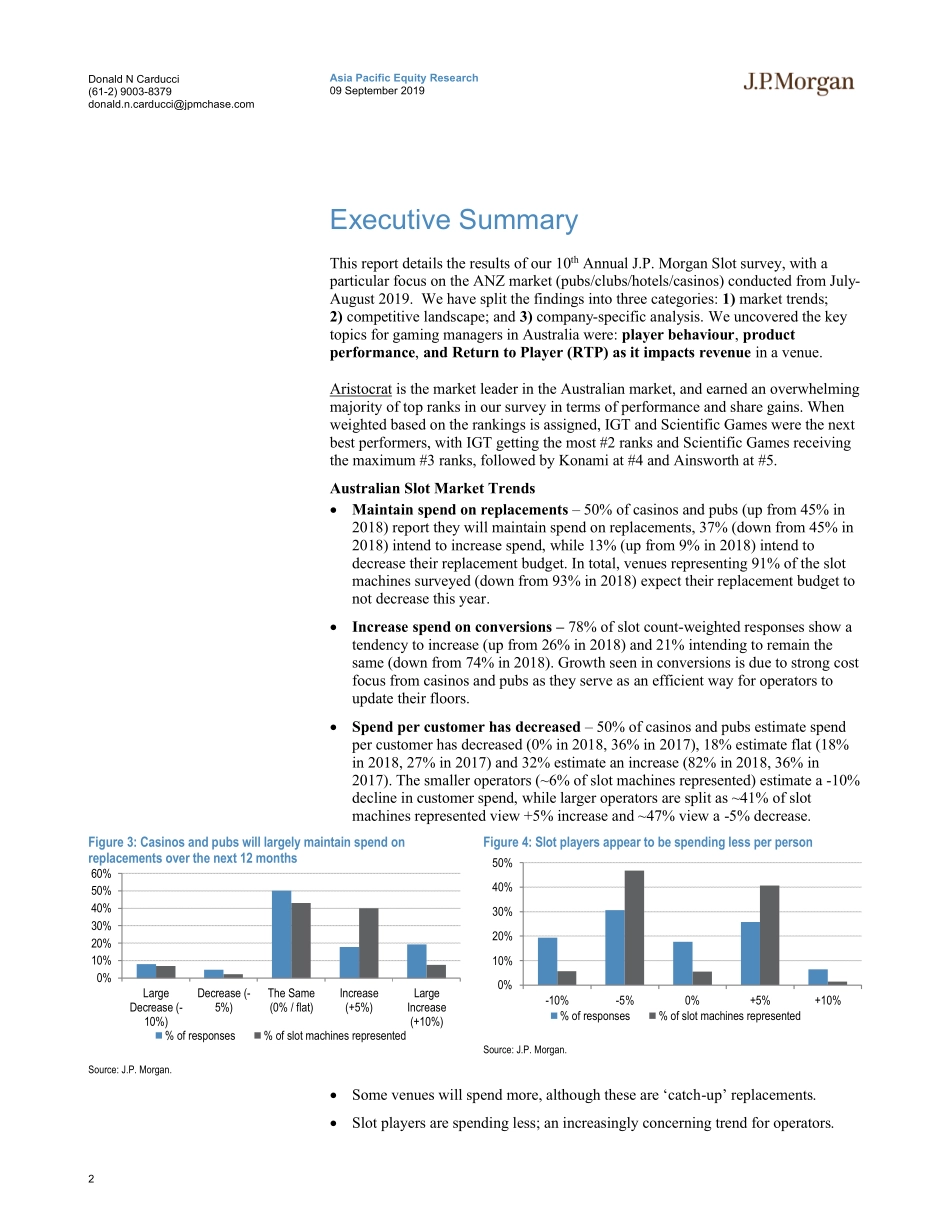

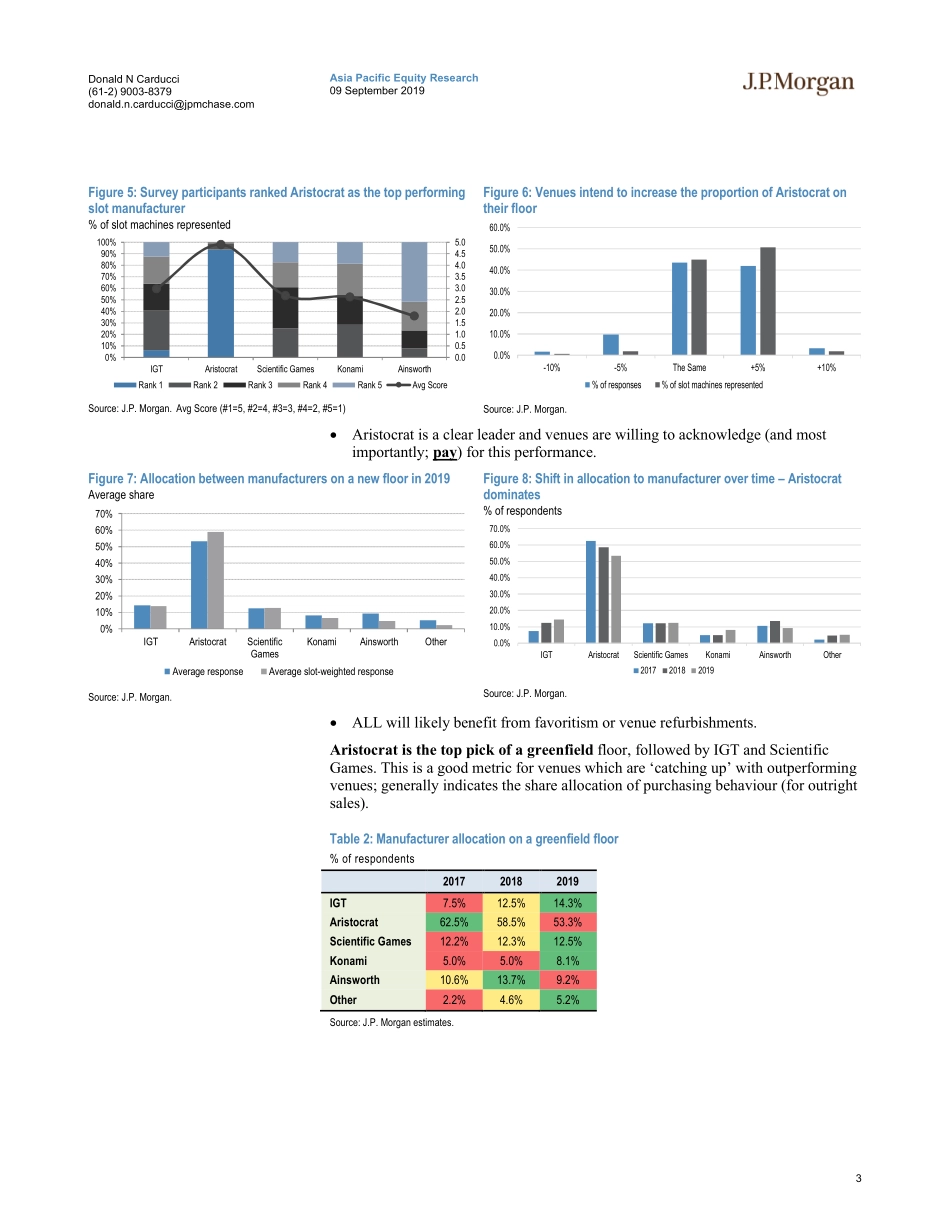

Asia Pacific Equity Research09 September 2019 10th Annual Slot Market SurveyThe gaming manager's conundrum – delivering growth in a capex- and consumer-constrained environmentAustraliaAustralian Consumer SectorDonald N Carducci AC(61-2) 9003-8379donald.n.carducci@jpmchase.comBloomberg JPMA CARDUCCI Jason Steed(61-2) 9003-8609jason.h.steed@jpmorgan.comShaun Cousins(61-2) 9003-8623shaun.r.cousins@jpmorgan.comJ.P. Morgan Securities Australia LimitedSee page 26 for analyst certification and important disclosures, including non-US analyst disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.www.jpmorganmarkets.comAustralian gaming managers are facing tough market conditions. Our 10thAnnual Slot Market Survey highlights the challenge of managing tight capex budgets against the backdrop of a retreating consumer. In this difficult environment, Aristocrat is well-positioned (w/game outperformance) to enjoy continued buyer preference through the remainder of 2019 and into 2020. Competition for share of consumer time and wallet is increasing; our survey suggests, however, that the ANZ slot market can enjoy another year of low to mid-single digit growth. ALL is the key beneficiary in these conditions, with 94% of participants voting the company as the #1 performing manufacturer. ALL’s performance gap with IGT and SGMS continues. Aristocrat was ranked as the best performer by 94% of respondents & top share gainer (92%). IGT ranked 2nd in performance & share gain metrics, while Scientific Gamesranked 3rd. Ship-share outside the top 5 manufacturers increased to 8% (vs. 4% in 2018) and a key reason Konami & Ainsworth tied for last place. These manufacturers face pressure from niche products as venues seek floor-diversity to balance outsized ALL floor share. ALL remains AUS market leader & most popular manufacturer. As 50% of participants expect decreased spend per customer on EGMs, the main focus from buyers is increasing conversions, while maintaining relevance amongst replacements.ALLwill likely be the clear beneficiary, receiving an overwhelming majority of share to a ‘greenfield’ game floor as our model portfolio of a gaming floor includes 59% Aristocrat, 14% IGT, 13% Scientific Games, 7% Konami and ~5% Ainsworth. 50% of the market expects increased machine pricing (to ALL’s benefit) as the market is willing to accept increased price-per-machine if outperformance is possible. We highlight August performance overleaf. Australian consumer overview. The consumer is heavily indebted and lower house prices have weighed on sentiment, although recent improvements are a positive. Job growth is occur...