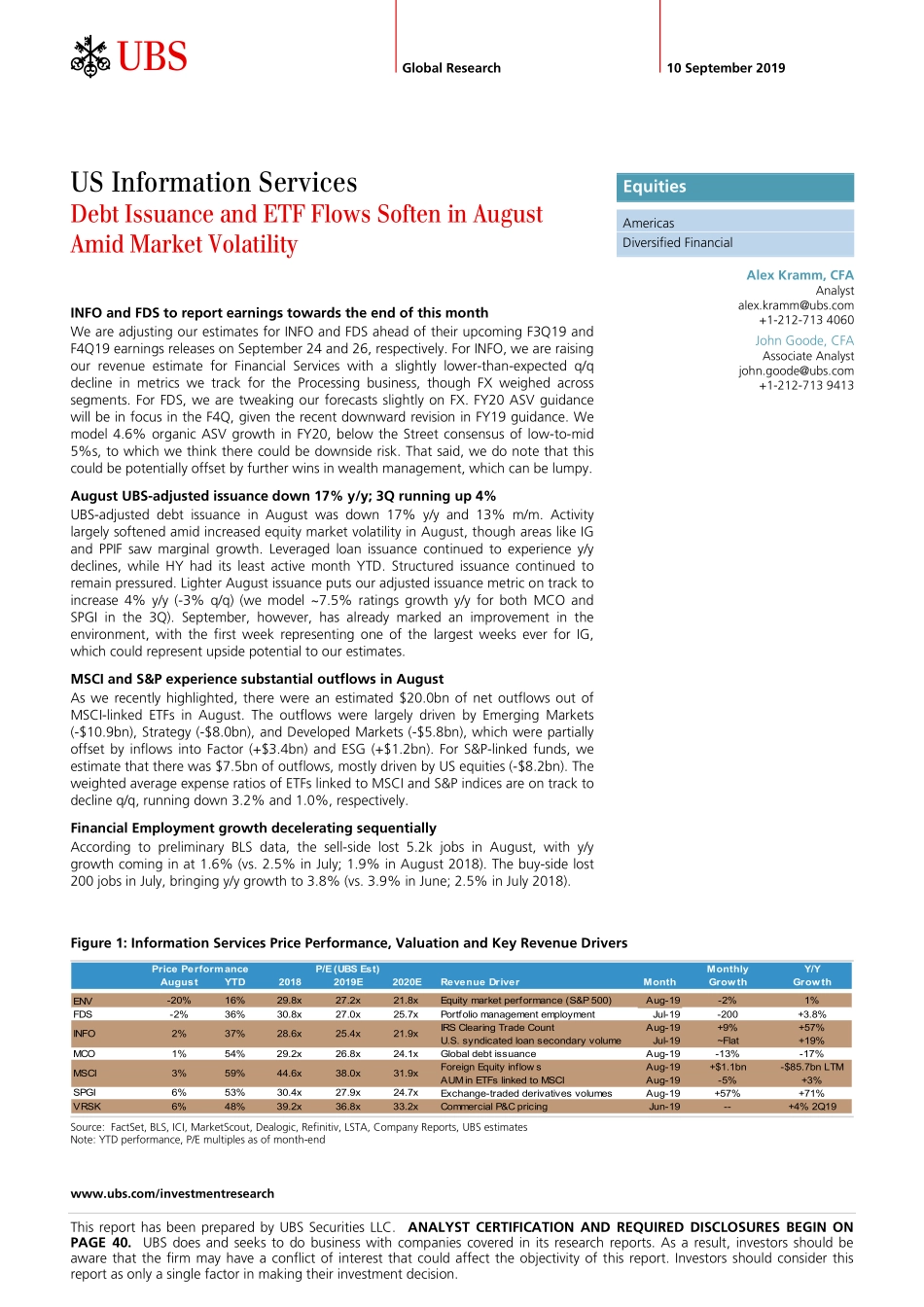

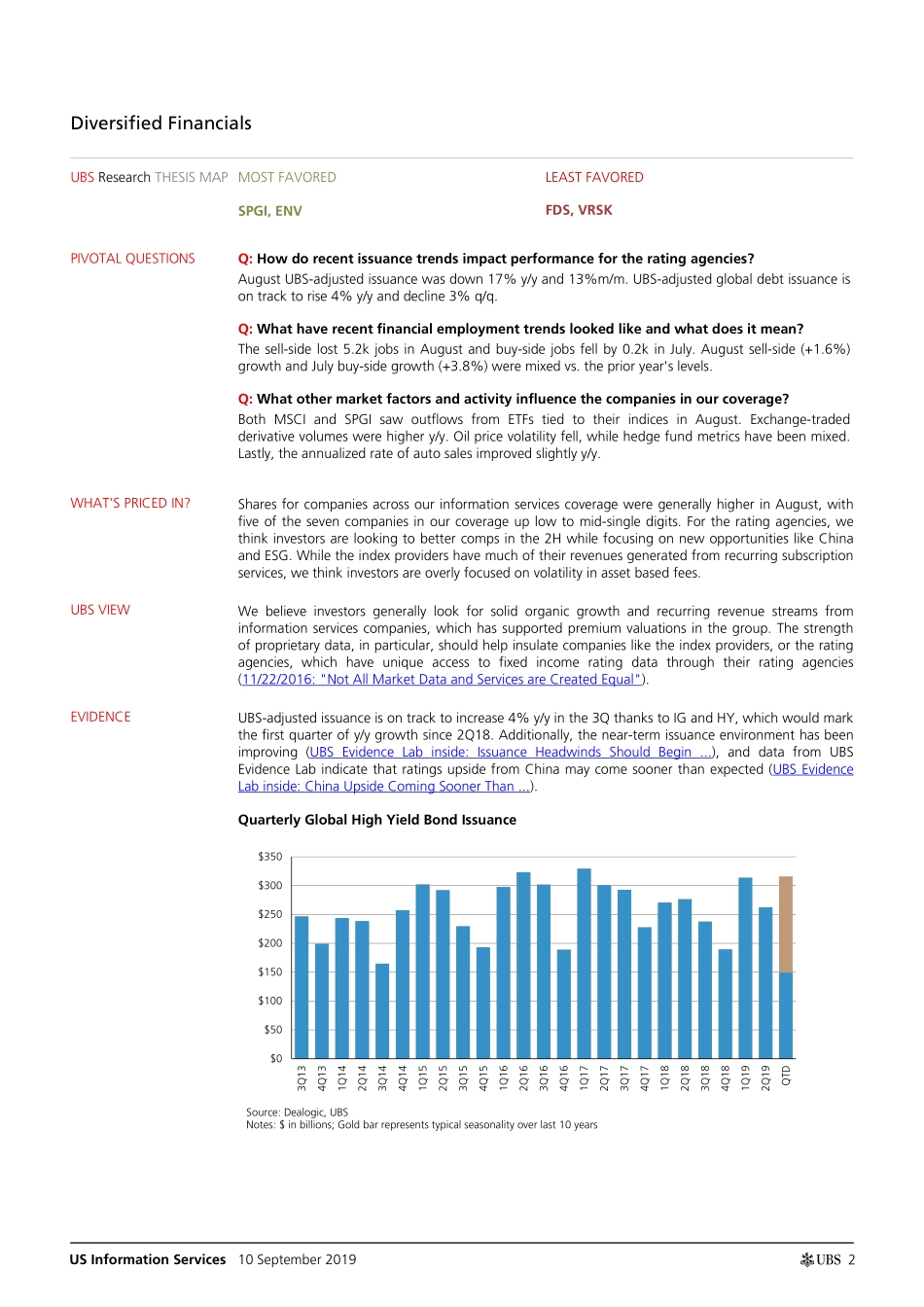

www.ubs.com/investmentresearch This report has been prepared by UBS Securities LLC. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 40. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 10 September 2019 US Information Services Debt Issuance and ETF Flows Soften in August Amid Market Volatility INFO and FDS to report earnings towards the end of this month We are adjusting our estimates for INFO and FDS ahead of their upcoming F3Q19 and F4Q19 earnings releases on September 24 and 26, respectively. For INFO, we are raising our revenue estimate for Financial Services with a slightly lower-than-expected q/q decline in metrics we track for the Processing business, though FX weighed across segments. For FDS, we are tweaking our forecasts slightly on FX. FY20 ASV guidance will be in focus in the F4Q, given the recent downward revision in FY19 guidance. We model 4.6% organic ASV growth in FY20, below the Street consensus of low-to-mid 5%s, to which we think there could be downside risk. That said, we do note that this could be potentially offset by further wins in wealth management, which can be lumpy. August UBS-adjusted issuance down 17% y/y; 3Q running up 4% UBS-adjusted debt issuance in August was down 17% y/y and 13% m/m. Activity largely softened amid increased equity market volatility in August, though areas like IG and PPIF saw marginal growth. Leveraged loan issuance continued to experience y/y declines, while HY had its least active month YTD. Structured issuance continued to remain pressured. Lighter August issuance puts our adjusted issuance metric on track to increase 4% y/y (-3% q/q) (we model ~7.5% ratings growth y/y for both MCO and SPGI in the 3Q). September, however, has already marked an improvement in the environment, with the first week representing one of the largest weeks ever for IG, which could represent upside potential to our estimates. MSCI and S&P experience substantial outflows in August As we recently highlighted, there were an estimated $20.0bn of net outflows out of MSCI-linked ETFs in August. The outflows were largely driven by Emerging Markets (-$10.9bn), Strategy (-$8.0bn), and Developed Markets (-$5.8bn), which were partially offset by inflows into Factor (+$3.4bn) and ESG (+$1.2bn). For S&P-linked funds, we estimate that there was $7.5bn of outflows, mostly driven by US equities (-$8.2bn). The weighted average expense ratios of ETFs linked to MSCI and S&P indices are on track to decline q/q, running down 3.2% and 1.0%, respectively. Financial Employment growth decelerating sequentially According to...