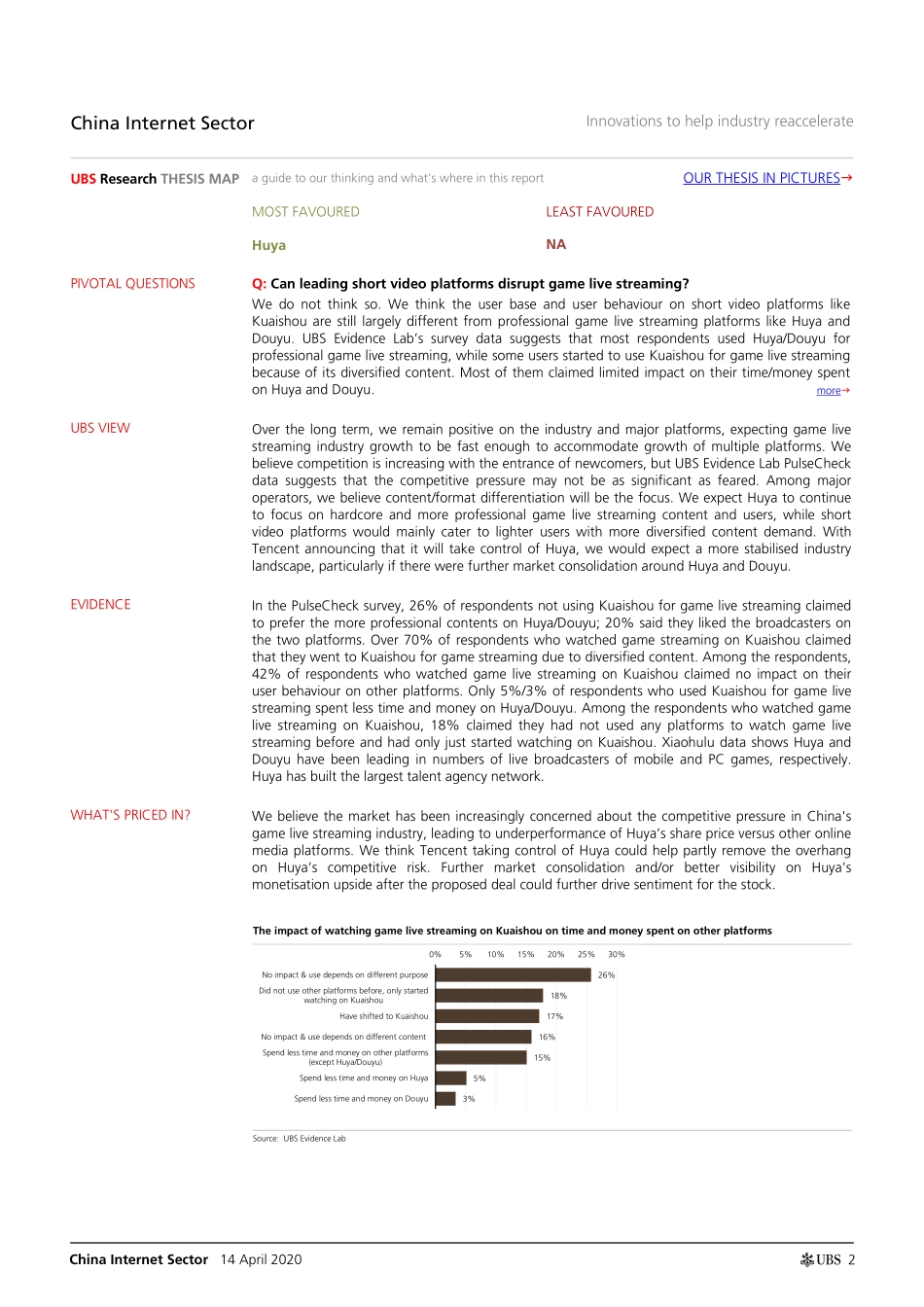

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Asia Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 20. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 14 April 2020 China Internet Sector UBS Evidence Lab inside: Huya and Douyu still dominate hardcore game live streaming Many platforms stream games but Huya and Douyu offer differentiation We believe investors are overly concerned about new entrants into China's game live streaming industry. UBS Evidence Lab data suggests competitive pressure on Huya and Douyu may not be as significant as feared, as users who go to short video platforms for game streaming have a different profile from Huya/Douyu users. In the survey, 26% of respondents not using Kuaishou for game live streaming claimed to prefer the more professional content on Huya/Douyu, while 70% of those who went to Kuaishou for game streaming chose it for its diversified content (Figures 4 and 5). Only 8% used Kuaishou for game live streaming, and only 8% of those said the use of Kuaishou impacted their time/ money spent on Huya/ Douyu (Figures 2 and 6). With Tencent’s proposal to take control of Huya, we think Huya could improve user engagement and monetisation, and further differentiate itself as a game live streaming-focused platform. Platforms with more professional broadcasters dominate game live streaming It is not easy to excel at a game and be entertaining at the same time. Top reasons cited for not using Kuaishou for game streaming were related to broadcaster types. While games are available on many streaming platforms, it is harder to replicate the community and the type of broadcasters of more niche platforms. Huya and Douyu's talent agency networks create an entry barrier (Figures 16-19). We believe other platforms could enlarge their game streaming viewer bases, especially casual users; 18% of respondents who used Kuaishou for game live streaming said they had not used other platforms before and started watching game live streaming on Kuaishou. Several platforms should divide up the game live streaming market We believe the industry can accommodate multiple platforms with different sources of traffic and community. We expect Huya to continue to focus on hardcore content, while short video platforms are likely to cater to casual viewers. Bilibili will have some overlap with the rest, but also target different game genres. We think Tencent could help drive industry stabilisation, as an investor in Kuaishou, Bilibili, Douyu and Huya. Huya: monetisation and cost-savings upsid...