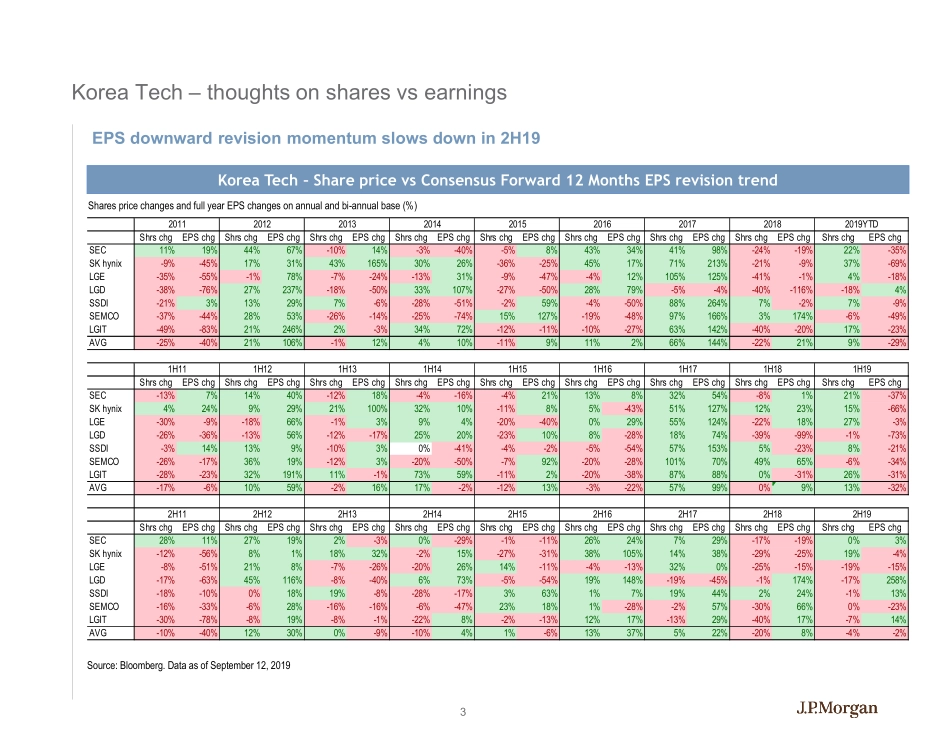

1See the end pages of this presentation for analyst certification and important disclosures, including non-US analyst disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.Asia Pacific Equity ResearchSeptember 20192019 Asia Tech OutlookFinding structural winders amidst growing political uncertaintiesThis report is neither intended to be distributed to Mainland China investors nor to provide securities investment consultancy services within the territory of Mainland China. This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of J.P. Morgan.Clients should contact representatives and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdictionunless governing law permits otherwise.JJ Park AC+82 2 758 5717jj.park@jpmorgan.comJ.P. Morgan Securities (Far East) Limited, Seoul BranchJay Kwon AC+82 2 758 5725jay.h.kwon@jpmorgan.comJ.P. Morgan Securities (Far East) Limited, Seoul BranchKY Oh+82 2 758 5728ky.oh@jpmorgan.comJ.P. Morgan Securities (Far East) Limited, Seoul BranchHisashi Moriyama+81 3 6736 8601hisashi.moriyama@jpmorgan.comJPMorgan Securities Japan Co., Ltd.2 2H19 EPS momentum weak, 5G pushes 20’ expectation Korea Tech and Material view: SEC (OW), SK Hynix (N), LGE (OW), LGD (N), SDI/LGIT (OW), SEMCO (N), SDS (N), POSCO CHEM/ILJIN MAT. (OW) Trade tensions and Politics: Growing uncertainty from Semi and Display material imports from Japan; Restrictions on Huawei alleviated 5G and Smartphone outlook: Sub-6GHz driven 5G replacement cycle in 2020 driven by OEM/Chipset push (smartphone unit: -6% in 19 > +3% in 20), China gearing up investment, AAPL commits 5G for all models in 20’ (vs. Verizon’s slower mm-Wave a risk) Apple supply chain: 2H19 new iPhone build 72M (OLED 37M vs LCD 35M), 2019 build at 180M (-13% y/y). Stronger cycle in 2020 (+8% y/y to 195M) Sector convergence: Tech in Auto and Industrial Battery: ESS recovery slightly milder in near-term, slowing cylindrical, stricter regulation from EU, weak 3Q19 China NEV sales post subsidy cut. Material (Anode our top pick) over Cell (Asia-ex > China)Investment Topics Contents growth story OLED: Improving China rigid OLED demand, more flexible OLED demand at milder growth pace. OLED for all iPhone in 2020. Foldable finally begins. OLED TV investment at Samsung set for LT, competition heats up vs. QLED Optical: Multi-cam adoption continues, good feedbackon new design: Periscope, higher resolution, and new OIS feature design-in discussion underway 3D sensing. Android 5G phones have world sensing, 2 iPhone models w/ world sensin...