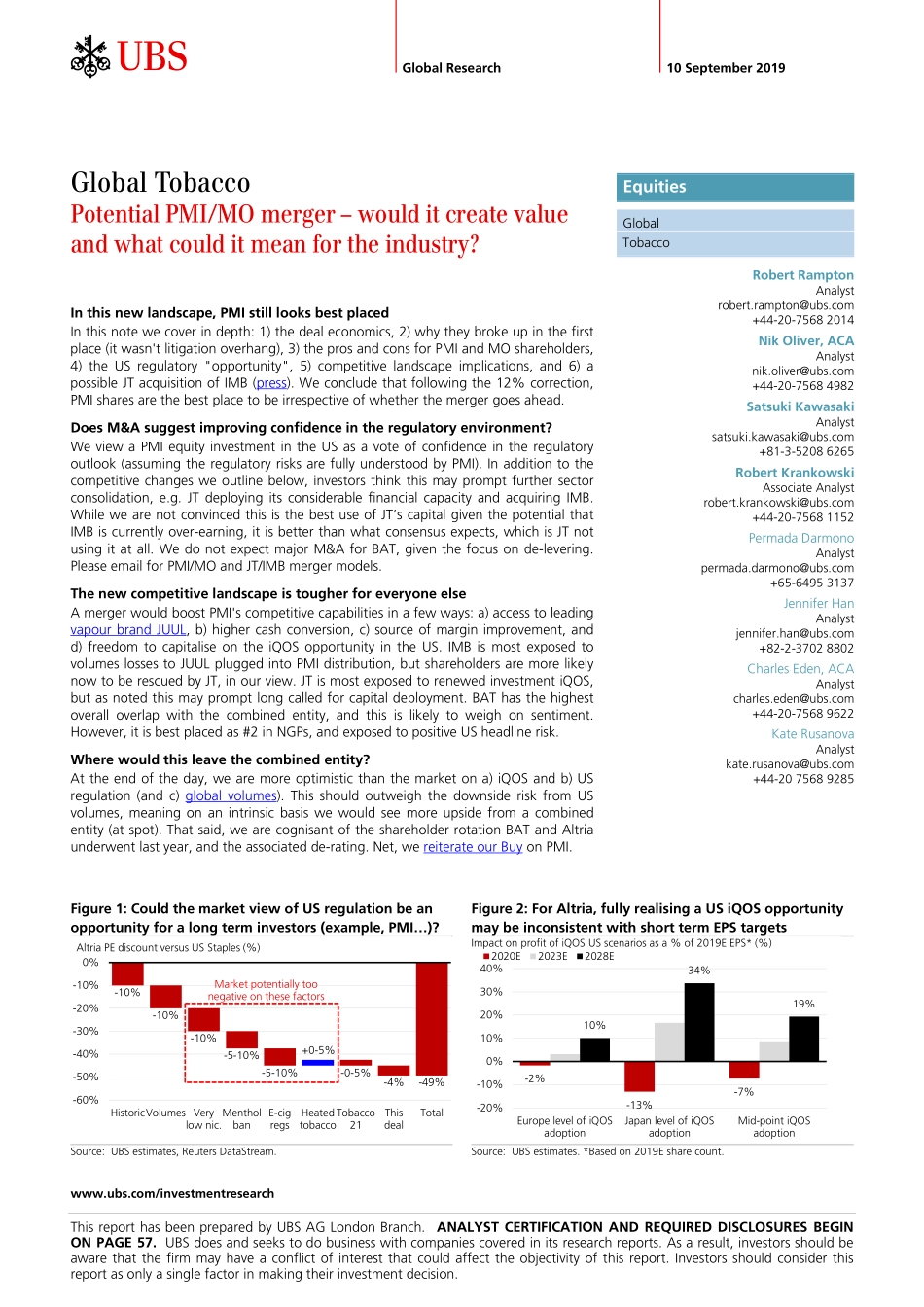

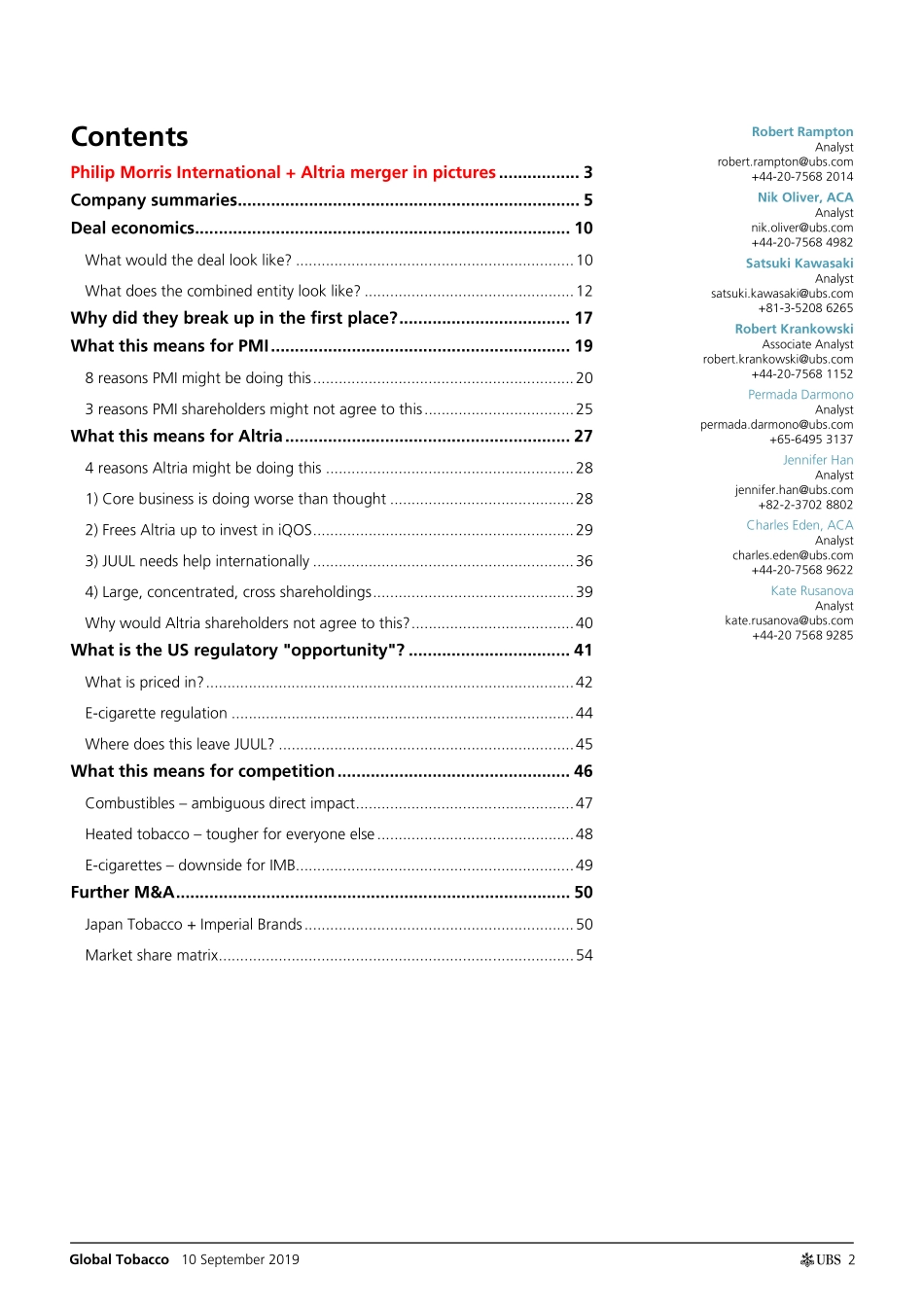

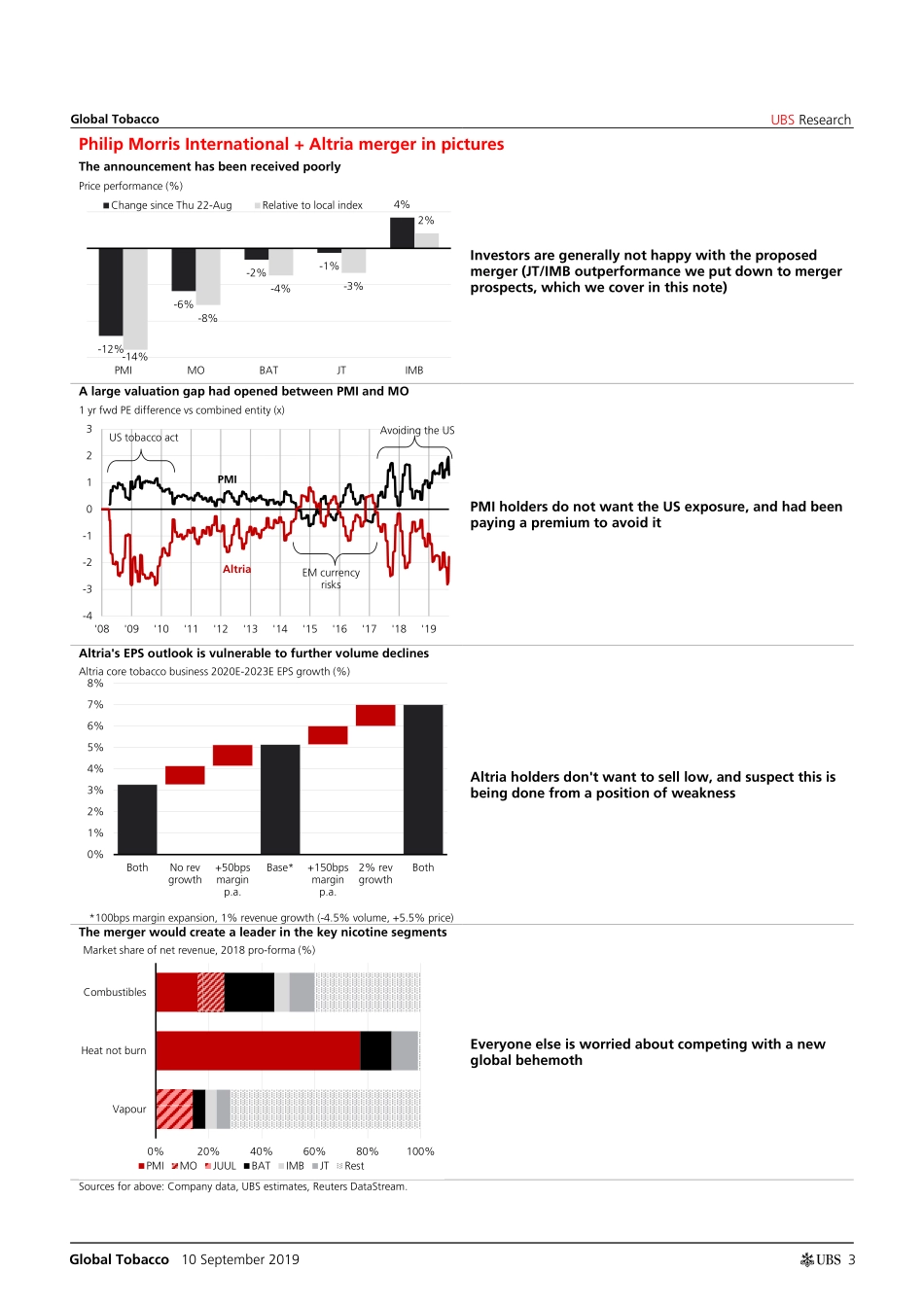

www.ubs.com/investmentresearch This report has been prepared by UBS AG London Branch. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 57. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 10 September 2019 Global Tobacco Potential PMI/MO merger – would it create value and what could it mean for the industry? In this new landscape, PMI still looks best placed In this note we cover in depth: 1) the deal economics, 2) why they broke up in the first place (it wasn't litigation overhang), 3) the pros and cons for PMI and MO shareholders, 4) the US regulatory "opportunity", 5) competitive landscape implications, and 6) a possible JT acquisition of IMB (press). We conclude that following the 12% correction, PMI shares are the best place to be irrespective of