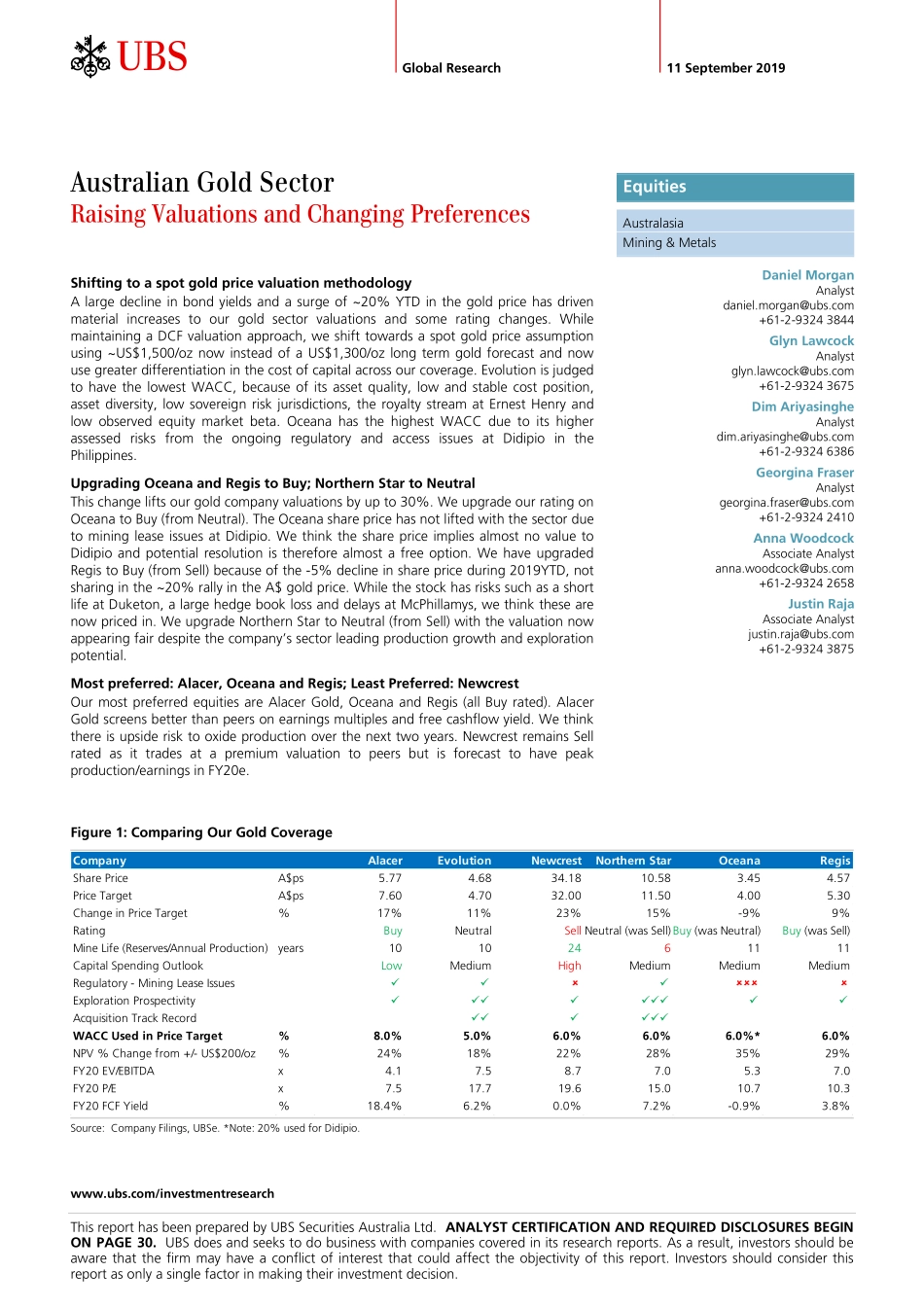

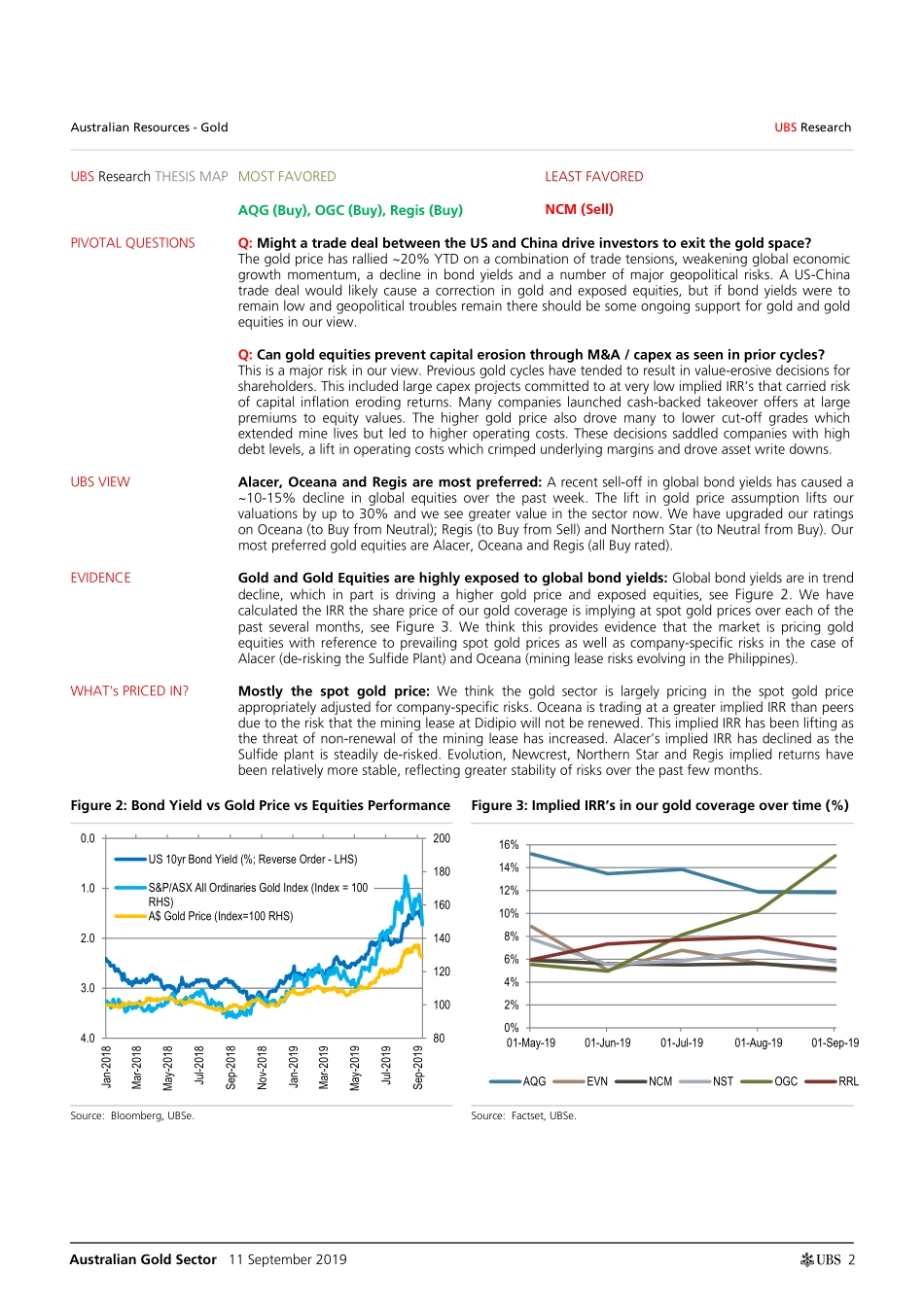

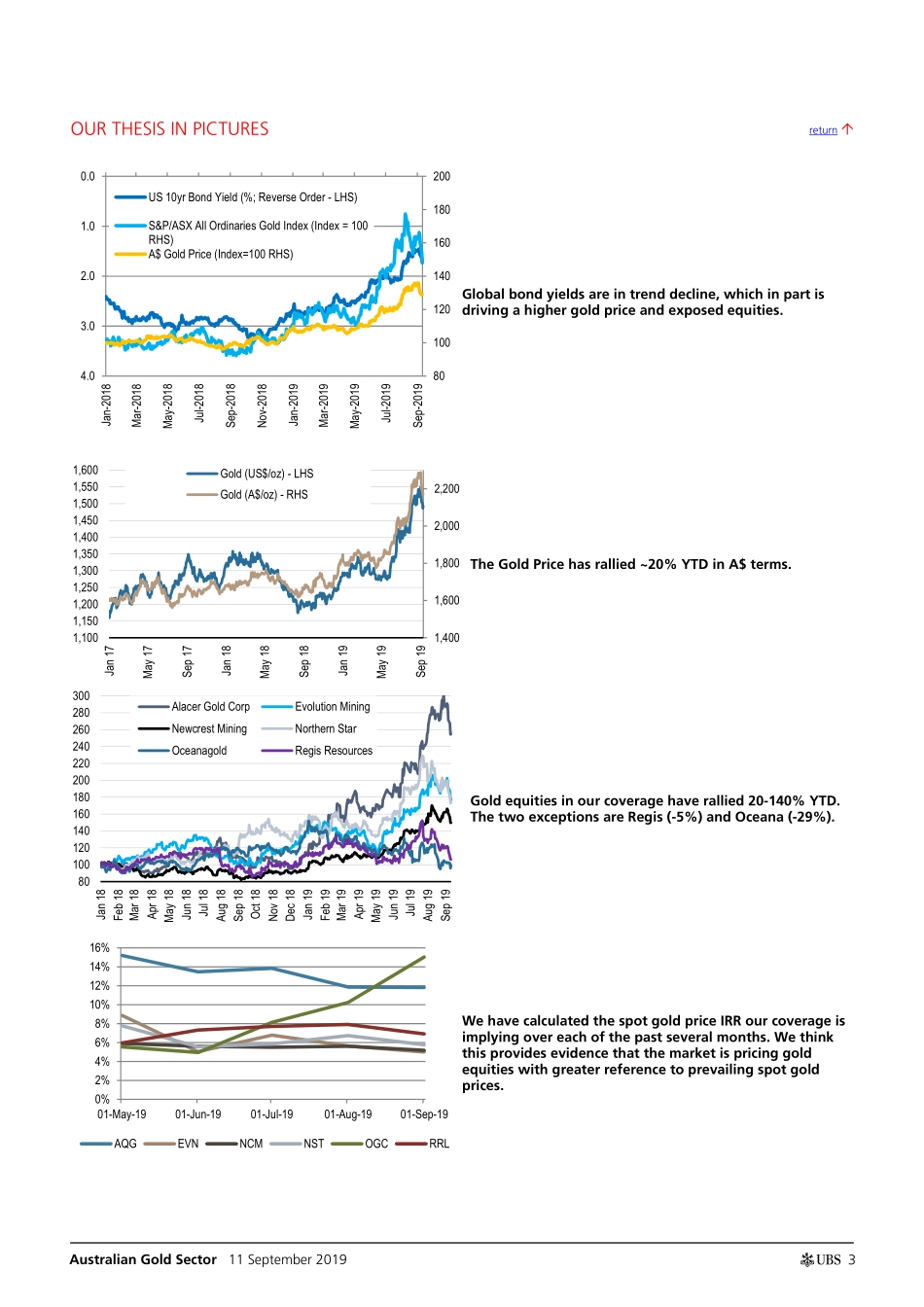

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Australia Ltd. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 30. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 11 September 2019 Australian Gold Sector Raising Valuations and Changing Preferences Shifting to a spot gold price valuation methodology A large decline in bond yields and a surge of ~20% YTD in the gold price has driven material increases to our gold sector valuations and some rating changes. While maintaining a DCF valuation approach, we shift towards a spot gold price assumption using ~US$1,500/oz now instead of a US$1,300/oz long term gold forecast and now use greater differentiation in the cost of capital across our coverage. Evolution is judged to have the lowest WACC, because