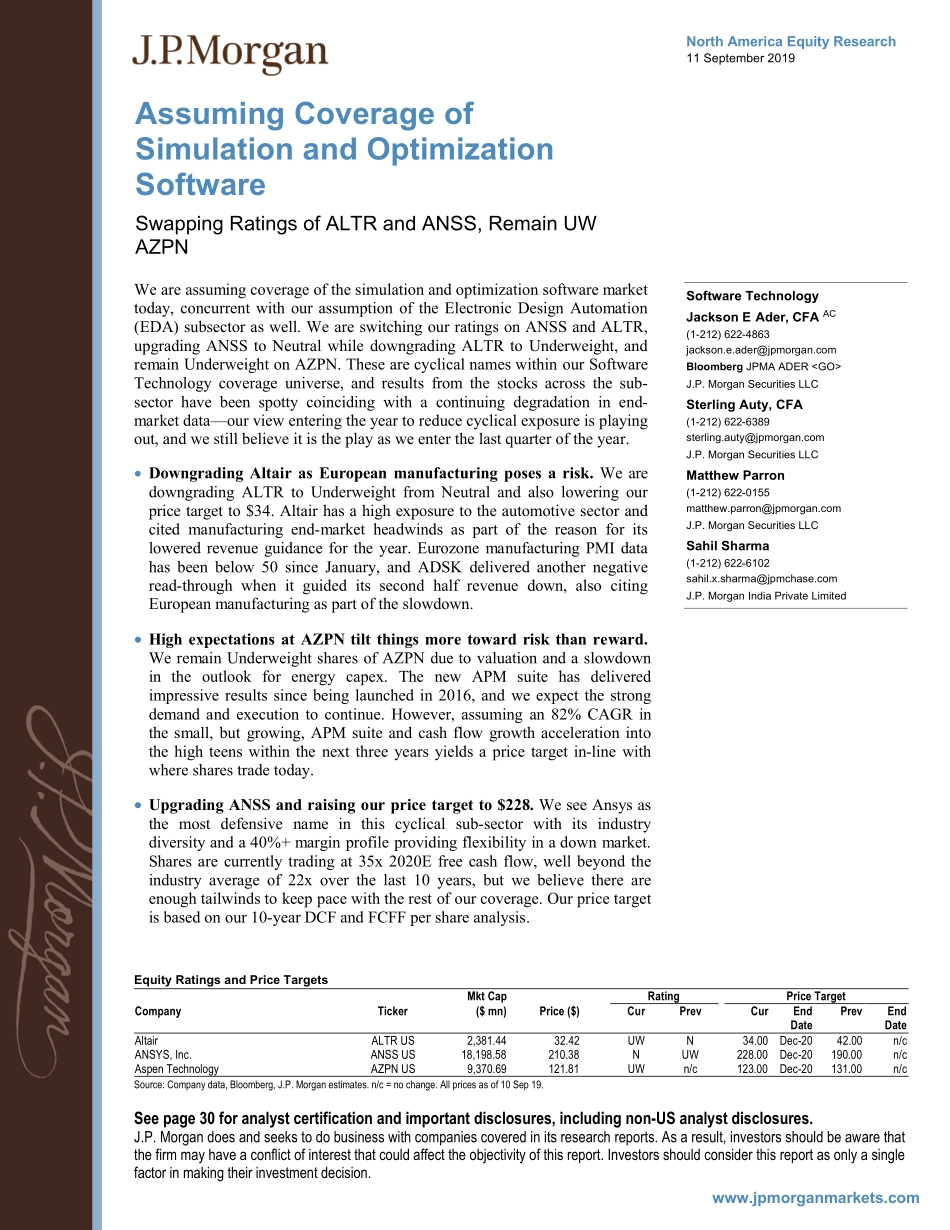

www.jpmorganmarkets.comNorth America Equity Research11 September 2019Equity Ratings and Price TargetsMkt CapRatingPrice TargetCompanyTicker($ mn)Price ($)CurPrevCurEnd DatePrevEnd DateAltairALTR US2,381.4432.42UWN34.00Dec-2042.00n/cANSYS, Inc.ANSS US18,198.58210.38NUW228.00Dec-20190.00n/cAspen TechnologyAZPN US9,370.69121.81UWn/c123.00Dec-20131.00n/cSource: Company data, Bloomberg, J.P. Morgan estimates. n/c = no change. All prices as of 10 Sep 19.Assuming Coverage of Simulation and Optimization SoftwareSwapping Ratings of ALTR and ANSS, Remain UW AZPNSoftware TechnologyJackson E Ader, CFA AC(1-212) 622-4863jackson.e.ader@jpmorgan.comBloomberg JPMA ADER J.P. Morgan Securities LLCSterling Auty, CFA(1-212) 622-6389sterling.auty@jpmorgan.comJ.P. Morgan Securities LLCMatthew Parron(1-212) 622-0155matthew.parron@jpmorgan.comJ.P. Morgan Securities LLCSahil Sharma(1-212) 622-6102sahil.x.sharma@jpmchase.comJ.P. Morgan India Private LimitedSee page 30 for analyst certification and important disclosures, including non-US analyst disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.We are assuming coverage of the simulation and optimization software market today, concurrent with our assumption of the Electronic Design Automation (EDA) subsector as well. We are switching our ratings on ANSS and ALTR, upgrading ANSS to Neutral while downgrading ALTR to Underweight, and remain Underweight on AZPN. These are cyclical names within our Software Technology coverage universe, and results from the stocks across the sub-sector have been spotty coinciding with a continuing degradation in end-market data—our view entering the year to reduce cyclical exposure is playing out, and we still believe it is the play as we enter the last quarter of the year. Downgrading Altair as European manufacturing poses a risk. We are downgrading ALTR to Underweight from Neutral and also lowering our price target to $34. Altair has a high exposure to the automotive sector and cited manufacturing end-market headwinds as part of the reason for its lowered revenue guidance for the year. Eurozone manufacturing PMI data has been below 50 since January, and ADSK delivered another negative read-through when it guided its second half revenue down, also citing European manufacturing as part of the slowdown. High expectations at AZPN tilt things more toward risk than reward.We remain Underweight shares of AZPN due to valuation and a slowdown in the outlook for energy capex. The new APM suite has delivered impressive results since being launched in 2016, and we expect the strong demand and execution to continue. However, assuming an 82% CAGR in the smal...