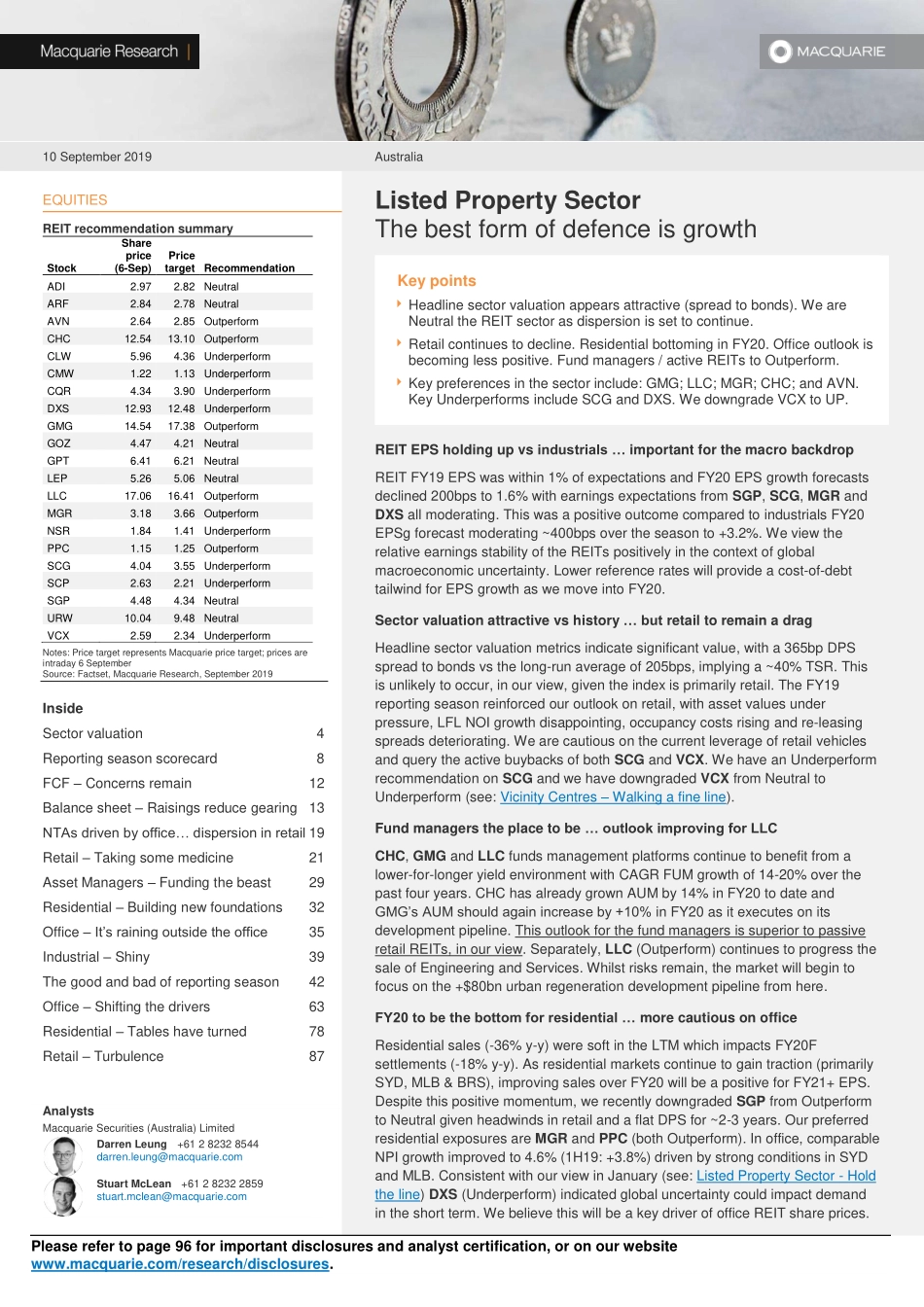

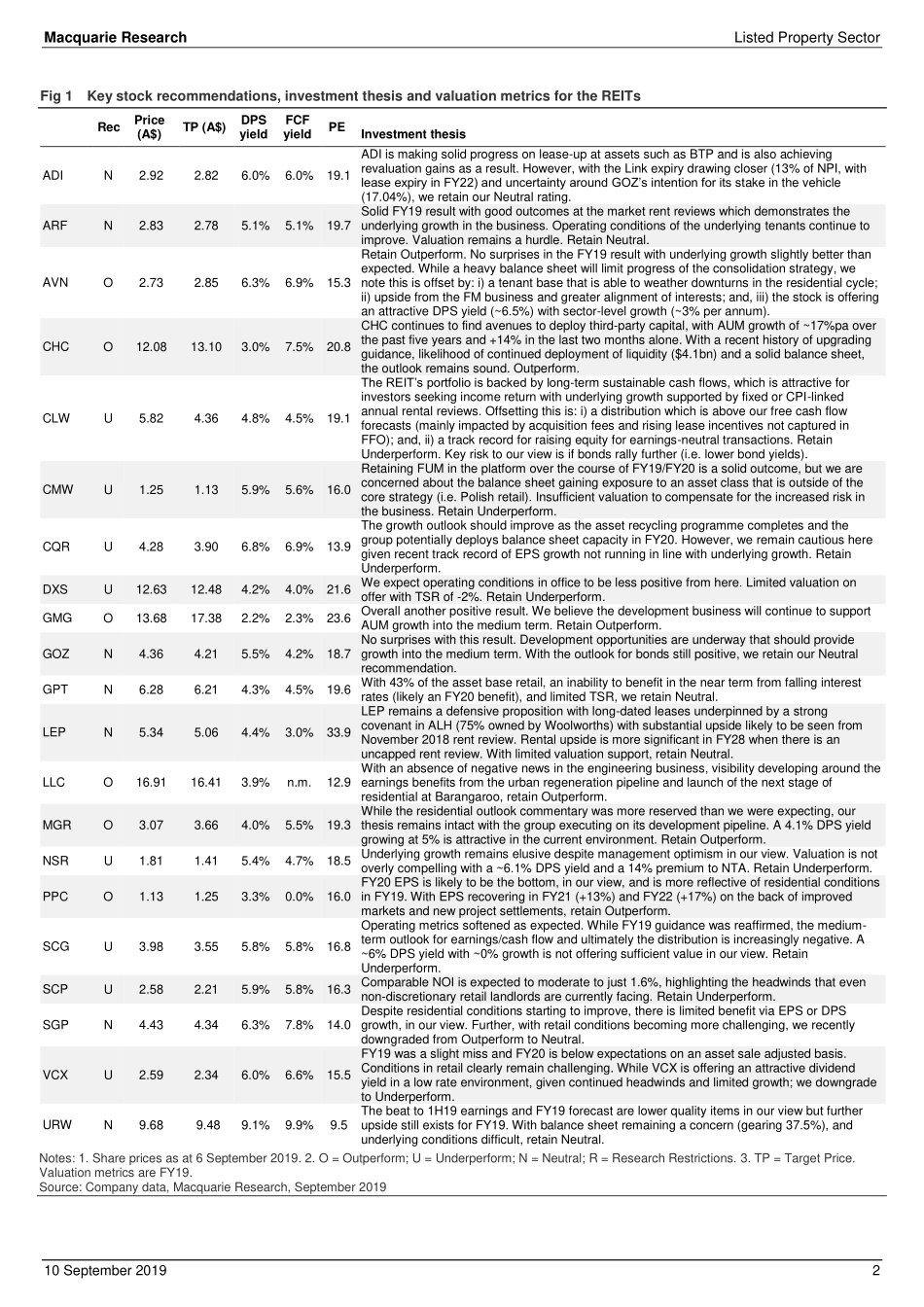

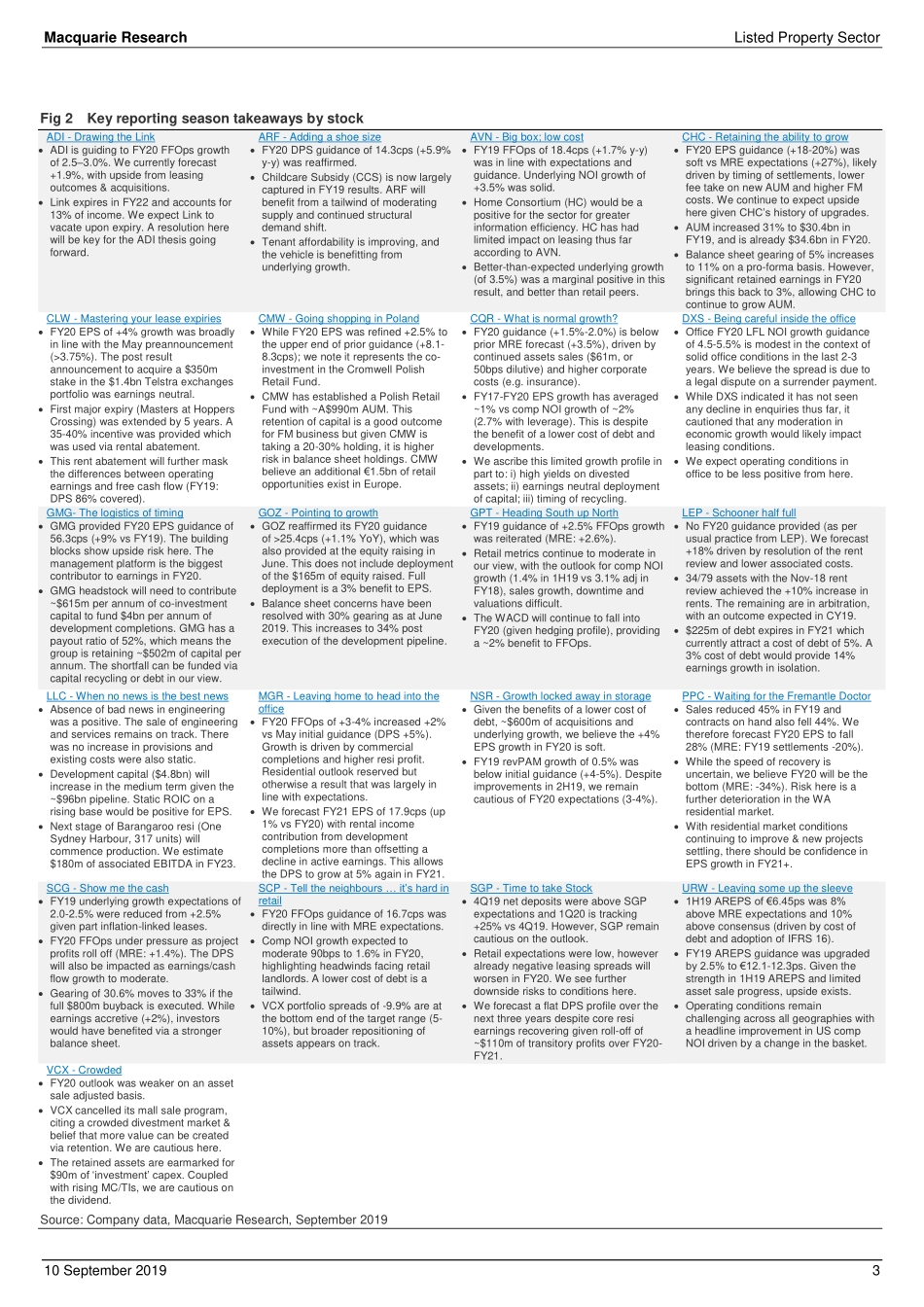

Please refer to page 96 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 10 September 2019 Australia EQUITIES REIT recommendation summary Stock Share price (6-Sep) Price target Recommendation ADI 2.97 2.82 Neutral ARF 2.84 2.78 Neutral AVN 2.64 2.85 Outperform CHC 12.54 13.10 Outperform CLW 5.96 4.36 Underperform CMW 1.22 1.13 Underperform CQR 4.34 3.90 Underperform DXS 12.93 12.48 Underperform GMG 14.54 17.38 Outperform GOZ 4.47 4.21 Neutral GPT 6.41 6.21 Neutral LEP 5.26 5.06 Neutral LLC 17.06 16.41 Outperform MGR 3.18 3.66 Outperform NSR 1.84 1.41 Underperform PPC 1.15 1.25 Outperform SCG 4.04 3.55 Underperform SCP 2.63 2.21 Underperform SGP 4.48 4.34 Neutral URW 10.04 9.48 Neutral VCX 2.59 2.34 Underperform Notes: Price target represents Macquarie price target; prices are intraday 6 September Source: Factset, Macquarie Research, September 