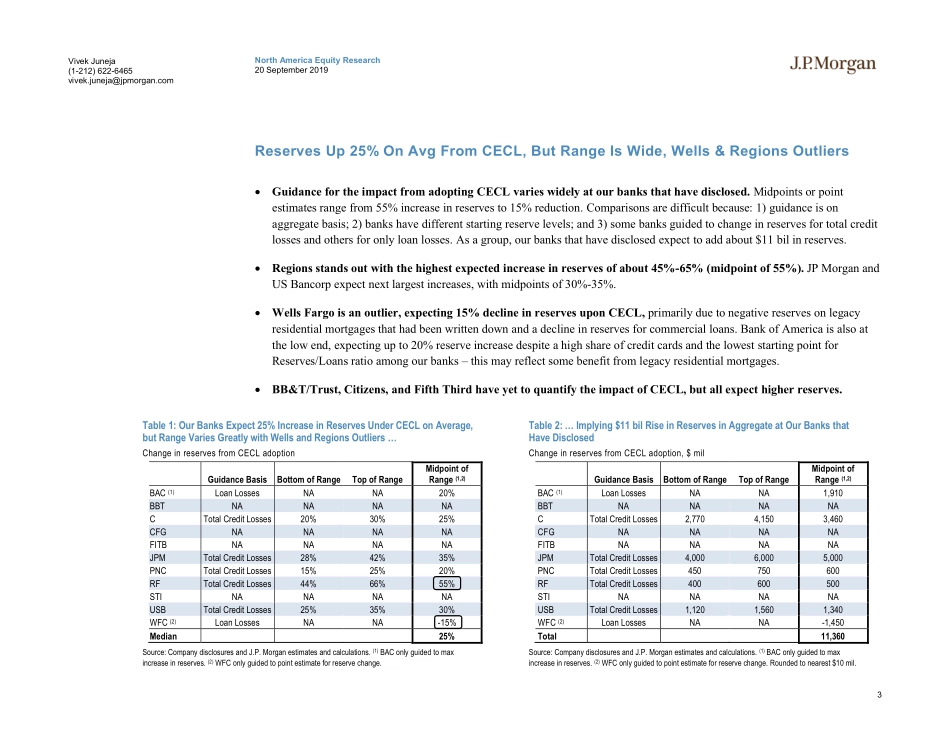

North America Equity Research20 September 2019 Large Cap BanksCECL Impact: Reserves +25% With Wide Divergence, Comparing Banks Harder; Provisions More Volatile?Banks — Large-CapVivek Juneja AC(1-212) 622-6465vivek.juneja@jpmorgan.comBloomberg JPMA JUNEJA Jonathan Summitt(1-212) 622-6341jonathan.summitt@jpmorgan.comAndrew J Dietrich(1-212) 622-4244aj.dietrich@jpmorgan.comJ.P. Morgan Securities LLCSee page 26 for analyst certification and important disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.www.jpmorganmarkets.comMajority of our banks have announced expected impact at the time of adoption of the new CECL accounting. We expect reserve levels and credit provisions will become much harder to compare across banks under CECL. Banks should consider adding disclosures to improve comparisons of earnings under CECL. And importantly, it is not clear whether CECL will cause reserves to be more or less pro-cyclical. Key points: 1) at adoption, reserves to rise by 25% on average at our banks or $11 bil in aggregate, with bigger increase typically at banks with greater share of longer-dated consumer loans – this widensrange of Reserves/Loans; 2) greater variability in provisions is likely from quarter to quarter, driven most by changes to economic outlook used in CECL models; 3) CECL may result in some loan sales to unlock gains at some banks; 4) capital impact from CECL seems manageable; 5) reduced purchase accounting accretion benefit from acquisitions; 6) CECL could change loan terms or origination mix; 7) loans with loss sharing could suffer ifhigher reserves under CECL temper interest; 8) need for reserves on non-loan assets could impact some of those markets; 9) surprisingly, large reserve increase for installment/retailloans at US Bancorp, and highest total reserve increase at Regions; 10) CECL leads tomore reserves than IFRS 9; 11) new credit disclosures required; and 12) final capital/regulatory treatment under stress tests not yet known. We expect average Reserves/Loans ratio to increase to 162bp from 105bp at CECL adoption at our banks that have disclosed thus far. However, change in reserves is expected to vary widely from down 15% at Wells Fargo to up 20% to 55% at the rest, using the midpoints or best estimated levels of banks’ guidance. Banks with higher share of commercial loans could see greater catch-up in reserves as economic outlook weakens due to the lower level of reserves on these loans. Regional banks generally have little higher share of commercial loans. Real estate loans will benefit from faster recognition of recoveries in collateral val...