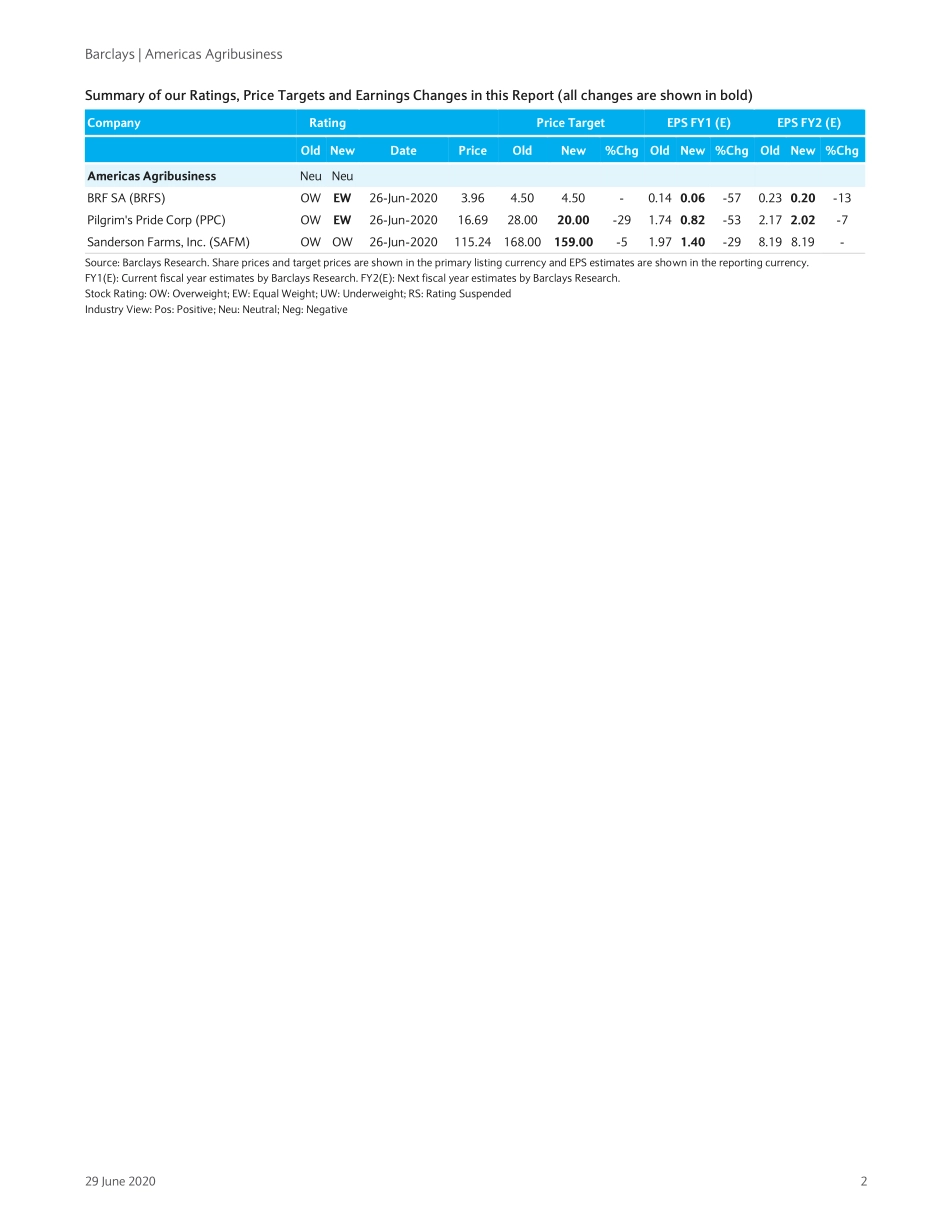

Equity Research 29 June 2020 CORE Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 16. Restricted - Internal Americas Agribusiness Chicken (over)supply & demand: Flying into headwinds Chicken supply & demand gap leads to a revaluation of the most exposed companies under our coverage: Contrary to cattle and hog slaughter, which faced stark YoY contractions in April amid temporary closures, chicken production is fairly protected; egg production and eggs set were only slightly down YoY. Additionally, poultry operations are relatively less labor intense, and chickens take a fairly lower amount of time to grow to their processing weight. Nonetheless, the strong supply might be too much for the pressured demand to handle; the chicken industry is highly exposed to foodservice, and we don’t expect this channel to be fully recovered any time soon. We therefore lower our estimates for PPC, BRF, and SAFM. We are downgrading PPC to EW from OW while lowering our price target to $20 from $28. Besides the aforementioned adverse industry conditions, PPC faces in our view two additional risks that drive our downgrade: an even weaker performance in Mexico, which likely lasts longer, and corporate governance issues. We are downgrading BRF to EW from OW while leaving our price target of $4.50 unchanged. BRF is the company most exposed to domestic consumption in Brazil within our protein coverage. The economic backdrop in Brazil, coupled with likely longer lasting closures within the Brazilian domestic foodservice channel amid rising Covid-19 cases, and FX headwinds drive our more cautious view in the short term. We reiterate our OW rating on SAFM although we are slightly trimming our price target to $159 (was $168). Taking the above-mentioned industry headwinds into account, we reduce our short-term estimates. SAFM in contrast to PPC or BRF operates mainly in the U.S. domestic market (with less than 10% of sales generated in the export markets), which leaves us with a relatively more optimistic view on the company. Additionally, SAFM among the three has the strongest balance sheet with very limited leverage, which should allow the company to best navigate through the current volatile environment. Risks to thesis and valuation: Poultry supply and demand imbalance could be narrowed sooner...