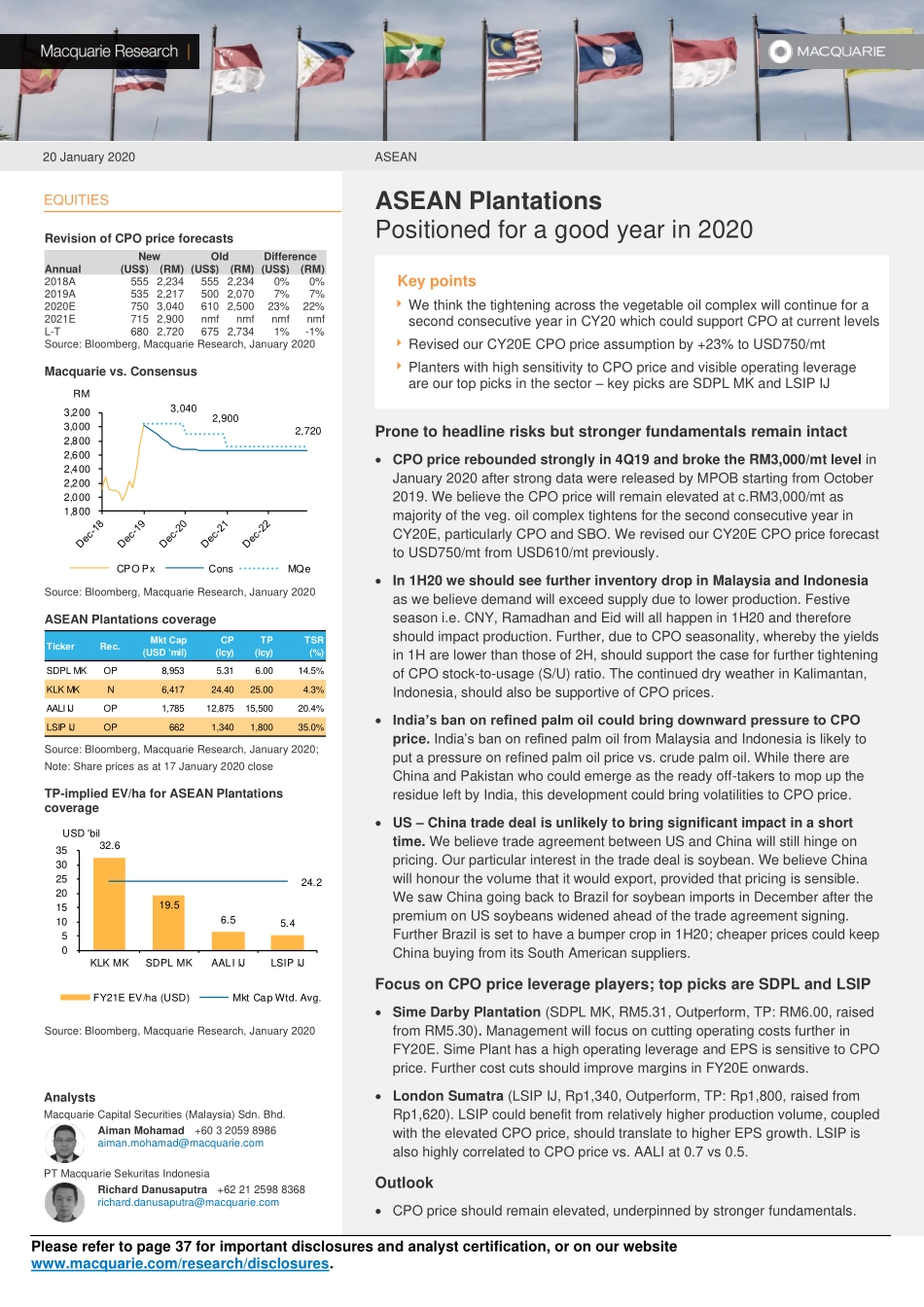

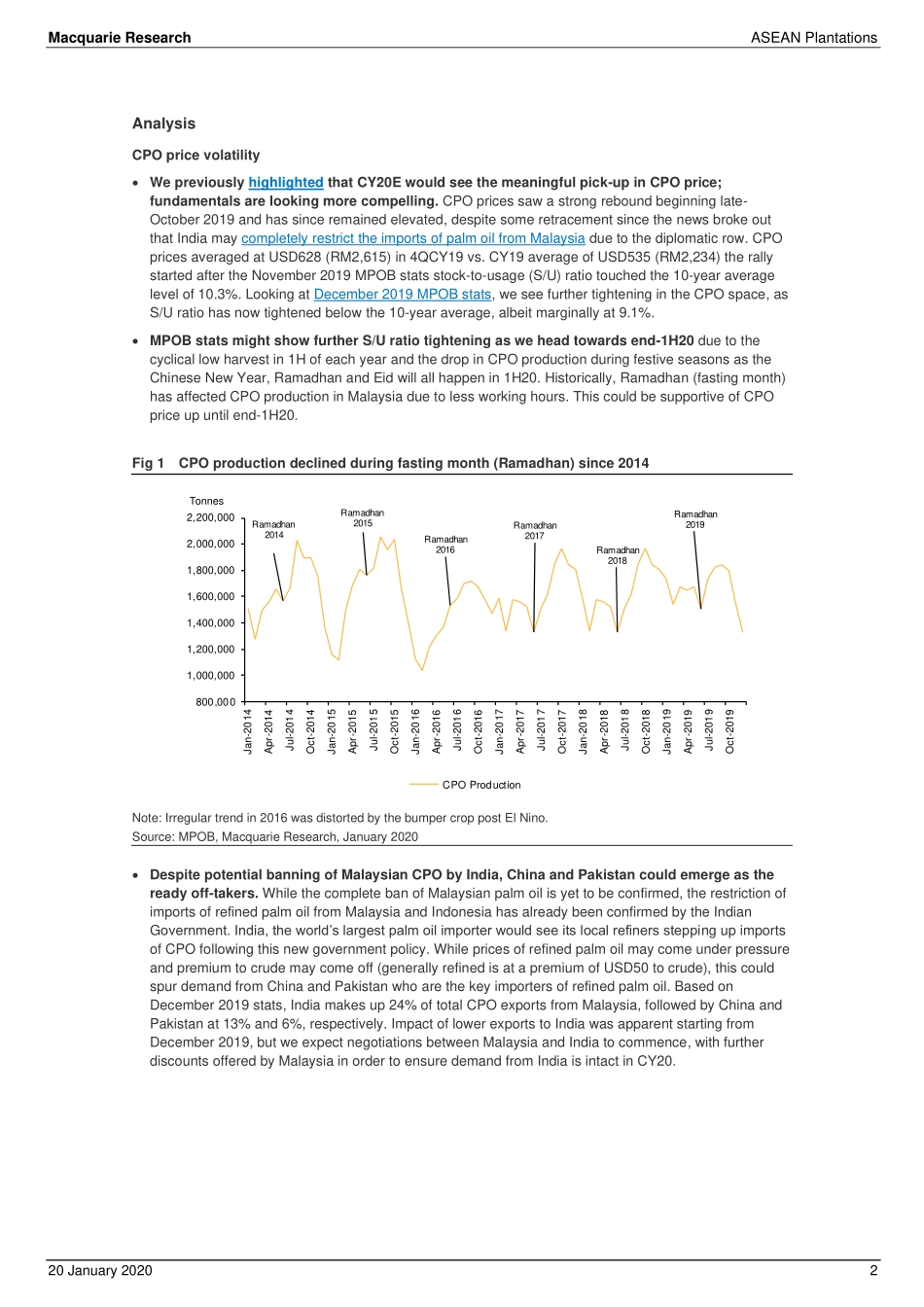

Please refer to page 37 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 20 January 2020 ASEAN EQUITIES Revision of CPO price forecasts New Old Difference Annual (US$) (RM) (US$) (RM) (US$) (RM) 2018A 555 2,234 555 2,234 0% 0% 2019A 535 2,217 500 2,070 7% 7% 2020E 750 3,040 610 2,500 23% 22% 2021E 715 2,900 nmf nmf nmf nmf L-T 680 2,720 675 2,734 1% -1% Source: Bloomberg, Macquarie Research, January 2020 Macquarie vs. Consensus Source: Bloomberg, Macquarie Research, January 2020 ASEAN Plantations coverage Source: Bloomberg, Macquarie Research, January 2020; Note: Share prices as at 17 January 2020 close TP-implied EV/ha for ASEAN Plantations coverage Source: Bloomberg, Macquarie Research, January 2020 Analysts Macquarie Capital Securities (Malaysia) Sdn. Bhd. Aiman Mohamad +60 3 2059 8986 aiman.mohamad@macquarie.com PT Macquarie Sekuritas Indonesia Richard Danusaputra +62 21 2598 8368 richard.danusaputra@macquarie.com ASEAN Plantations Positioned for a good year in 2020 Key points We think the tightening across the vegetable oil complex will continue for a second consecutive year in CY20 which could support CPO at current levels Revised our CY20E CPO price assumption by +23% to USD750/mt Planters with high sensitivity to CPO price and visible operating leverage are our top picks in the sector – key picks are SDPL MK and LSIP IJ Prone to headline risks but stronger fundamentals remain intact • CPO price rebounded strongly in 4Q19 and broke the RM3,000/mt level in January 2020 after strong data were released by MPOB starting from October 2019. We believe the CPO price will remain elevated at c.RM3,000/mt as majority of the veg. oil complex tightens for the second consecutive year in CY20E, particularly CPO and SBO. We revised our CY20E CPO price forecast to USD750/mt from USD610/mt previously. • In 1H20 we should see further inventory drop in Malaysia and Indonesia as we believe demand will exceed supply due to lower production. Festive season i.e. CNY, Ramadhan and Eid will all happen in 1H20 and therefore should impact production. Further, due to CPO seasonality, whereby the yields in 1H are lower than those of 2H, should support the case for further tightening of CPO stock-to-usage (S/U) ratio. The continued dry weather in Kalimantan, Indonesia, should also be supportive of CPO prices. • India’s ban on refined palm oil could bring downward pressure to CPO price. India’s ban on refined palm oil from Malaysia and Indonesia is likely to put a pressure on refined palm oil price vs. crude palm oil. While there are China and Pakistan who could emerge as the ready off-takers to mop up the residue left by India, this development could bring volatilities to CPO price. • US – China trade deal is unlikely to bring significant impact in a short time. W...