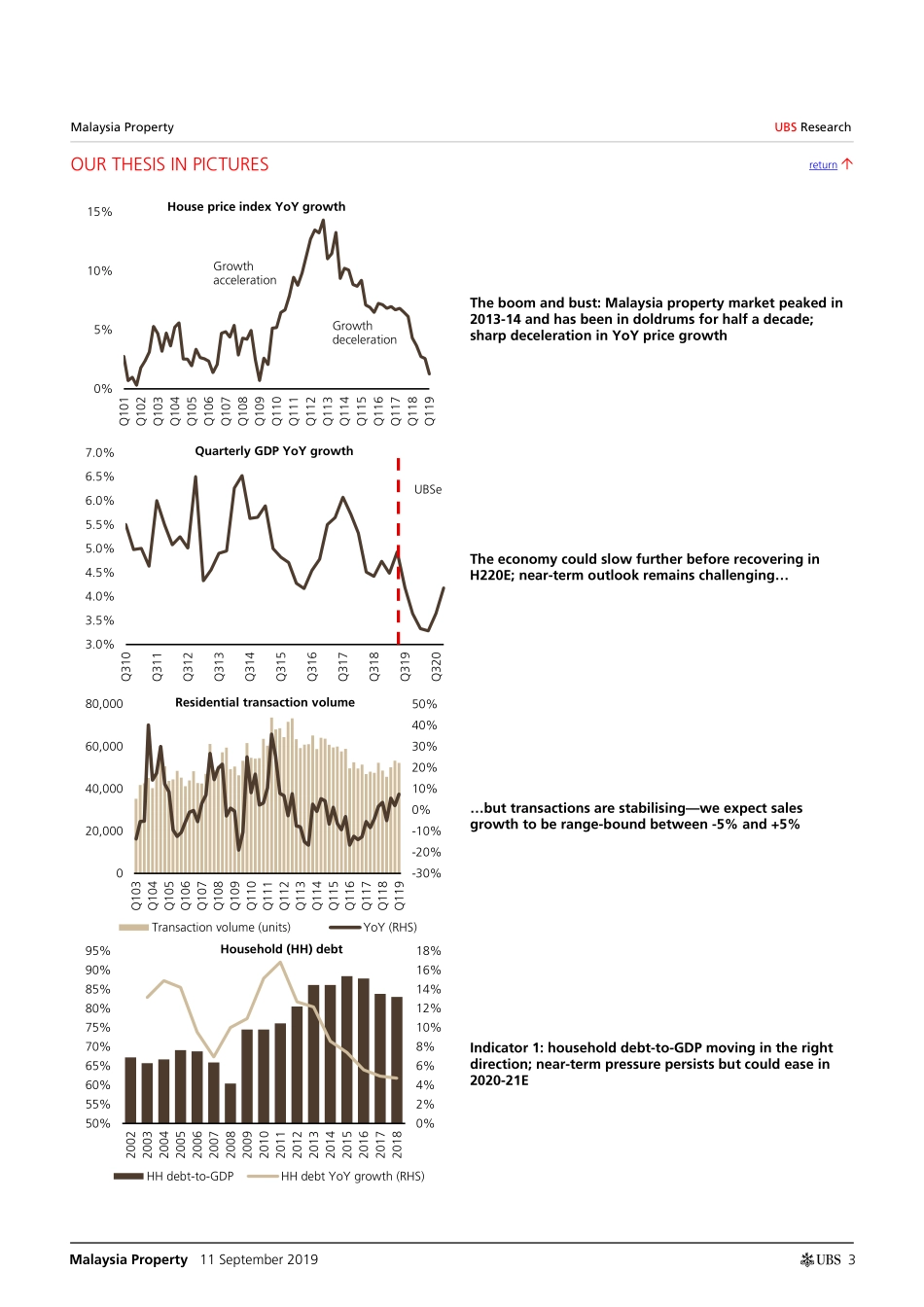

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Pte. Ltd. (Reg. No. 198500648C). ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 62. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 11 September 2019 Malaysia Property Sell-off overdone, sector at trough valuations Buying opportunity The Malaysia property sector is stabilising and we think current valuations provide a buying opportunity. H119 property sales steadied after four years in decline. While a meaningful recovery will take time, we think underlying fundamentals are improving and should pave the way for an eventual upturn. We expect sales to stay range-bound between -5% and +5% in the near term. On that basis, we think the share price decline of 10% YTD and 34% since end-2017 is unwarranted. At 40-60% discounts to book (valued at cost), valuations are in unchartered territory and imply significant value destruction on every new dollar developers put to work. Demand for landed properties is still resilient and we prefer township developers. We assume coverage and upgrade SP Setia from Sell to Buy, with revised price targets for Eco World and Mah Sing. Navigating near-term noise; key indicators in the right direction The residential sector has been in doldrums for half a decade with primary sales down 38% from the peak and home prices falling QoQ for the first time in Q119 since the Global Financial Crisis. However, other leading indicators are pointing in the right direction. Affordability has improved compared with two years ago. The household debt-to-GDP ratio is falling as intended and is likely to drop below 80% in 2020E, providing leeway for potential easing, in our view. Completed but unsold inventory fell 20-25% HoH in H119, driven by the national Home Ownership Campaign 2019 where stamp duty exemption is granted for properties priced below RM1m. We believe the campaign’s recent extension to end-2019 is an encouraging sign of supportive policies. Landed development stays resilient; township developers could outperform In a challenging market, demand from owner-occupiers provides support as investors weigh buying decisions. Buyers continue to prefer landed properties, while there is a significant supply-demand mismatch for high-rise with a large amount of completed but unsold units. With high density, Kuala Lumpur (KL) and Penang are hardest hit, while demand in Selangor (with large land parcels) is resilient. We expect township developers to do better. With the government potentially crowding out the affordable market segment (less than RM500k...