whether the merger goes ahead. Does M&A suggest improving confidence in the regulatory environment? We view a PMI equity investment in the US as a vote of confidence in the regulatory outlook (assuming the regulatory risks are fully understood by PMI). In addition to the competitive changes we outline below, investors think this may prompt further sector consolidation, e.g. JT deploying its considerable financial capacity and acquiring IMB. While we are not convinced this is the best use of JT’s capital given the potential that IMB is currently over-earning, it is better than what consensus expects, which is JT not using it at all. We do not expect major M&A for BAT, given the focus on de-levering. Please email for PMI/MO and JT/IMB merger models. The new competitive landscape is tougher for everyone else A merger would boost PMI's competitive capabilities in a few ways: a) access to leading vapour brand JUUL, b) higher cash conversion, c) source of margin improvement, and d) freedom to capitalise on the iQOS opportunity in the US. IMB is most exposed to volumes losses to JUUL plugged into PMI distribution, but shareholders are more likely now to be rescued by JT, in our view. JT is most exposed to renewed investment iQOS, but as noted this may prompt long called for capital deployment. BAT has the highest overall overlap with the combined entity, and this is likely to weigh on sentiment. However, it is best placed as #2 in NGPs, and exposed to positive US headline risk. Where would this leave the combined entity? At the end of the day, we are more optimistic than the market on a) iQOS and b) US regulation (and c) global volumes). This should outweigh the downside risk from US volumes, meaning on an intrinsic basis we would see more upside from a combined...