2019 Inside Sector valuation 4 Reporting season scorecard 8 FCF – Concerns remain 12 Balance sheet – Raisings reduce gearing 13 NTAs driven by office… dispersion in retail 19 Retail – Taking some medicine 21 Asset Managers – Funding the beast 29 Residential – Building new foundations 32 Office – It’s raining outside the office 35 Industrial – Shiny 39 The good and bad of reporting season 42 Office – Shifting the drivers 63 Residential – Tables have turned 78 Retail – Turbulence 87 Analysts Macquarie Securities (Australia) Limited Darren Leung +61 2 8232 8544 darren.leung@macquarie.com Stuart McLean +61 2 8232 2859 stuart.mclean@macquarie.com Listed Property Sector The best form of defence is growth Key points Headline sector valuation appears attractive (spread to bonds). We are Neutral the REIT sector as dispersion is set to continue. Retail continues to decline. Residential bottoming in FY20. Office outlook is becoming less positive. Fund managers / active REITs to Outperform. Key preferences in the sector include: GMG; LLC; MGR; CHC; and AVN. Key Underperforms include SCG and DXS. We downgrade VCX to UP. REIT EPS holding up vs industrials … important for the macro backdrop REIT FY19 EPS was within 1% of expectations and FY20 EPS growth forecasts declined 200bps to 1.6% with earnings expectations from SGP, SCG, MGR and DXS all moderating. This was a positive outcome compared to industrials FY20 EPSg forecast moderating ~400bps over the season to +3.2%. We view the relative earnings stability of the REITs positively in the context of global macroeconomic uncertainty. Lower reference rates will provide a cost-of-debt tailwind for EPS growth as we move into FY20. Sector valuation attractive vs history … but retail to remain a drag Headline sector valuation metrics indicate significant value, with a 365bp DPS spread to bonds vs the long-run average of 205bps, implying a ~40% TSR. This is unlikely to occur, in ou...