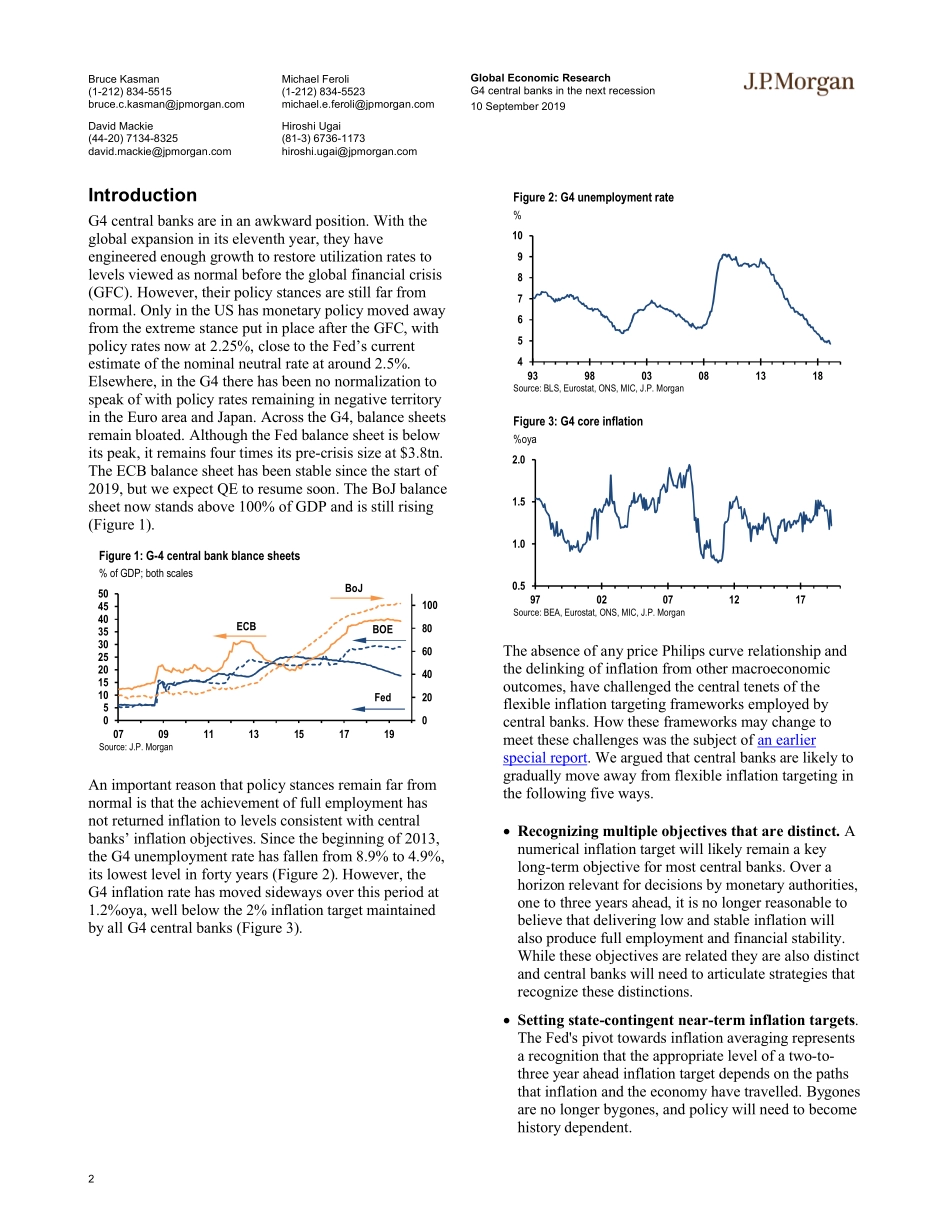

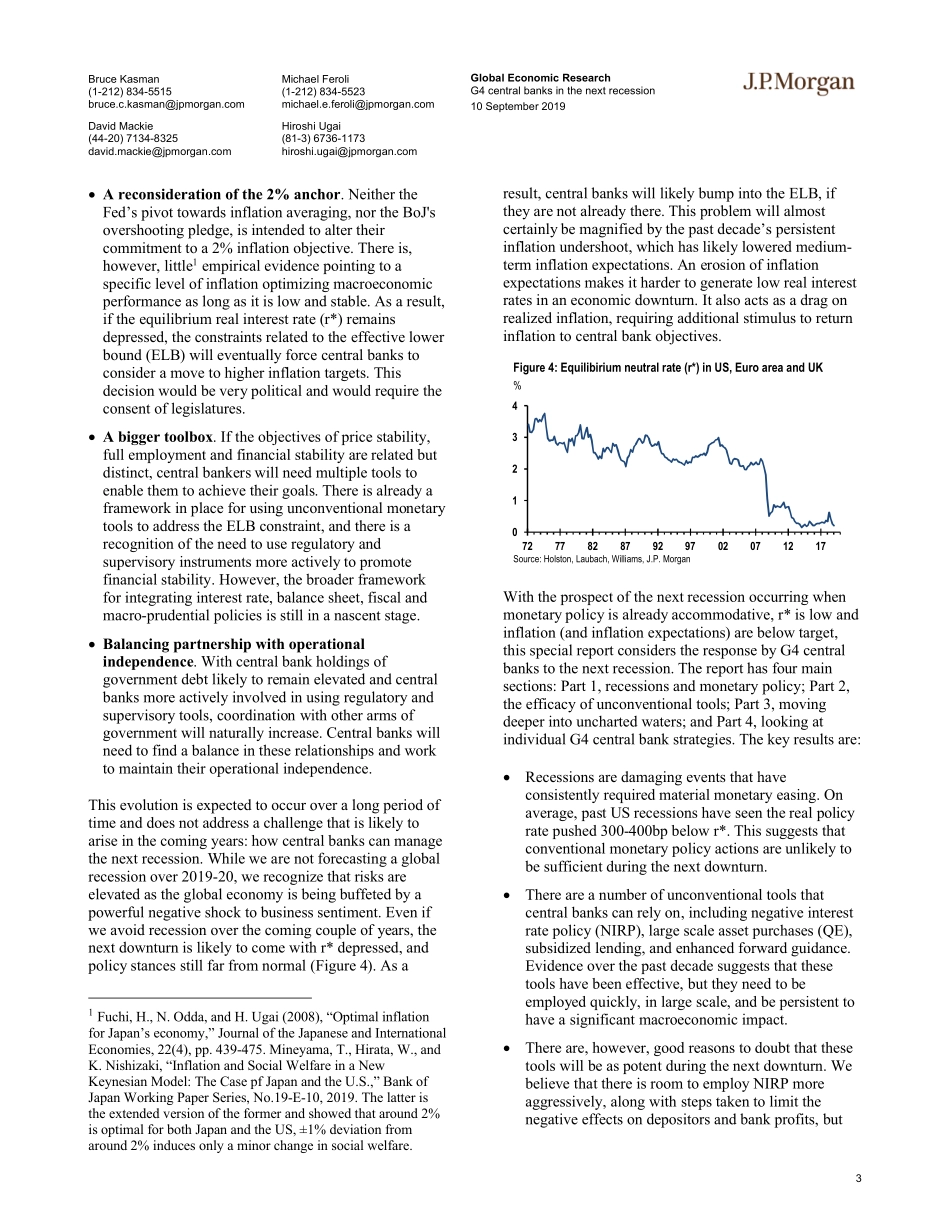

Global Economic Research10 September 2019 G4 central banks in the next recessionConfronting limited monetary efficacyEconomic and Policy ResearchBruce Kasman(1-212) 834-5515bruce.c.kasman@jpmorgan.comJPMorgan Chase Bank NADavid Mackie(44-20) 7134-8325david.mackie@jpmorgan.comJPMorgan Chase Bank N.A, London BranchMichael Feroli(1-212) 834-5523michael.e.feroli@jpmorgan.comJPMorgan Chase Bank NAHiroshi Ugai(81-3) 6736-1173hiroshi.ugai@jpmorgan.comJPMorgan Securities Japan Co., Ltd.Greg Fuzesi(44-20) 7134-8310greg.x.fuzesi@jpmorgan.comJPMorgan Chase Bank N.A, London BranchAllan Monks(44-20) 7134-8309allan.j.monks@jpmorgan.comJPMorgan Chase Bank N.A, London BranchSee page 20 for analyst certification and important disclosures.www.jpmorganmarkets.com Traditionally, the instrument that G4 central banks have used to manage recessions has been the policy rate. In response to recessionary pressures, central banks would cut policy rates aggressively. On average, recessions in recent decades have involved cuts in the policy rate of around 400bp. Central banks have also ensured that real interest rates moved into negative territory, and that they were around 300-400bp below the equilibrium interest rate (r*). The recession associated with the global financial crisis pushed central banks into uncharted waters, as interest rates alone did not provide sufficient stimulusto restore macroeconomic balance. Unconventional monetary policy comprisedfour instruments: negative policy rates, asset purchases, lending to private sector entities and forward guidance. These instruments proved to be effective in reducing borrowing costs for banks, households and corporates, and in lifting asset prices, which together supported stronger demand. Empirical analysis suggests that there is room to use these instruments more in the next downturn, but to have a meaningful macro effect they need to be implemented quickly, in size and be persistent. In our view, the effective lower bound for the policy rate is lower than anything seen thus far, and forward guidance can gain power by being threshold-based regarding the level of inflation. There are plenty of assets that can be purchased,but there are clearly constraints as unconventional monetary policy is pushed further: negative interest rates start to adversely affect monetary transmission and financial stability, and there is a limit to how far risk and term premia can be compressed. G4 central banks will face different constraints in the next recession. The Fed has significant room to lower the policy rate before it reaches zero, but it is reluctant to go beyond that. Meanwhile, the ECB and BoJ are currently closer to the effective lower bound, but are more willing to use NIRP. In contrast to the more limited room to cut the policy rate, the ECB, BoJ and BoE have more room to maneuver than the Fed in the types of assets that can be purchased an...