flow vs. pcp; Balance Sheet = Net Debt/EBITDA vs. pcp; da...