of its asset quality, low and stable cost position, asset diversity, low sovereign risk jurisdictions, the royalty stream at Ernest Henry and low observed equity market beta. Oceana has the highest WACC due to its higher assessed risks from the ongoing regulatory and access issues at Didipio in the Philippines. Upgrading Oceana and Regis to Buy; Northern Star to Neutral This change lifts our gold company valuations by up to 30%. We upgrade our rating on Oceana to Buy (from Neutral). The Oceana share price has not lifted with the sector due to mining lease issues at Didipio. We think the share price implies almost no value to Didipio and potential resolution is therefore almost a free option. We have upgraded Regis to Buy (from Sell) because of the -5% decline in share price during 2019YTD, not sharing in the ~20% rally in the A$ gold price. While the stock has risks such as a short life at Duketon, a large hedge book loss and delays at McPhillamys, we think these are now priced in. We upgrade Northern Star to Neutral (from Sell) with the valuation now appearing fair despite the company’s sector leading production growth and exploration potential. Most preferred: Alacer, Oceana and Regis; Least Preferred: Newcrest Our most preferred equities are Alacer Gold, Oceana and Regis (all Buy rated). Alacer Gold screens better than peers on earnings multiples and free cashflow yield. We think there is upside risk to oxide production over the next two years. Newcrest remains Sell rated as it trades at a premium valuation to peers but is forecast to have peak production/earnings in FY20e. Figure 1: Comparing Our Gold Coverage Source: Company Filings, UBSe. *Note: 20% used for Didipio. CompanyAlacerEvolutionNewcrestNorthern StarOceanaRegisShare PriceA$ps5.774.6834.181...